EUR/USD Forecast - Prices, Charts, and AnalysisGerman inflation continues to fall as energy costs tumble.FOMC and US NFPs will steer EUR/USD in the s

EUR/USD Forecast – Prices, Charts, and Analysis

- German inflation continues to fall as energy costs tumble.

- FOMC and US NFPs will steer EUR/USD in the short term.

Download our Q1 Euro Technical and Fundamental Reports Below:

Recommended by Nick Cawley

Get Your Free EUR Forecast

Most Read: Euro (EUR/USD) Pares Recent Losses After German and Euro Aera Q4 Releases

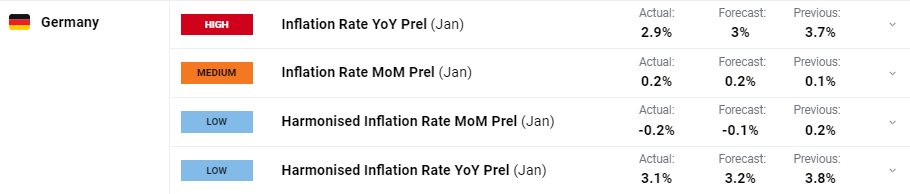

German inflation fell by more than expected in January, official data showed today, hitting the lowest level since June 2021, as goods inflation fell sharply. Energy costs fell by 2.8%, compared to a 4.1% increase in December, while food inflation fell from 4.5% to 3.8%.

For all market-moving economic data and events, see the real-time DailyFX Economic Calendar

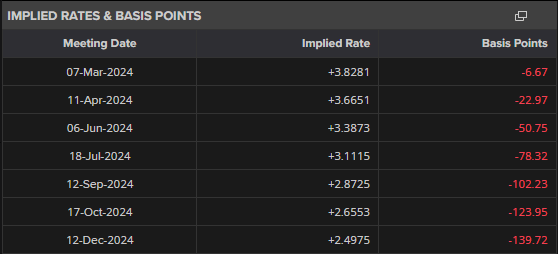

The single currency has been under of pressure recently as expectations grow that the European Central Bank (ECB) will start to trim borrowing costs at the April 11th meeting. Euro Area interest rate probabilities currently show a 75% chance of a 25 basis point cut at the start of Q2 with a series of cuts taking the Deposit Rate down to 2.50% by the end of the year.

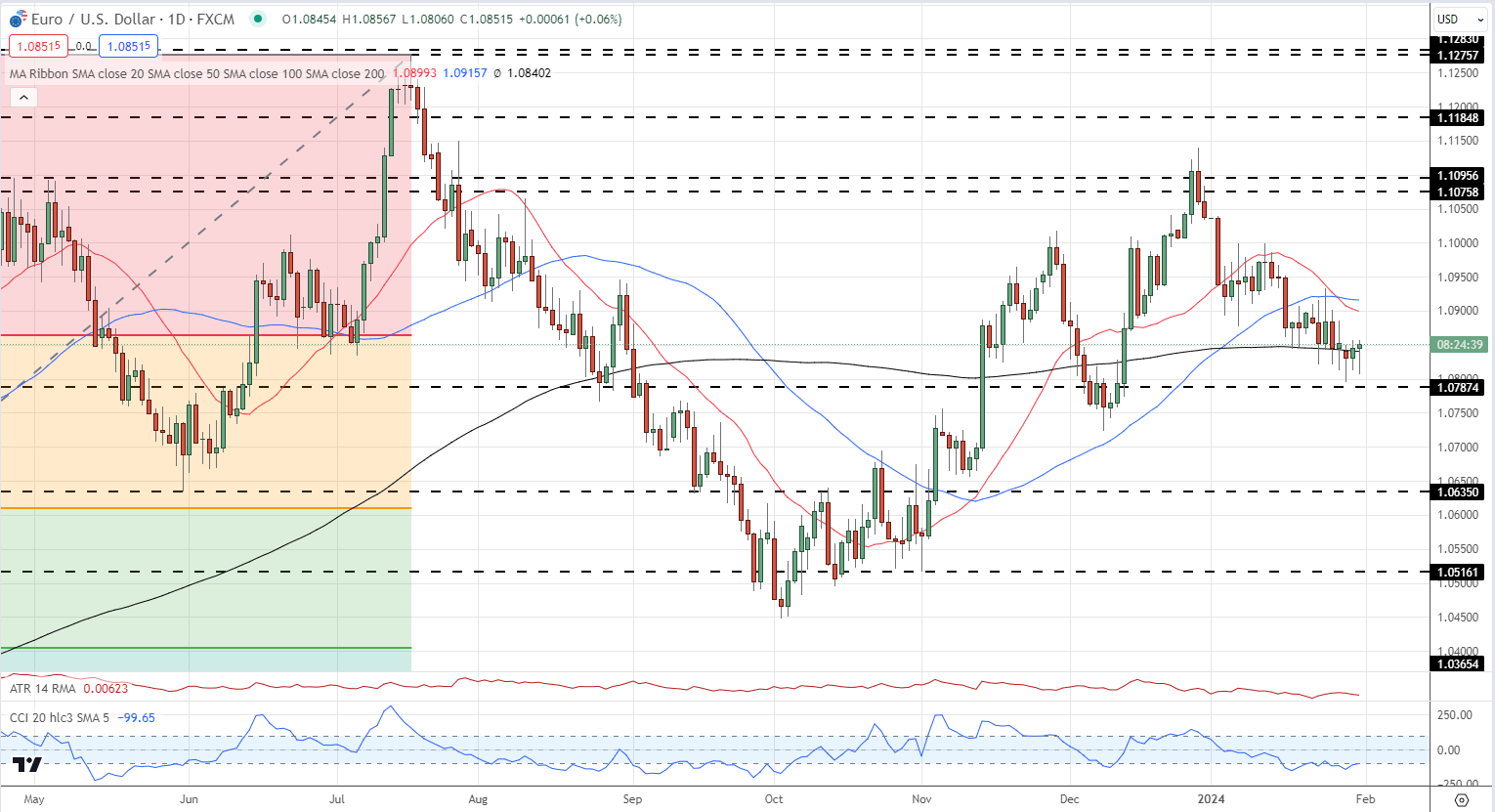

EUR/USD briefly dipped below 1.0800 on Tuesday but did not test a prior level of horizontal support at 1.0787. The pair are currently trading on either side of the 200-day simple moving average around 1.0840 and are likely to remain around this level ahead of this evening’s FOMC meeting. Chair Powell is expected to leave US interest rates untouched but may give some more detail about when the Fed will start to cut interest rates at the post-decision press conference.

EUR/USD Daily Chart

Charts Using TradingView

IG retail trader data show 55.75% of traders are net-long with the ratio of traders long to short at 1.26 to 1.The number of traders net-long is 1.04% lower than yesterday and 3.74% higher than last week, while the number of traders net-short is 1.31% lower than yesterday and 6.77% lower than last week.

To See What This Means for EUR/USD, Download the Full Retail Sentiment Report Below

| Change in | Longs | Shorts | OI |

| Daily | -7% | -2% | -4% |

| Weekly | 14% | -13% | -1% |

What is your view on the EURO – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com

COMMENTS