EUR/USD Forecast - Prices, Charts, and AnalysisThe Euro edges lower on weak PMI data..Sliding US Treasury bond yields undermine the US dollar.Download

EUR/USD Forecast – Prices, Charts, and Analysis

- The Euro edges lower on weak PMI data..

- Sliding US Treasury bond yields undermine the US dollar.

Download our Latest Q4 Euro Forecast Below

Recommended by Nick Cawley

Get Your Free EUR Forecast

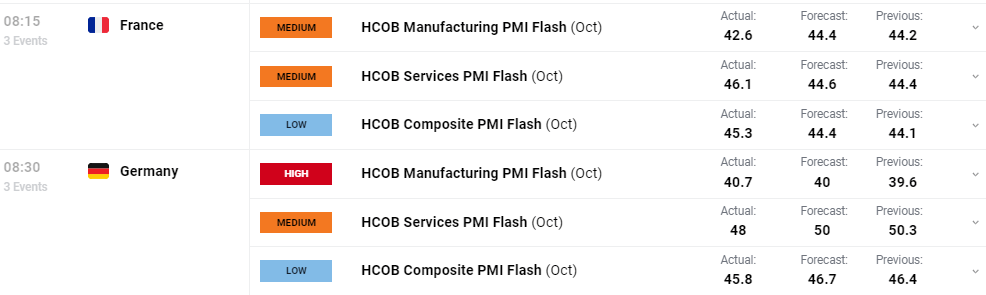

The German economy remained in contraction territory for the fourth month in a row, according to the latest S&P HCOB flash PMIs. The composite index fell to 45.9 from 46.4 in September, while business activity fell from 50.3 to 48.0.

Business activity in France, the Eurozone’s second-largest economy, picked up marginally from September but remained in contraction territory. With the manufacturing sector falling deeper into contraction territory, indicators point to fractional growth at best in the fourth quarter, according to data provider S&P HCOB.

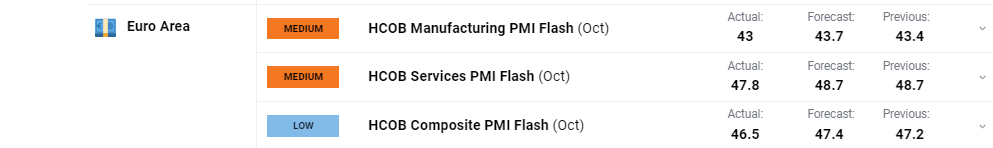

Overall, the Euro Area economic downturn accelerated at the start of the fourth quarter with the composite index falling to a 35-month low of 46.5 compared to 47.2 in September.

Commenting on the flash PMI data, Dr. Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, said: “In the Eurozone, things are moving from bad to worse. Manufacturing has been in a slump for sixteen months, services for three, and both PMI headline indices just took another hit. In addition, all subindices point very consistently downwards, too, with only a few exceptions. Overall, this points to another lacklustre quarter. We wouldn’t be caught off guard to see a mild recession in the Eurozone in the second half of this year with two back-to-back quarters of negative growth.’

S&P HCOB Flash Eurozone PMI

DailyFX Calendar

Recommended by Nick Cawley

Get Your Free Top Trading Opportunities Forecast

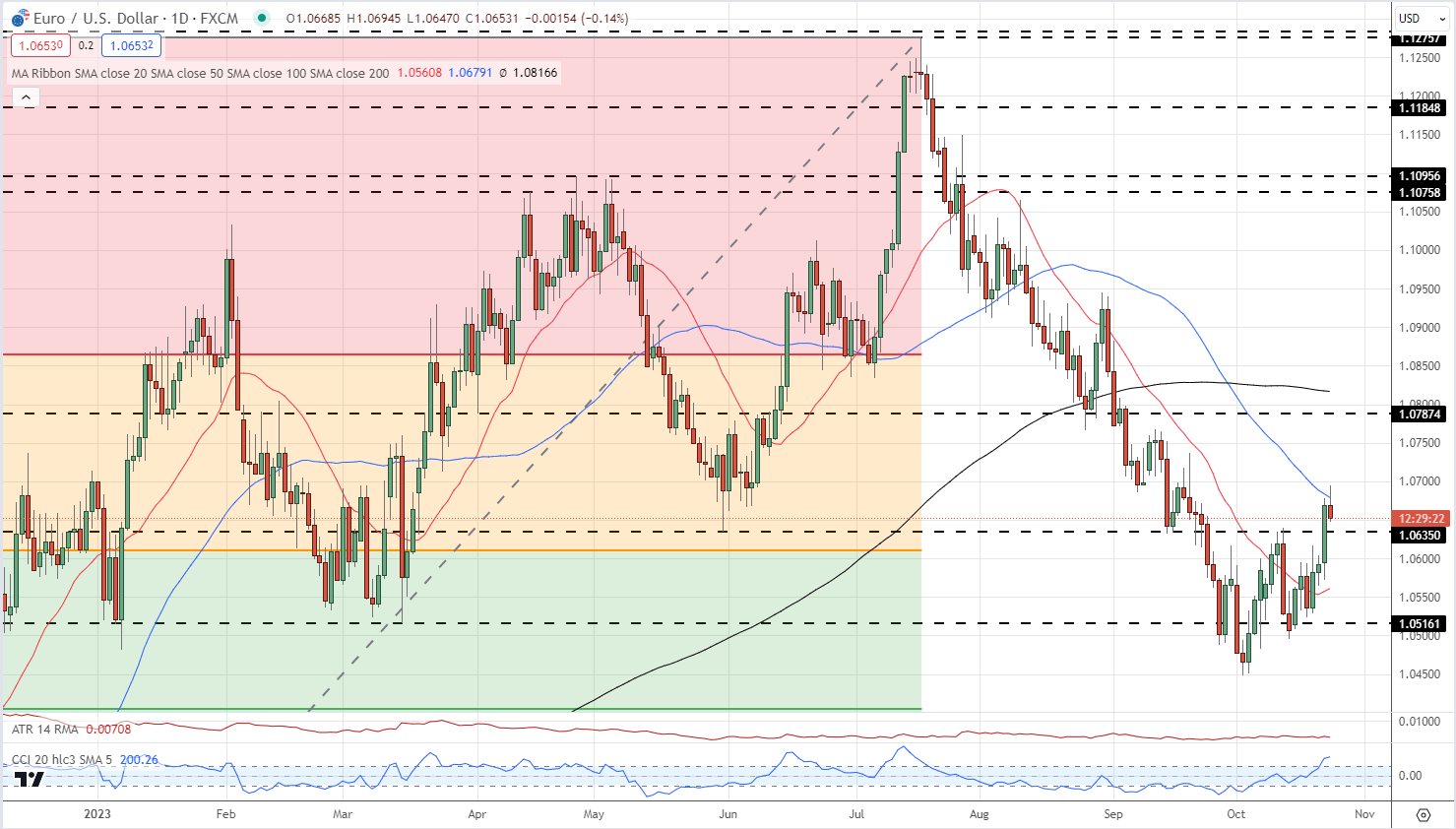

While the Euro edged marginally lower post-PMI data, yesterday’s sell-off in US Treasury yields has helped to underpin EUR/USD. US 10-year yields are now 20 basis points lower from Monday’s multi-year peak of 5.02%, while the 30-year UST is now quoted at 4.95%, down from Monday’s high of 5.18%.

EUR/USD is currently trading on either side of 1.0650 ahead of this week’s ECB meeting on Thursday. The single currency remains weak but with the greenback losing US Treasury yield support, the pair may actually move further higher. EUR/USD has broken back above the 20-day simple moving average with conviction over the last few days, while the 50-day sma is currently being tested. A break above here, currently at 1.0679, would leave 1.0787 as the next level of resistance.

EUR/USD Daily Price Chart – October 24, 2023

See How Clients are Positioned in EUR/USD and What it Means

| Change in | Longs | Shorts | OI |

| Daily | -15% | 24% | 0% |

| Weekly | -22% | 31% | -3% |

All Charts via TradingView

What is your view on the EURO – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com

COMMENTS