It’s been a giant day for Euro backers because the EUR/USD has damaged out to the bull. With only some hours to go in at the moment’s foreign exch

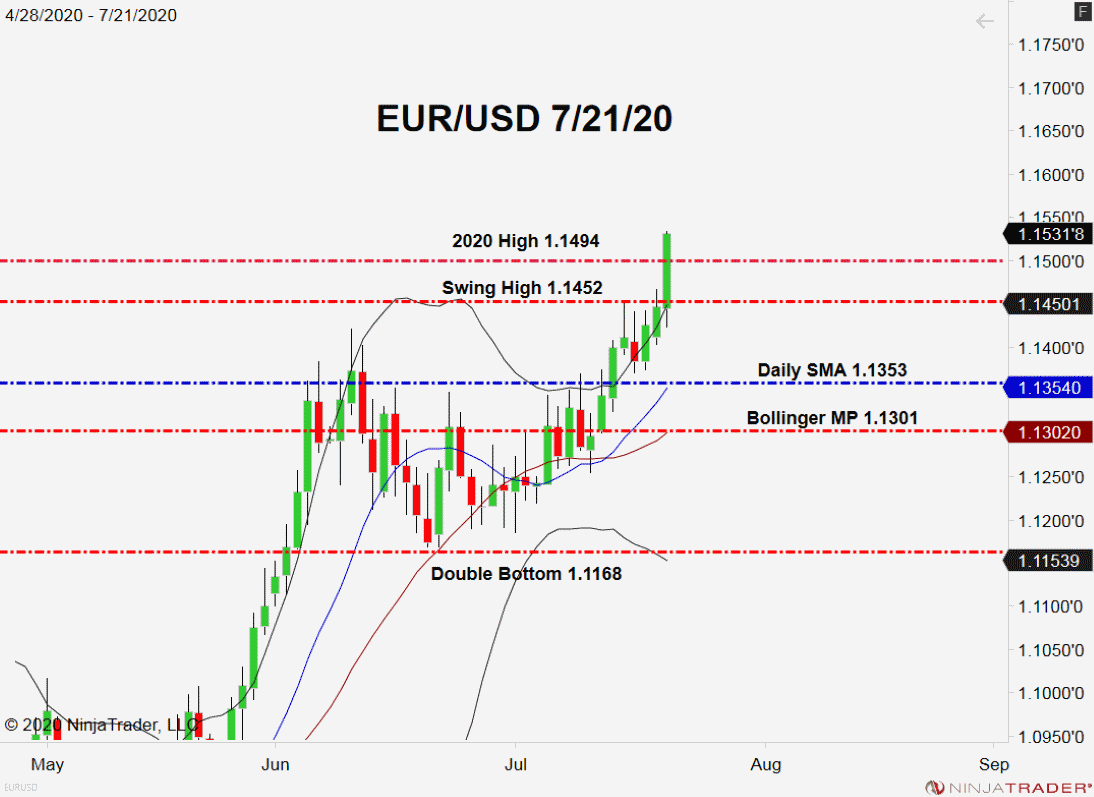

It’s been a giant day for Euro backers because the EUR/USD has damaged out to the bull. With only some hours to go in at the moment’s foreign exchange session, the EUR/USD is up practically 100 pips on heavy bidding. Charges have eclipsed 1.1530, shattering the earlier yearly excessive at 1.1494. The final time we noticed valuations above the 1.1500 deal with was January of 2019.

So, why the sudden power within the EUR/USD? There are a number of components at play:

- At the moment’s announcement of an E.U. bailout package deal is driving hopes of a Q3 and This fall 2020 Eurozone financial restoration.

- COVID-19 circumstances proceed to extend within the U.S. at a speedy tempo. Subsequently, requires a rollback of June’s reopen are starting to take root.

- One other U.S. stimulus package deal is being negotiated, which can inject much more capital into {the marketplace}.

- The FED stays dedicated to QE Limitless and a 0.0% goal fee for the foreseeable future.

If you happen to add these components up, it’s straightforward to see why the Buck is fading vs the euro. For now, it seems that the good cash is buying and selling of their USDs for practically some other asset.

EUR/USD Spikes Over 1.1500

From a technical standpoint, there’s not a lot to see within the EUR/USD. Charges are posting multi-year highs and a bullish bias is warranted.

+2020_07_21+(11_46_37+AM).png)

Overview: Since March, it’s been up, up, and away for the euro vs the Buck. And, this pattern is more likely to proceed into 2021. Till the FED decides to chop again on QE and enhance rates of interest, the USD will proceed to relinquish market share.

Whereas a weaker greenback is nice for equities, commodities, and exports, the lack of buying energy will negatively affect shoppers. At this level, one has to suppose that USD devaluation would be the final long-term end result of the COVID-19 pandemic.