Central bank policies, particularly those of the ECB, are pivotal in shaping the EUR/USD exchange rate. The ECB is expected to maintain a

Central bank policies, particularly those of the ECB, are pivotal in shaping the EUR/USD exchange rate.

The ECB is expected to maintain a hawkish tone, signalling no imminent interest rate cuts. With inflation risks resurging, this stance is likely to be reinforced. The Eurozone’s struggle with high inflation and economic slowdown for over 18 months further complicates the scenario. As Samer Hasn, Market Analyst at XS.com, commented:

‘The euro’s side trading comes in light of the anticipation of the ECB meeting and a set of PMI figures for the Eurozone. The central bank is expected to continue its hawkish tone and emphasize that there will be no interest rate cut soon.’

The ECB’s policy direction, juxtaposed with the Federal Reserve’s (Fed) actions, plays a crucial role in the EUR/USD dynamics.

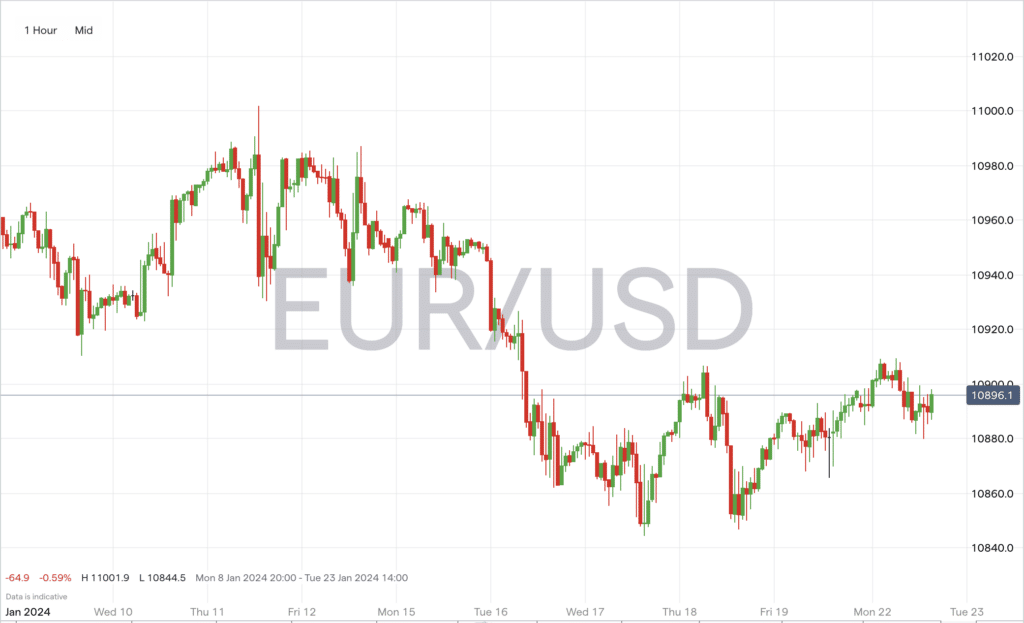

The Euro started this week trading at approximately 1.08930 against the US dollar, with traders closely monitoring the European Central Bank (ECB) meeting and Eurozone PMI figures. This period of side trading reflects the anticipation surrounding the ECB’s stance and key economic data.

Source: IG Markets

On the economic front, preliminary January readings for the manufacturing and services PMIs in Germany, France, and the Eurozone are due. While a decline in activities is anticipated, it is expected to be at a slower pace compared to December 2023.

Meanwhile, across the Atlantic, expectations for a Fed rate cut in March are diminishing. The likelihood of a 25-basis point cut has reduced significantly, influencing the dollar’s strength and, consequently, the EUR/USD pair. Bas Kooijman, CEO and Asset Manager of DHF Capital, confirmed this conclusion:

‘Federal Reserve officials have also confirmed their hawkish outlook, indicating that the Fed might not be ready for an early rate cut. Traders could turn to the release of new economic data this week which could impact expectations and the trajectory of the dollar.’

In the bond markets, yields on Eurozone bonds, particularly German Bunds, saw a decrease after peaking in mid-January 2024. This fluctuation in bond yields reflects the broader economic sentiments influencing the Euro.

Analysts are closely observing the region’s inflation numbers, with core Consumer Price Index (CPI) expected to remain above the ECB’s target. Retail sales data from both Europe and the US are also crucial in determining the short-term movements of the EUR/USD pair.

As of January 22, 2024, the EUR/USD pair showed potential for either a bullish or bearish trend depending on key economic data releases and central bank statements. Traders and investors are advised to monitor these developments closely, as they are likely to influence the currency pair’s trajectory in the near term.

People Also Read

www.forextraders.com

COMMENTS