The Dollar is alive and properly in the present day, rallying versus the majors. To this point, the EUR/USD (-0.38%), USD/CAD (+0.36%), GBP/USD (-0

The Dollar is alive and properly in the present day, rallying versus the majors. To this point, the EUR/USD (-0.38%), USD/CAD (+0.36%), GBP/USD (-0.25%), USD/CHF (+0.32%), and USD/JPY (+0.44%) are all trending in favor of the greenback. With just a few hours left within the session, it appears just like the USD is poised to shut early-week commerce on a excessive word.

As we speak’s information cycle has been comparatively quiet. Nevertheless, there was an fascinating launch within the CB Client Confidence (March) report. The determine for March got here in at 109.7, properly above projections (96.9) and the earlier launch (90.4). This can be a main leap and means that U.S. residents have gotten optimistic concerning the ongoing COVID-19 restoration.

On Capitol Hill, there’s a new debate over COVID-19 restoration funds and the place they could be headed. Final week, President Joe Biden launched plans for a sweeping $three trillion COVID-19 restoration stimulus bundle. The proposal is to be damaged up into two components going through infrastructure and direct support. Later in the present day, Biden is scheduled to offer a speech on the huge “Construct Again Higher” plan. If handed sooner or later in Q2 2021, the Biden administration could have spent practically $5 trillion on COVID-19 stimulus and support packages in below six months.

Typical foreign exchange knowledge tells us that extra stimulus is prone to result in inflation and a debasing of the Dollar. That is proving incorrect in the present day, as illustrated by the drop within the EUR/USD.

EUR/USD Breaks To The Bear, Help In View

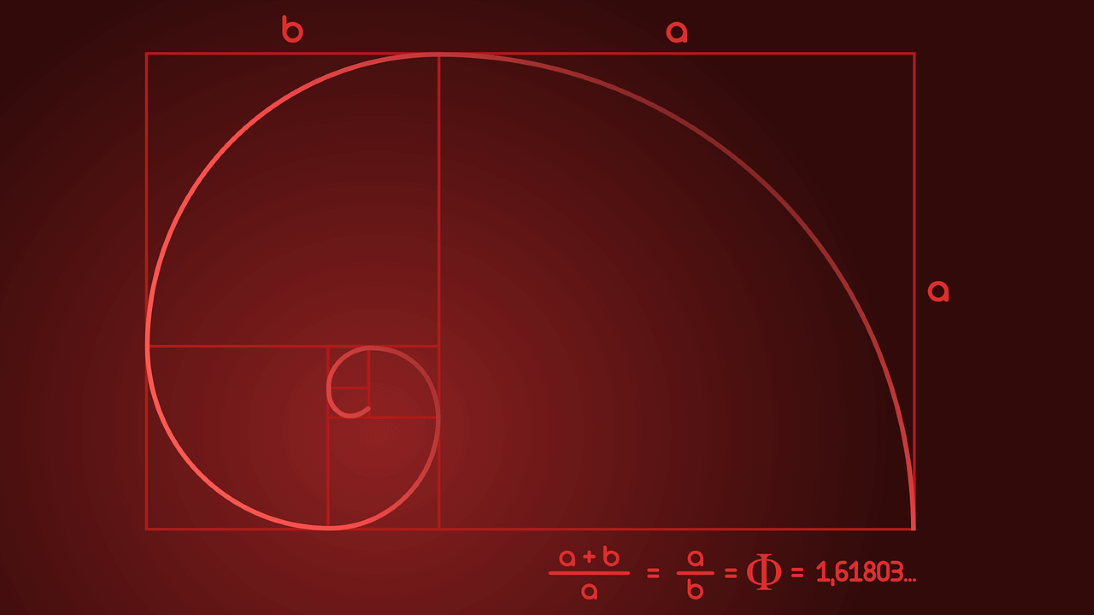

The weekly chart beneath offers us an ideal have a look at how the EUR/USD has carried out over the previous yr. Following a swift drop throughout March 2021, values have steadily risen. Nevertheless, the long-term uptrend is now below hearth as this pair is within the midst of a three-week shedding streak.

+2021_14+(10_54_43+AM).png)

Listed here are two help ranges value awaiting the close to future:

- Help(1): 38% Macro Retracement, 1.1693

- Help(2): November Low, 1.1602

Backside Line: So long as charges keep above the 38% Macro Fibonacci Retracement (1.1693), a bullish bias will stay warranted. If not, we could also be in for a problem to final yr’s uptrend.

Till elected, I’ll have purchase orders queued up within the EUR/USD from 1.1697. With an preliminary cease loss at 1.1667, this commerce produces 30 pips on a typical 1:1 threat vs reward ratio.