The foreign money markets have been alive right this moment, that includes whipsaw motion throughout the majors. Probably the most fascinating has

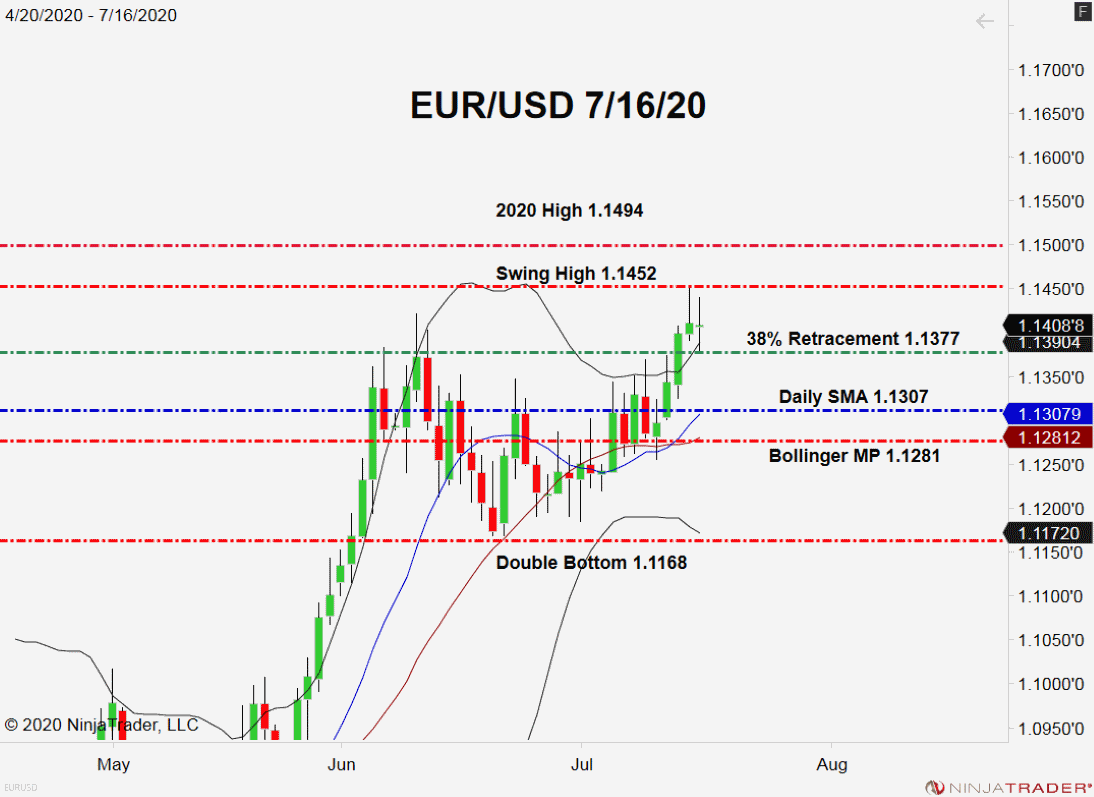

The foreign money markets have been alive right this moment, that includes whipsaw motion throughout the majors. Probably the most fascinating has been the EUR/USD, posting an intraday excessive close to 1.1450 and low round 1.1375. Whereas not a very spectacular buying and selling vary, the important thing variety of 1.1400 has been hotly contested by each patrons and sellers.

So, why the motion within the EUR/USD? Key fundamentals have been the story, highlighted by the releases beneath:

Occasion Precise Projected Earlier

ECB Curiosity Charge Determination 0% 0% 0%

U.S. Retail Gross sales (MoM, June) 7.5% 5.0% 18.2%

NAHB Housing Market Index (July) 72 60 58

Briefly, the ECB has prolonged its dovish outlook and the American financial system is displaying indicators of life. Maybe probably the most telling statistic is the NAHB Housing Market Index. The quantity got here in at 72, smashing expectations of 60. This determine means that patrons are snatching up U.S. actual property and lenders are excited to lend given a gradual circulation of 0% money from the FED.

Right now’s fundamentals level to a bearish EUR/USD. Nevertheless, a market sell-off has not developed, with charges holding agency above 1.1400.

EUR/USD Pivots From Wednesday’s Highs

In a Stay Market Replace from earlier this month, I outlined a brief commerce within the EUR/USD. Though the timing was just a few days off, the commerce proved efficient producing 38 pips.

+2020_07_16+(10_58_56+AM).png)

Overview: Although the elemental image could also be shifting for the EUR/USD, a bullish bias remains to be warranted. Charges are north of 1.1400 and holding above the each day 38% Present Wave Retracement (1.1377). Till we see a big transfer beneath this degree, it’s finest to carry longs and search for extra weak point out of the USD.