Eurozone GDP to substantiate double-dip recession however euro appears to be like to brighter Q2 – Foreign exchange Informatio

Eurozone GDP to substantiate double-dip recession however euro appears to be like to brighter Q2 – Foreign exchange Information Preview

Posted on April 28, 2021 at 2:58 pm GMTRaffi Boyadjian, XM Funding Analysis Desk

The flash estimate of first quarter GDP progress is due out of the Eurozone on Friday at 09:00 GMT. Contemporary lockdowns are anticipated to have dragged the euro space economic system right into a double-dip recession, highlighting Europe’s bumpy restoration street. Nonetheless, forward-looking indicators counsel a rebound is already underway, and mixed with the pick-up in Europe’s vaccination tempo, traders are extra optimistic concerning the months forward. Consequently, the euro has perked up currently, however how sustainable is that this bullish part?

Not so grim in Europe

The Eurozone economic system contracted by 0.7% quarter-on-quarter within the three months to December because the restoration unravelled when Europe grew to become gripped by a second wave of Covid-19. After a short respite, a 3rd wave struck the continent, which remains to be ongoing and lots of international locations stay in lockdown. The preliminary GDP print for the primary quarter is predicted to indicate the euro space economic system shrunk by an additional 0.8% q/q.

The year-on-year decline, nonetheless, is forecast to have narrowed from 4.9% to 2.0%. Though this might primarily be right down to the low base impact from Q1 2020, there are different causes to be inspired from the information. For one, analysts had been predicting a a lot steeper contraction just some weeks in the past. However after a yr of fixed lockdowns, companies and people have tailored to residing with the infinite virus curbs and European economies are actually in a position to stand up to the newest spherical of restrictions significantly better.

Companies have learnt to stay with virus guidelines

Eurozone PMIs have surged prior to now couple of months, with the providers sector increasing in April for the primary time since August 2020. The growth in manufacturing additionally exhibits no signal of abating; the manufacturing PMI hit the very best on report in April.

Though it would most likely be a number of weeks earlier than the large European economies see virus restrictions being considerably lifted – so a full restoration undoubtedly stays a good distance off – the latest acceleration of the European Union’s vaccination programme has raised hopes that the newest lockdowns would be the final.

Can US yields keep so tamed for much longer?

This renewed optimism is being mirrored in Eurozone authorities bond yields, which have been edging greater throughout April, even because the European Central Financial institution has supposedly been ratcheting up its asset purchases. US Treasury yields have within the meantime been drifting decrease, lowering the greenback’s yield benefit over the one forex.

Nonetheless, it stays to be seen how lengthy this development will final and whether or not the euro’s spectacular rebound might be sustained. The US economic system is firing on all cylinders so the chance of inflation spiralling uncontrolled and forcing central financial institution motion is way better in America than it’s within the euro space. However that will not essentially imply a stronger greenback.

ECB might wrestle to be as dovish because the Fed

The ECB seems keener to wind down its emergency stimulus measures than the Fed and will sign such a transfer as early as June. There’s a rising concentrate on the June assembly for the Fed too, however the distinction is that the ECB has a critical communication downside and will wrestle to comprise market expectations, whereas the Fed is much less more likely to spark taper tantrum.

Euro meets sticky resistance at $1.21

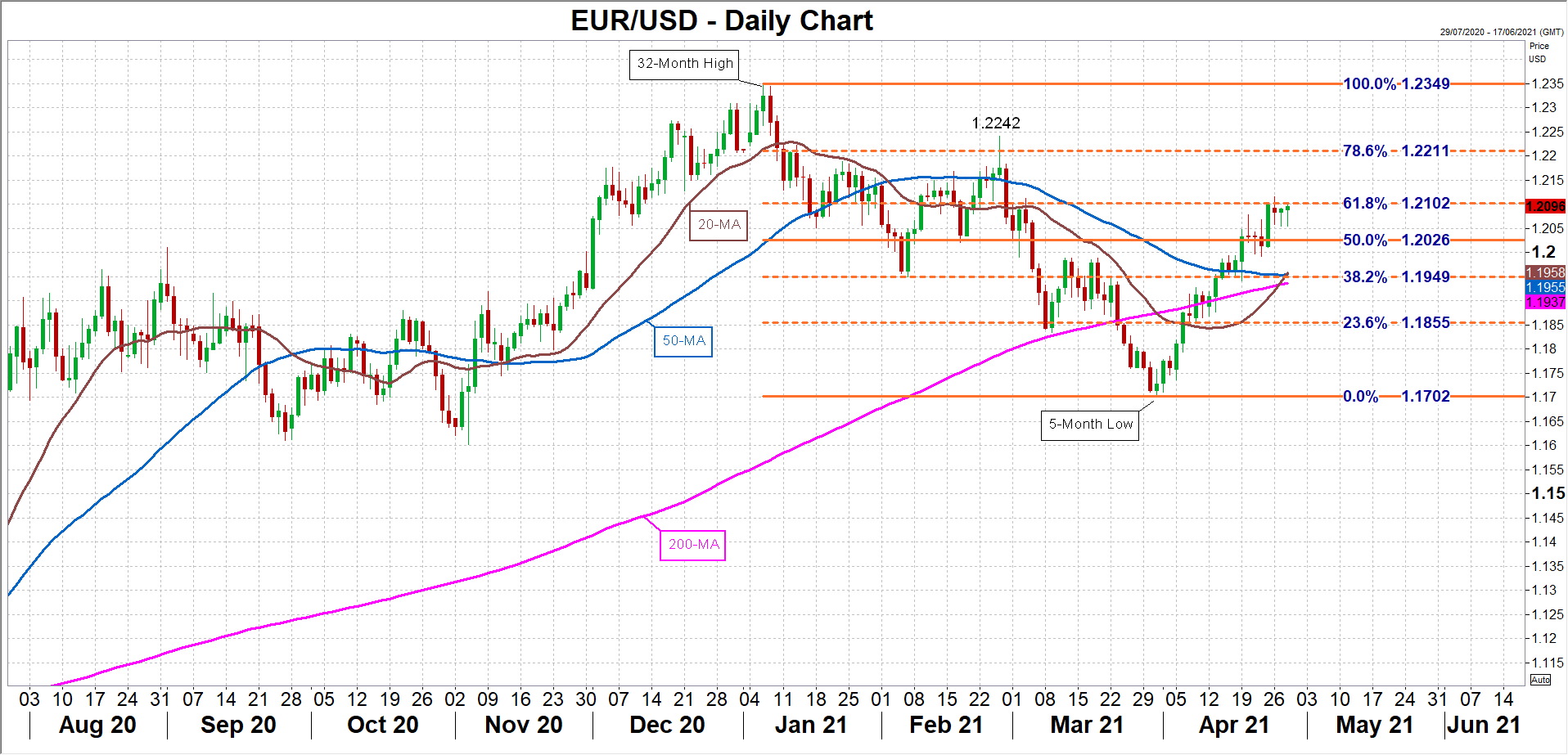

Thus, the euro might prolong its restoration towards the greenback at the same time as progress within the US exceeds that in Europe within the subsequent few quarters. Within the quick time period, nonetheless, euro/greenback’s fortunes shall be decided by whether or not the pair can overcome powerful resistance within the $1.21 space, which is the 61.8% Fibonacci retracement of the January-March downleg. A profitable climb above this mark might pave the best way for the February prime of $1.2242.

Nonetheless, ought to a few of the European optimism fade or the greenback makes an attempt a comeback, the euro might decline in the direction of the $1.1950 area which is the intersection of the 38.2% Fibonacci in addition to the 20- and 50-day transferring averages. A drop beneath this junction would flip consideration to the 23.6% Fibonacci of $1.1855.

EURUSD