EUR/USD Price Speaking FactorsEUR/USD largely retains the advance following the European Central Financial institution (ECB) asse

EUR/USD Price Speaking Factors

EUR/USD largely retains the advance following the European Central Financial institution (ECB) assembly although President Christine Lagarde warns that “the appreciation of the euro workouts a unfavourable strain on costs,” and the Relative Energy Index (RSI) might supply a bullish sign because the indicator threatens the downward pattern carried over from the tip of July.

EUR/USD Price Eyes 2020 Excessive as RSI Threatens Downward Development

EUR/USD might proceed to retrace the decline from the 2020 excessive (1.2011) because the ECB seems to be in no rush to change the trail for financial coverage, and the up to date employees projections point out the central financial institution will depend on its present instruments to assist the Euro Space as “the incoming information since our final financial coverage assembly in July recommend a powerful rebound in exercise broadly consistent with earlier expectations.”

It appears as if the ECB willproceed to endorse a wait-and-see strategy on the subsequent assembly on October 29 because the Governing Council stands “prepared to regulate all of its devices, as acceptable, to make sure that inflation strikes in direction of its intention in a sustained method,” however present market tendencies might preserve EUR/USD afloat as President Lagarde emphasizes that “the European Central Financial institution doesn’t goal the alternate fee.”

In flip, the ECB might retain the present coverage all through the rest of the 12 months as the European Union (EU) plans to make the EUR 750B recovery fund accessible from 2021 to 2023, and it stays to be seen if the Federal Reserve rate of interest choice will sway the near-term outlook for EUR/USD as Chairman Jerome Powell and Co. plan to “obtain inflation that averages 2 % over time.”

In consequence, the replace to the Abstract of Financial Projections (SEP) might drag on the US Greenback if the rate of interest dot-plot reveals a downward revision in longer-run forecast for the Fed Funds fee, and present market tendencies might persist forward of the US election because the Federal Open Market Committee (FOMC) exhibits little intentions of scaling again its emergency measures in 2020.

Nonetheless, extra of the identical from the June assembly might spark a restricted response as Fed officers talk about an outcome-based strategy versus a calendar-based ahead steerage for financial coverage, and EUR/USD might proceed to trace the month-to-month vary because the decline from the 2020 excessive (1.2011) failed to supply a take a look at of the August low (1.1696).

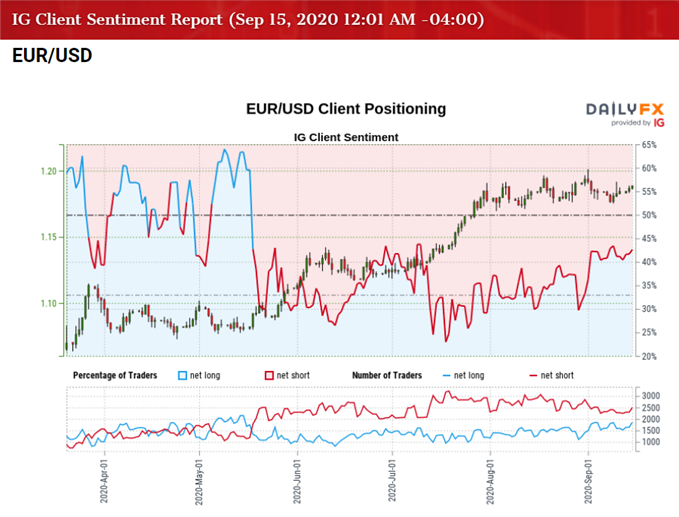

Nonetheless, the crowding habits in EUR/USD seems poised to persist although the alternate fee extends the rebound from the month-to-month low (1.1753) as retail merchants have been net-short the pair since mid-Might.

The IG Shopper Sentiment report exhibits 42.61% of merchants are net-long EUR/USD, with the ratio of merchants brief to lengthy at 1.35 to 1. The variety of merchants net-long is 10.26% increased than yesterday and three.36% decrease from final week, whereas the variety of merchants net-short is 8.02% increased than yesterday and 1.57% increased from final week.

The current rise in net-long place has helped to alleviate the lean in retail sentiment as solely 41.95% of merchants had been net-long EUR/USD on the finish of final week, however the rise in net-short curiosity suggests the crowding habits will persist although the Euro largely retains the advance following the ECB assembly.

With that stated, the continued skew in retail sentiment might proceed to coincide with the bullish worth motionin EUR/USD because it tags a contemporary yearly excessive (1.2011) in September, and the Relative Energy Index (RSI) might foreshadow an additional appreciation within the alternate fee because the indicator threatens the downward pattern carried over from the tip of July.

Really helpful by David Track

Study Extra In regards to the IG Shopper Sentiment Report

Enroll and be part of DailyFX Forex Strategist David Track LIVE for a chance to talk about key themes and potential commerce setups surrounding overseas alternate markets.

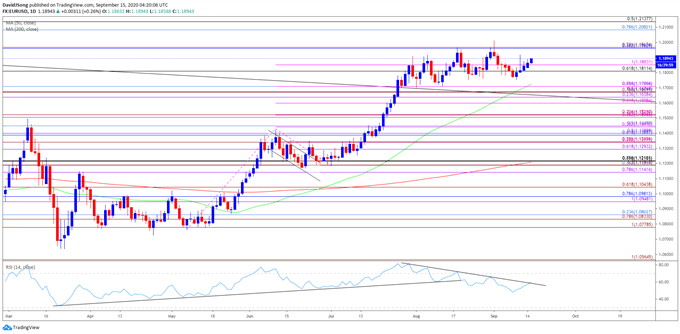

EUR/USD Price Every day Chart

Supply: Buying and selling View

- Take into account, a ‘golden cross’ materialized in EUR/USD in direction of the tip of June because the 50-Day SMA (1.1724) crossed above the 200-Day SMA (1.1210), with the shifting averages extending the optimistic slopes into the second half of the 12 months.

- On the identical time, a bull flag formation panned out following the failed try to shut beneath the 1.1190 (38.2% retracement) to 1.1220 (78.6% enlargement) area in July, with the Relative Energy Index (RSI) serving to to validate the continuation sample because the oscillator bounced alongside trendline assist to protect the upward pattern from March.

- Nonetheless, the EUR/USD rally stalled following the failed try to shut above the 1.1960 (38.2% retracement) to 1.1970 (23.6% enlargement) area, with the RSI highlighting the same dynamic because it slipped beneath 70 to finally break trendline assist.

- An identical state of affairs seems to have materialized in September although EUR/USD traded to a contemporary yearly excessive (1.2011) initially of the month, with the alternate fee staging one other failed try to shut above the 1.1960 (38.2% retracement) to 1.1970 (23.6% enlargement) area.

- EUR/USD might proceed to consolidate because the RSI preserves the downward pattern carried over from the tip of July, however the alternate fee seems to have reversed course forward of the Fibonacci overlap round 1.1670 (50% retracement) to 1.1710 (61.8% retracement), which strains up with the August low (1.1696).

- In flip, looming developments within the RSI might assist to validate a near-term breakout in EUR/USD because the oscillator comes up towards trendline resistance, with a break of the downward pattern to point a resumption of the bullish momentum.

- Will preserve a detailed eye on the RSI if it approaches overbought territory, with a transfer above 70 more likely to be accompanied by an additional appreciation within the alternate fee just like the habits seen in July.

- The shut above the Fibonacci overlap round 1.1810 (61.8% retracement) to 1.1850 (100% enlargement) brings the 1.1960 (38.2% retracement) to 1.1970 (23.6% enlargement) area again on the radar, with a break above the present September excessive (1.2011) opening up the 1.2080 (78.6% retracement) to 1.2140 (50% retracement) space.

Begins in:

Reside now:

Sep 17

( 16:09 GMT )

Be part of Day Three of the DailyFX Summit discussing currencies

DailyFX Training Summit: Commerce Your Market – Day 3, Foreign exchange

— Written by David Track, Forex Strategist

Observe me on Twitter at @DavidJSong