FNG Exclusive… FNG has learned that London based Retail FX and CFDs broker 4T Markets Limited posted a net loss of £300,000 in fiscal ye

FNG Exclusive… FNG has learned that London based Retail FX and CFDs broker 4T Markets Limited posted a net loss of £300,000 in fiscal year 2023 (year ended March 31), its first full year of operation under its new brand.

As was also exclusively reported here at FNG, the FCA licensed MT4/MT5 broker formally known as Formax Prime was acquired and rebranded as 4T Markets in early 2022. The broker’s new url is 4t.co.uk, with a sister offshore entity in Seychelles operating website 4t.com.

Formax Prime was a broker established mid last decade by Chinese entrepreneur Xi Wang. Formax set up operations (with licenses) in a number of jurisdictions, including the UK, targeting mainly HNW traders, but never really got off the ground. The company was sold last year to UK based businessman Waqas Mahmood, via his holding company Regalis Trading Solutions Limited. 4T Markets brought on board former SquaredFinancial CEO Youssef Barakat, to head the group’s offshore operations.

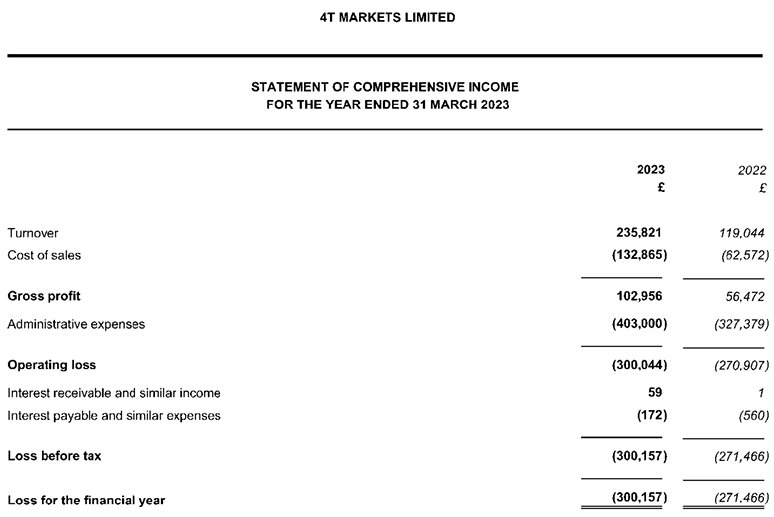

4T Markets nearly doubled its Revenues during FY2023 to £236K (from £119K the previous year), but increased expenses led to a larger loss of £300K in 2023 (2022: £271K), as noted above.

The firm’s principal activity is to act as an agency intermediary broker to its clients, who wish to use the firm’s electronic trading platform to trade the financial markets, and in particular Foreign Exchange Over The Counter (OTC) traded instruments.

During the period of 1st of April 2022 to the 31st of March 2023, 4T Markets Limited has continued the implementation of its business plan and completed the first full financial year of operation following the rebranding that the firm underwent in Q4 of 2021.

Senior Management oversaw a complete website overhaul that was completed in Q2 2022, incorporating fully automated client on-boarding capabilities. Private client trading in rolling spot Foreign Exchange was relaunched and the firm continues to provide white label technology services to other brokerage companies, including trading platform management and compliance support. The provision of such services ensure that the firm has a stable monthly revenue stream.

Delays in the implementation of the business plan have been, and still are being experienced due to many different factors, like the current difficult market conditions, the uncertainty in the financial markets, and although not as severe as in the previous years, there are still negative effects of the COVID-19 pandemic and also the uncertainty around the new rules relating to the financial services regulation after Brexit.

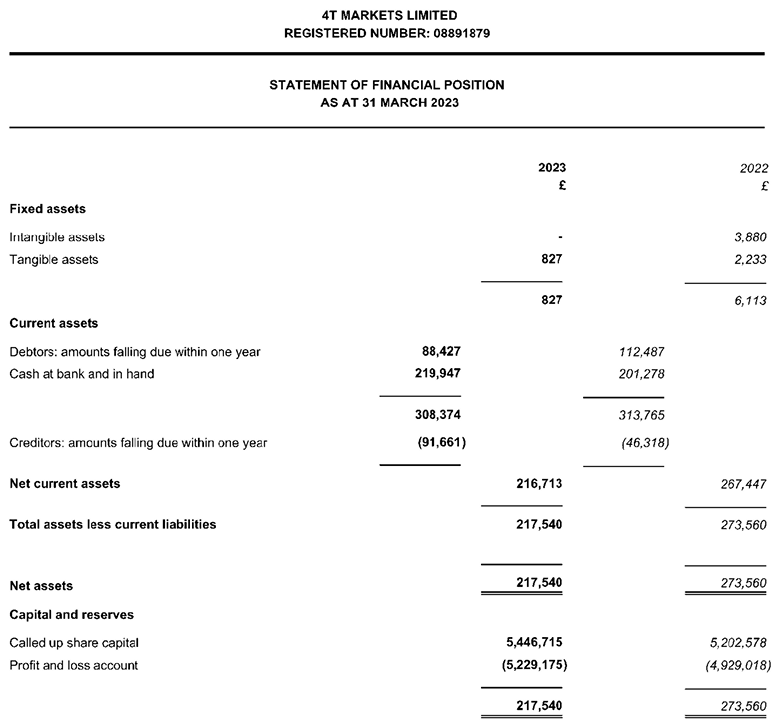

The IFPR that came into force in 2022, has increased the firm’s permanent minimum requirement (PMR) from a base capital figure of €125,000 to £190,000 as of January 1st 2023. As there is no matched principal exemption under IFPR, the firm will move to a PMR of £750,000 over a 5-year period that started in 2022. The shareholders have injected additional capital to cover the minimum capital requirement, and senior management will ensure that the firm is adequately capitalised during the transitional 5-year period to comply with the new regime.

4T Markets senior management have been working to ensure that the revised business plan implementation is on track, taking into account the aforementioned delays. The shareholders have funded 4T Market with adequate capital to address not only the minimum regulatory capital necessary for the firm to comply with the FCA’s requirements but also its working capital requirements, and will continue to do so to ensure that it can sustain the business until it is profitable and can operate organically on its own resources.

Following the relaunch of its business, the 4T Markets is targeting a range of clients, from high net worth individuals to professional and institutional investors, with extensive knowledge in the trading industry. The company has always been a customer needs led organisation and treating customers fairly is ingrained in its culture. The behaviour of employees towards customers is governed by the company policies and the FCA’s requirements.

4T Markets is controlled by UK businessman Waqas Mahmood, via his holding company Regalis Trading Solutions Limited. The broker, operated mainly from the UK and Lebanon, focuses on an Arabic language speaking client base.

4T Markets Limited’s FY2023 income statement and balance sheet follow.

fxnewsgroup.com

COMMENTS