EUR/USD FORECASTEUR/USD begins the week on the back foot, following disappointing economic data in Europe and rising U.S. Treasury yieldsVolatility, h

EUR/USD FORECAST

- EUR/USD begins the week on the back foot, following disappointing economic data in Europe and rising U.S. Treasury yields

- Volatility, however, is limited, with many traders on the sidelines ahead of Thursday’s U.S. inflation report, which could be critical for the U.S. dollar

- This article also discusses key EUR/USD technical levels to watch in the coming sessions

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Most Read: Gold and Silver Price Forecast: XAU/USD & XAG/USD at Mercy of US Inflation Data

The euro was modestly softer against the U.S. dollar on Monday, pressured by rising U.S. Treasury yields and subdued sentiment following lower-than-expected industrial production figures in Germany – the country with the largest and most powerful economy in the eurozone.

In early afternoon trading, EUR/USD was down about 0.15% to 1.0990, in a context of limited and depressed FX volatility, with many traders avoiding taking large speculative positions ahead of a major risk event later in the week: the release of the latest U.S. inflation report.

July Headline CPI is expected to have risen 0.2% m/m, pushing the annual rate to 3.3% from 3.0% previously. The core indicator, which excludes energy and food, is also seen climbing 0.2% m/m, but the yearly reading is projected to cool to 4.7% from 4.8% in June – a very small improvement for the Fed.

While recent U.S. data, including the somewhat weaker-than-forecast nonfarm payrolls survey, have reduced the likelihood of further Fed tightening in the months ahead, interest rate expectations could drift higher again if the overall trend in consumer prices does not show convincing signs of moderation.

For insight into the broader market trajectory, it is important to watch the upcoming inflation numbers closely, placing more emphasis on underlying metrics. That said, any core CPI print above 4.7% should be quite bullish for the U.S. dollar, insofar as it could boost the odds of another FOMC hike later in 2023. This could mean steep losses for EUR/USD.

On the other hand, a large downside surprise in core inflation, say 4.5% or below, might trigger a dovish repricing of the Fed’s monetary policy outlook, exerting downward pressure on Treasury yields. This scenario could pave the way for a solid recovery of the euro against the greenback.

Stay ahead of the game with our exclusive third-quarter euro technical and fundamental forecast. Download it now to make make informed trading decisions in the coming days and weeks.

Recommended by Diego Colman

Get Your Free EUR Forecast

EUR/USD TECHNICAL ANALYSIS

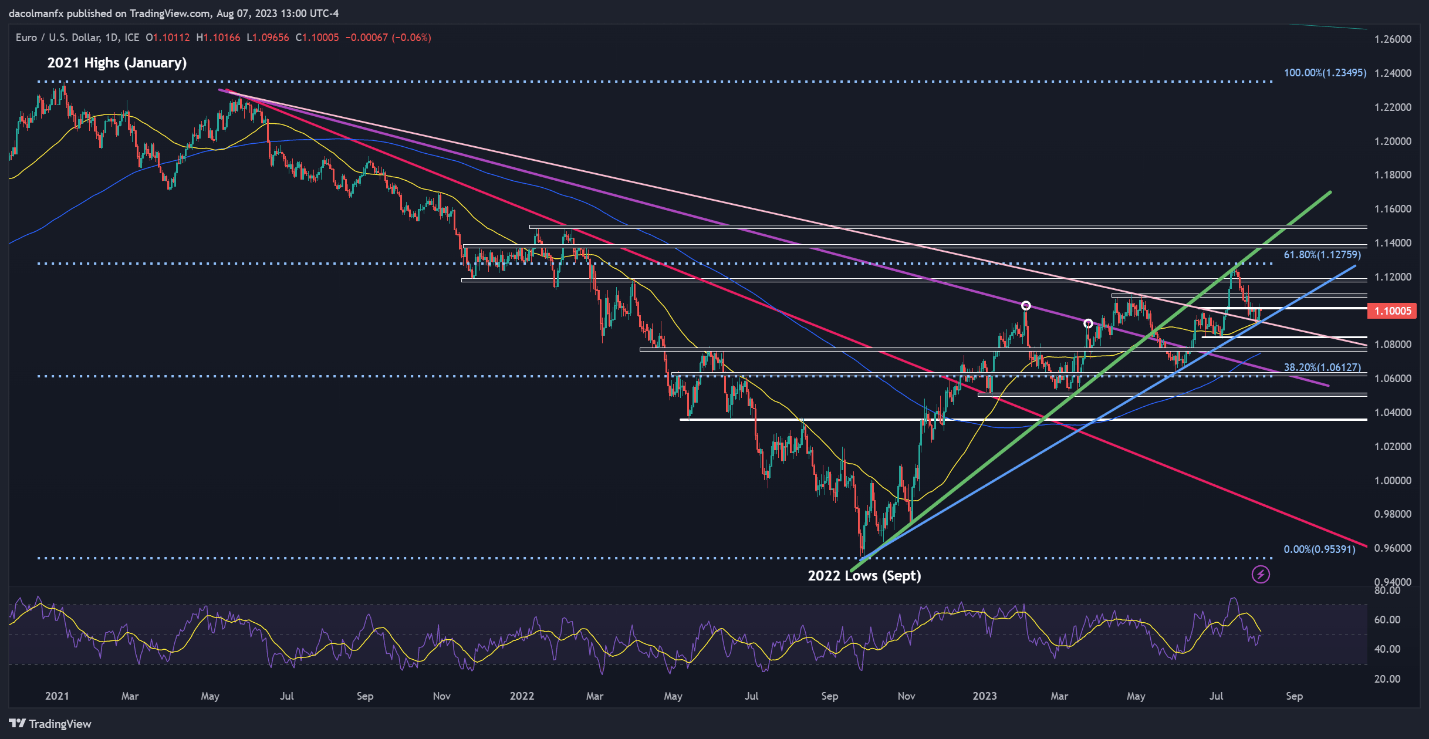

Focusing on price action, EUR/USD appears to be sandwiched between two key technical levels after its recent pullback: resistance at ~1.1000 and support at ~1.0925.

In terms of possible scenarios, successful clearance of the psychological 1.1000 handle could open the door for a move to 1.1090, followed by 1.1180. On further strength, the focus shifts to 1.1275, the 61.8% Fib retracement of the 2021/2022 selloff.

On the flip side, a breach of confluence support near 1.0925 could attract new sellers into the market, setting the stage for a drop toward 1.0850. On further weakness, bearish pressure could gather pace, clearing the pathway for a pullback toward the 200-day simple moving average.

EUR/USD TECHNICAL CHART

EUR/USD Chart Created Using TradingView

| Change in | Longs | Shorts | OI |

| Daily | 19% | 6% | 12% |

| Weekly | 7% | 3% | 5% |

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com