EUR/USD Rate Talking PointsEUR/USD clears the 2020 low (1.0636) as it extends the series of lower highs and lows from last week, but the update to th

EUR/USD Rate Talking Points

EUR/USD clears the 2020 low (1.0636) as it extends the series of lower highs and lows from last week, but the update to the Euro Area’s Consumer Price Index (CPI) may generate a rebound in the exchange rate as inflation is expected to increase for the third consecutive month.

EUR/USD Rate Clears 2020 Low Ahead of Euro Area Inflation Report

EUR/USD trades to a fresh yearly low (1.0635) on the back of US Dollar strength, with the recent weakness in the exchange rate pushing the Relative Strength Index (RSI) into oversold territory for the second time this year.

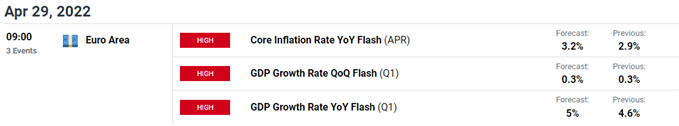

The move below 30 in the RSI raises the scope for a further decline in EUR/USD as the bearish momentum gathers pace, and it remains to be seen if another uptick in the Euro Area CPI will curb the weakness in the exchange rate as the core rate is projected to increase to 3.2% from 2.9% per annum in March.

Evidence of persistent inflation may force the European Central Bank (ECB) adjust the forward guidance for monetary policy as President Christine Lagarde and Co. acknowledge that “inflation has increased significantly and will remain high over the coming months,” and speculation for a looming shift in ECB policy may generate a near-term rebound in EUR/USD as a growing number of Governing Council officials show a greater to implement higher interest rates.

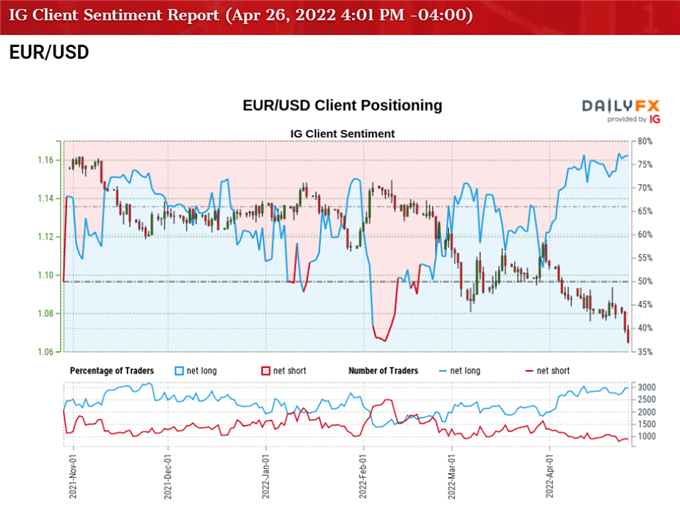

Nevertheless, EUR/USD may continue to exhibit a bearish trend in 2022 as the Federal Reserve appears to be on track to deliver a 50bp rate hike at its next rate decision on May 4, but a further decline in the exchange rate is likely to fuel the tilt in retail sentiment like the behavior seen earlier this year.

The IG Client Sentiment report shows 76.32% of traders are currently net-long EUR/USD, with the ratio of traders long to short standing at 3.22 to 1.

The number of traders net-long is 2.76% higher than yesterday and 0.13% higher from last week, while the number of traders net-short is 3.01% higher than yesterday and 15.22% lower from last week. The rise in net-long interest has fueled the crowding behavior as 68.72% of traders were net-long EUR/USD during the first full week of April, while the decline in net-short position could be a function of profit-taking behavior as the exchange rate trades to a fresh yearly low (1.0635).

With that said, another uptick in the Euro Area’s CPI may curb the recent selloff in EUR/USD as it puts pressure on the ECB to switch gears, but the exchange rate may attempt to test the April 2017 low (1.0569) as the RSI shows the bearish momentum gathering pace.

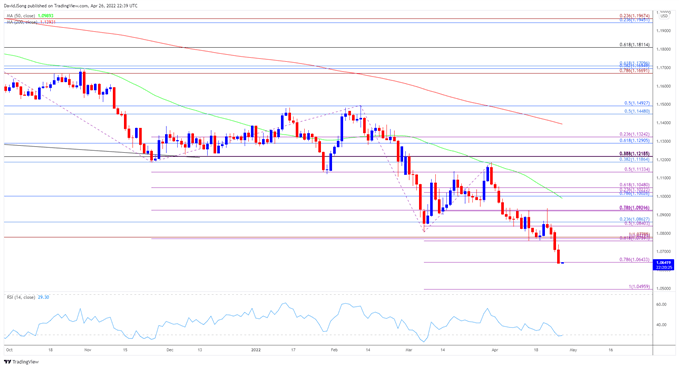

EUR/USD Rate Daily Chart

Source: Trading View

- The broader outlook for EUR/USD remains tilted to the downside as the 200-Day SMA (1.1393) still reflects a negative slope, with the recent decline in the exchange rate pushing the Relative Strength Index (RSI) into oversold territory for the second time this year as it clears the 2020 low (1.0636).

- Need a close below the 1.0640 (78.6% expansion) area to brings the April 2017 low (1.0569) on the radar, with a break/close below the 1.0500 (100% expansion) handle raising the scope for a test of the March 2017 Low (1.0495).

- However, lack of momentum to close below 1.0640 (78.6% expansion) may curb the recent series of lower highs and lows in EUR/USD, with a move back above the 1.0760 (61.8% expansion) to 1.0780 (100% expansion) area bringing the 1.0840 (50% expansion) to 1.0860 (23.6% retracement) region back on the radar.

— Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com