The EUR/USD has been on the march south as we speak, falling by 0.64%. Charges have damaged arduous to the bear, plunging beneath the 1.1750 deal

The EUR/USD has been on the march south as we speak, falling by 0.64%. Charges have damaged arduous to the bear, plunging beneath the 1.1750 deal with. With inflation stale on either side of the Atlantic, one has to marvel what’s driving the sentiment. In the interim, it seems that a second wave of COVID-19 is hitting the eurozone and prompting the sell-off.

On the COVID-19 entrance, there are a number of information tales which have damaged previously 18 hours. Listed below are two of the most important:

- Vaccine Troubles: Pharmaceutical firm Johnson & Johnson has paused medical trials for its COVID-19 vaccine because of “unexplained sicknesses.” Within the race for a vaccine, Johnson & Johnson was a number one participant; the sudden halt of its program means that creating such a product could also be more difficult than anticipated.

- Virus Surge: In response to a coronavirus surge within the U.Okay., a three-tier lockdown system has been launched. The measures have been adopted to stop the unfold of the virus and flatten a possible hospitalization curve. The U.Okay.’s new insurance policies have come on the heels of tightened restrictions in Germany because it seems a second-wave of infections is falling upon the eurozone.

Because it has been all 12 months lengthy, the coronavirus pandemic continues to be a key foreign exchange market driver. For the EUR/USD, new issues are a minimum of partially chargeable for as we speak’s decline.

EUR/USD Falls As COVID-19 Re-emerges

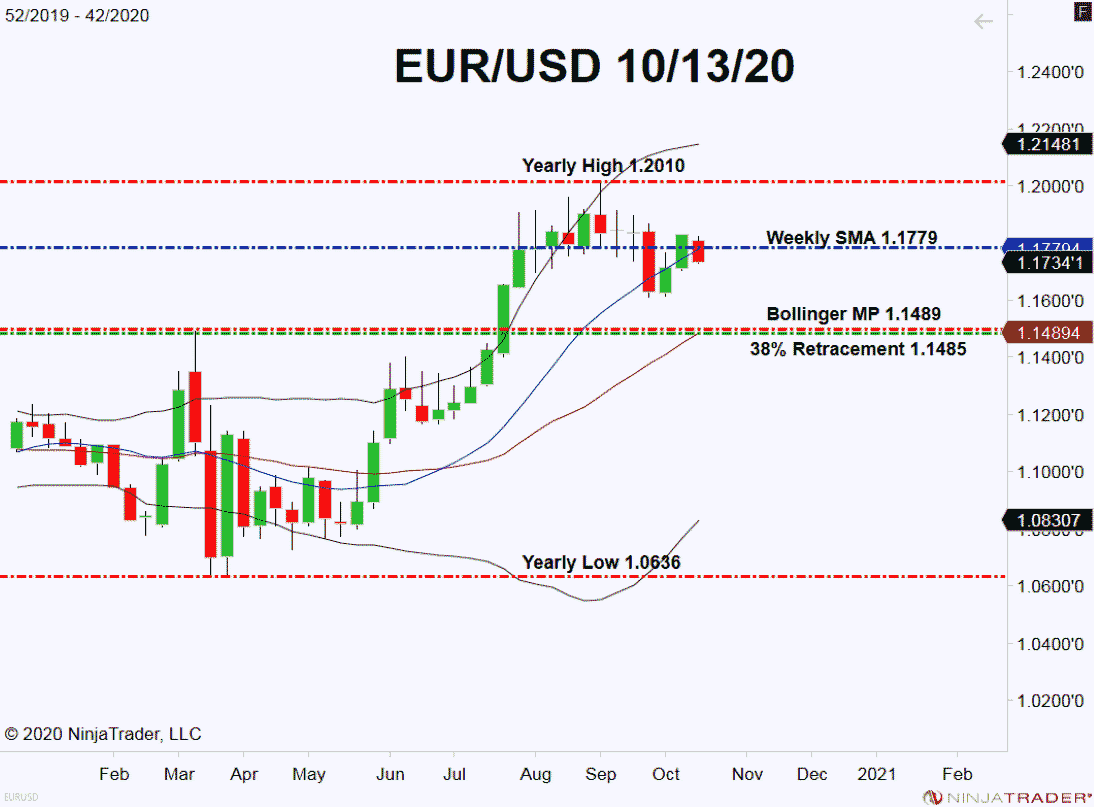

For the reason that lows of March, it has been a giant 12 months for EUR/USD bulls. However, are we at a turning level on this market? In brief, not but. Nevertheless, if charges fall beneath the 38% Fibonacci Retracement at 1.1485, then a correction might be underway.

+2020_42+(11_15_00+AM).png)

Listed below are the important thing ranges to look at on this market:

- Resistance(1): Weekly SMA, 1.1779

- Assist(1): Bollinger MP, 1.1489

- Assist(2): 38% Retracement, 1.1485

Backside Line: If the current bearish motion within the EUR/USD retains up, then a shopping for alternative could come into play for later this month. Till elected, I’ll have purchase orders within the queue from 1.1506. With an preliminary cease loss at 1.1446, this commerce produces 120 pips on a 1:2 threat vs reward ratio.