In what has been whipsaw week on the foreign exchange, the Dollar is trying to shut it out on a optimistic be aware. With just a few hours left wit

In what has been whipsaw week on the foreign exchange, the Dollar is trying to shut it out on a optimistic be aware. With just a few hours left within the buying and selling day, the EUR/USD (-0.29%), USD/CHF (+0.61%), and GBP/USD (-0.50%) are all trending in favor of the greenback. Major drivers of the USD’s bullish posture are early-2021 bumps in inflation and shopper sentiment.

At the moment’s financial calendar was good for the U.S. greenback. Right here’s a fast have a look at the highlights:

Occasion Precise Projected Earlier

Core PPI (MoM, Feb.) 2.5% 2.6% 2.0%

Core PPI (YoY, Feb.) 0.2% 0.2% 1.2%

PPI (MoM, Feb.) 0.5% 0.5% 1.3%

PPI (YoY, Feb.) 2.8% 2.7% 1.7%

In brief, the inflation image continues to be cloudy. Nevertheless, Core PPI from February rose from January, as did PPI (YoY, Feb.). This can be a good signal, given the Fed’s issues over lagging inflation. If nothing else, limitless QE and aggressive COVD-19 stimulus seem like having their supposed results.

The headliner of this morning’s financial knowledge was the spike in shopper sentiment. The College of Michigan Shopper Sentiment Index (March) got here in at 83.0, properly above projections (78.5) and the earlier launch (76.8). As soon as once more, that is good for the USD. At this level, it seems that customers are gaining positivity as COVID-19 vaccines and authorities stimulus are being distributed to the general public. It is going to be attention-grabbing to observe this determine as 2021 unfolds.

For the EUR/USD, the bears have dominated the motion. Nevertheless, charges are properly off intraday lows (1.1909) and within the neighborhood of 1.1950.

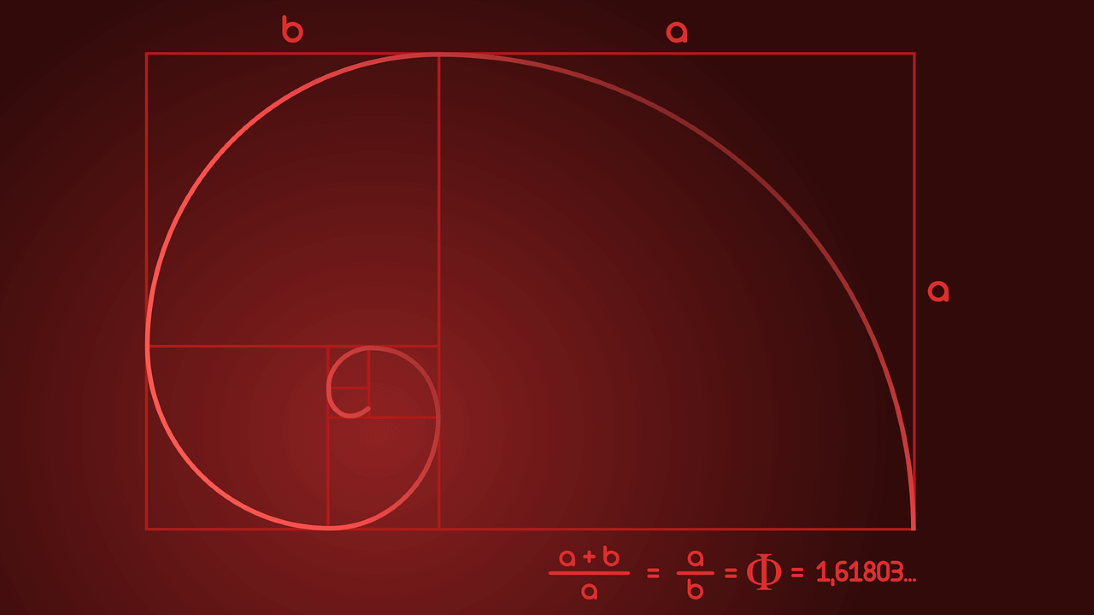

EUR/USD Rejects 38% Fibby

In a Dwell Market Replace from Thursday, I outlined a shorting alternative within the EUR/USD. The commerce was a winner, cashing in for 40 pips because the market rejected the 38% retracement of the February/March vary.

+2021_03_12+(10_52_22+AM).png)

Overview: As we roll into subsequent week’s commerce, the important thing quantity to observe on this market is 1.1991. If the EUR/USD continues commerce beneath this stage, a bearish bias is warranted; whether it is taken out, a robust transfer to the upside could develop. With subsequent week’s Fed assembly quickly to dominate the information cycle, it’s anybody’s guess the place this pair will likely be buying and selling subsequent Friday.