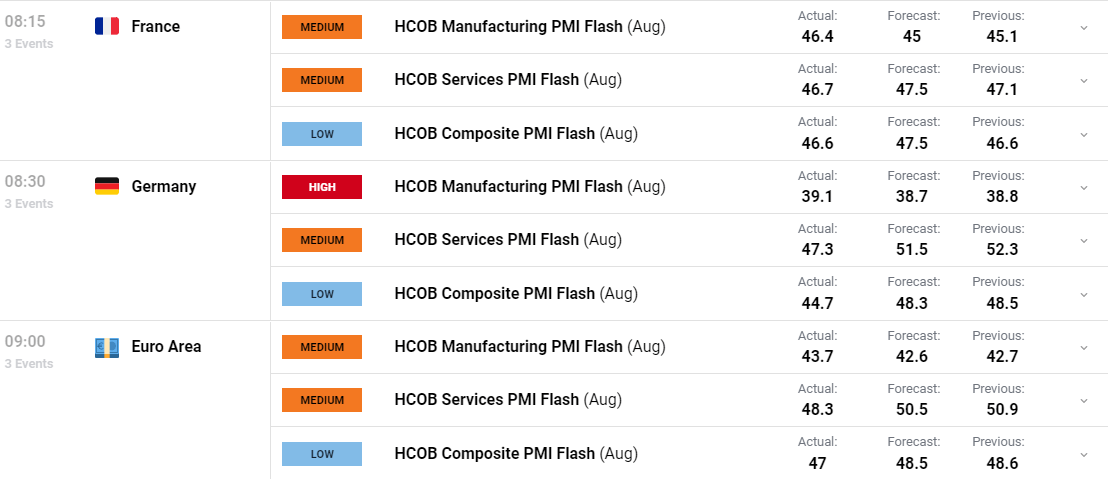

EURO AREA PMI KEY POINTS:Germany Manufacturing PMI Flash at 39.1. Forecasted Figure 38.7. Business Activity Fell the Most in Over 3 Years.German Servi

EURO AREA PMI KEY POINTS:

- Germany Manufacturing PMI Flash at 39.1. Forecasted Figure 38.7. Business Activity Fell the Most in Over 3 Years.

- German Services PMI at 47.3. Forecasted Figure 51.5.

- Flash Euro Area Composite Output Index at 47 (July: 48.6). 33-Month Low.

- Flash Euro Area Services PMI Activity Index at 48.3 (July: 50.9). 30-Month Low.

- Flash Euro Area Manufacturing PMI at 43.7 (July: 42.7). 3-month high.

Recommended by Zain Vawda

Get Your Free EUR Forecast

German Business Activity suffered its steepest decline in 3 years as lackluster manufacturing PMI was accompanied by a renewed contraction in services activity. The service sector is particularly concerning as it was viewed as a potential saving grace for the German economy, with those hopes now all but erased. Businesses remain pessimistic on their outlook for the rest of year with the survey noting an uptick in inflationary pressures largely down to the service sector.

Source: HCOB. S&P Global PMI

Business Activity in the Euro Area contracted at an accelerated pace for the month of August, with services in particular becoming a concern. Services and Manufacturing reported falling output and new orders with manufacturing recording the sharper rate of decline.

The seasonally adjusted HCOB Flash Eurozone PMI Composite PMI fell to 47.0 in August 2023 from 48.6 in the previous month, well below market expectations of 48.5, a preliminary estimate showed. The latest reading pointed to the steepest pace of contraction in the region’s private sector activity since November 2020. Manufacturing output contracted at the second-strongest pace over the past 11 years, second only to the initial COVID-19 lockdowns, and services output dropped for the first time since last December.

Customize and filter live economic data via our DailyFX economic calendar

New business inflows fell for a 3rd straight month, excluding the pandemic this is now the steepest since October 2012. New orders for goods continued to fall at one of the sharpest rates since the global financial crisis, accompanied by a second month of deteriorating demand for services.

Price pressures increased as well with both input costs and average selling prices rising while expectations around output for the months ahead have reached their lowest point since December 2022.

Employment slowed as well registering the smallest rate of job creation since the post-pandemic recovery began. Manufacturing jobs declined for a 3rd straight month while the service sector recorded the smallest net-job gain since February 2021.

For Tips on Strategy and News Trading Download Your Free Guide Below

Recommended by Zain Vawda

Trading Forex News: The Strategy

THE PMI RELEASE AND IMPLICATIONS FOR THE EUROPEAN ENTRAL BANK (ECB)

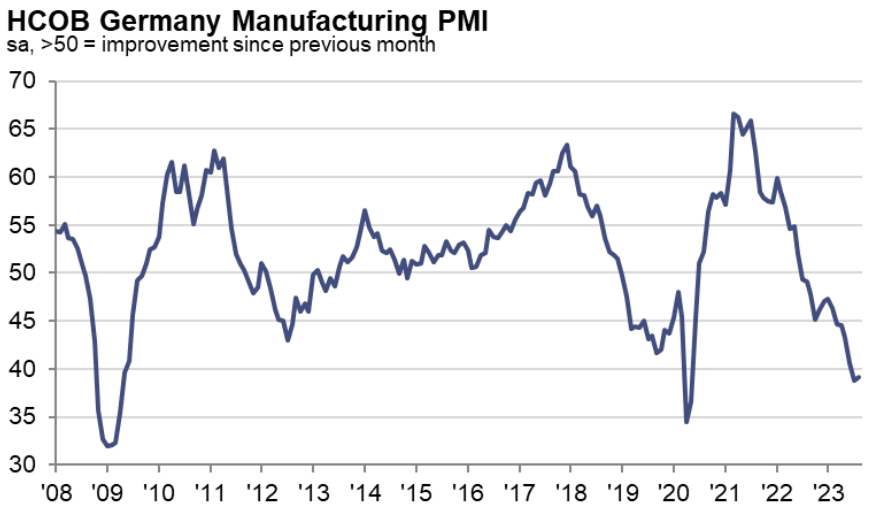

The German and Euro Area PMI data has been on a steady decline since its most recent peak in January at 47.3 and 48.8 respectively. This is concerning as a print below 50 means the economy has remained in contraction territory for the entire year thus far with Germany in particular an area of concern.

The rest of this week leaves very little in terms of risk events moving forward with the Jackson Hole Symposium taking the limelight. Comments will be delivered by Christine Lagarde which could give a better indication of where the Central Bank stands heading toward the September meeting.

Following today’s data, we have seen the probability of a rate hike in September decline from around the 60% mark toward 40%. The data will no doubt give the European Central Bank (ECB) food for thought as talks around a pause likely to resurface. ECB President Christine Lagarde is scheduled to speak at Jackson Hole on Friday with her comments now looking even more intriguing as market participants look to gauge what the response from the Central Bank will be in September.

MARKET REACTION

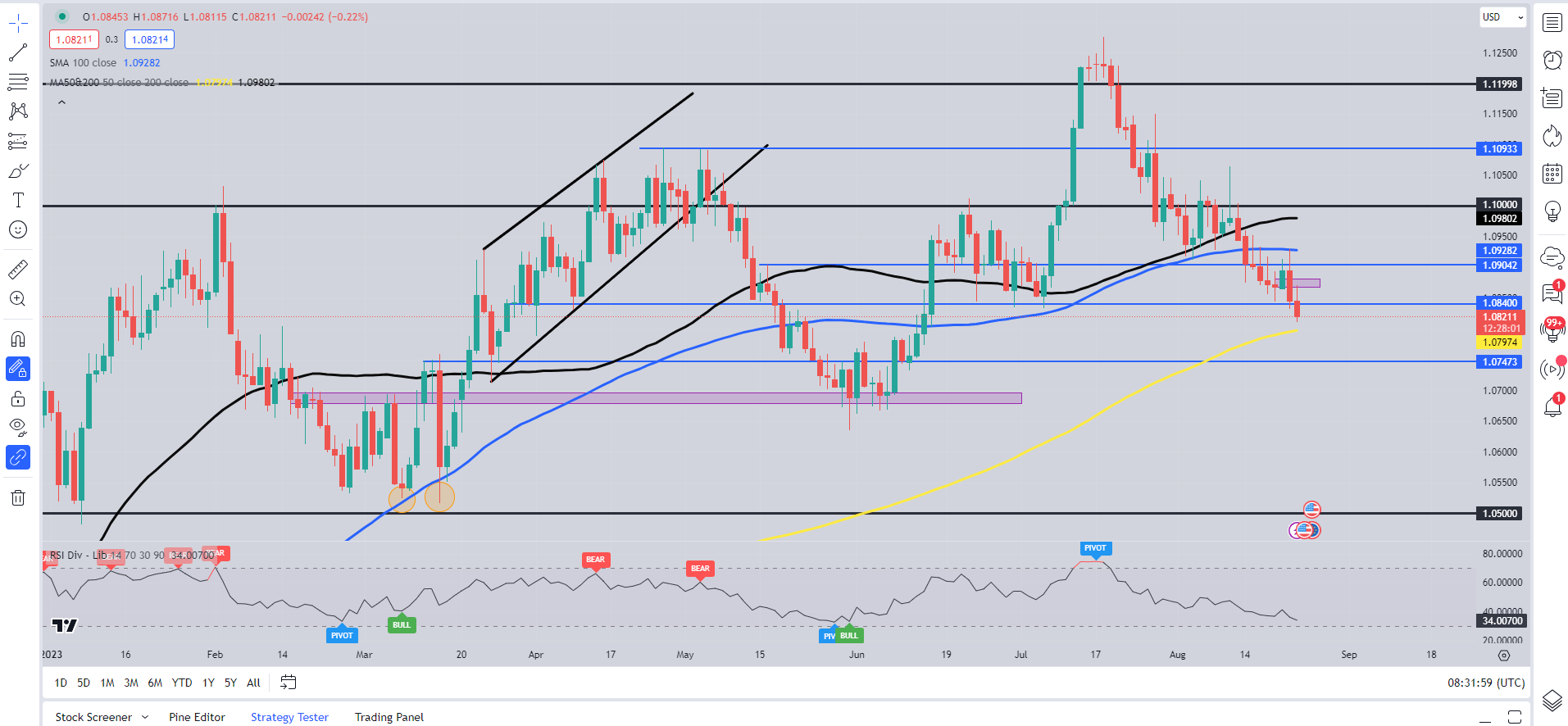

EUR/USD Daily Chart

Source: TradingView, prepared by Zain Vawda

The Initial reaction to the data saw EURUSD spike 50 pips lower before hovering around the 1.0820 handle at the time of writing. Key area at present with the 200-day MA resting just below the 1.0800 handle and could cap further losses.

EURUSD did face selling pressure as a stronger US Dollar and rising US yields saw the pair fall to support around the 1.0840 handle and print a fresh 7-week low. There is potential for further downside with a break below the 1.0840 support handle opening up a run toward the 200-day MA resting just a smidge below the 1.0800 handle. For now, though much like the majority of major pairs the range between the 100 and 200-day MAs could continue to hold firm keeping EURUSD confined to the 220 odd pip range.

Key Levels to Keep an Eye On:

Support levels:

- 1.0840

- 1.0797 (200-day MA)

- 1.0747

Resistance levels:

- 1.0900

- 1.0930 (100-day MA)

- 1.1000 (psychological level)

For a Full and Comprehensive Breakdown of Client Sentiment Data Click on the Guide Below

| Change in | Longs | Shorts | OI |

| Daily | 11% | -23% | -3% |

| Weekly | 16% | -15% | 4% |

— Written by Zain Vawda for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com

COMMENTS