PPI Data Reveals Slowing Price PressuresUS PPI inflation data printed a welcomed decline on both the core and headline figures. The year-on-year prin

PPI Data Reveals Slowing Price Pressures

US PPI inflation data printed a welcomed decline on both the core and headline figures. The year-on-year print for April revealed a 2.3% increase compared to expectations of 2.5% and down from last month’s 2.7%. Likewise, Core PPI printed 3.2% against expectations of 3.3% and is down from the prior 3.4%.

On a month-to-month basis, PPI rose 0.2% in April compared to last month decline of 0.5% and against expectations of a 0.3% rise – suggesting while the overall direction of travel remains constructive, prices are showing little motivation to come down.

Recommended by Richard Snow

See what our analysts think of USD in Q2

Customize and filter live economic data via our DailyFX economic calendar

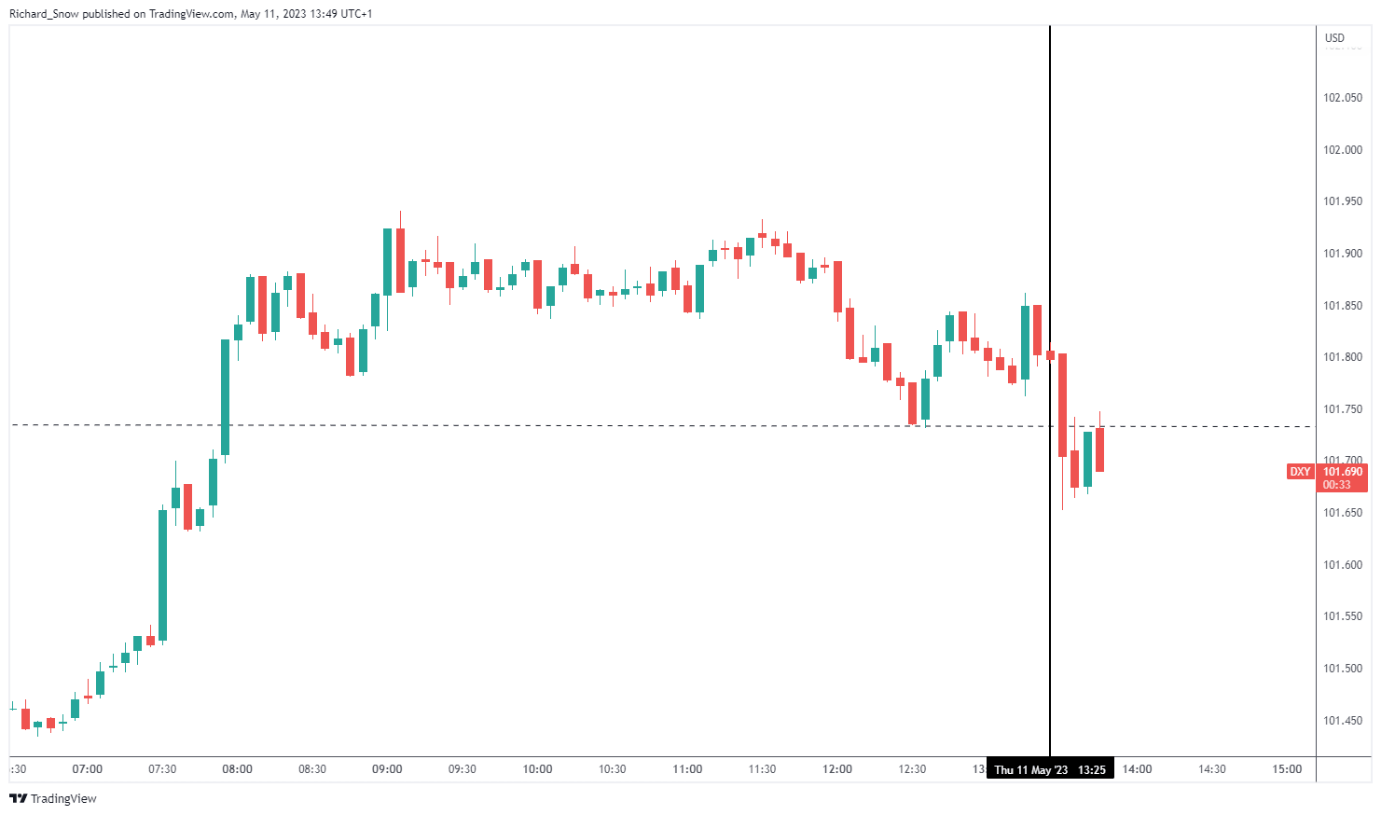

USD Grinds Lower on Release of PPI data and Concerning Jobs data

The dollar moved slightly lower after the data release but it’s difficult to separate the potential cause of the move as initial jobless claims rose to numbers last seen in 2021. A softer jobs market implies the Fed may contemplate changing its tune and consider letting up on future rate hikes – which is typically bearish for the dollar. Although, it appears as if the Fed is pausing hikes at current levels dependent on incoming data. This only reinforces the importance of future inflation prints.

US Dollar Basket (DXY) 5-Min Chart

Source: TradingView, prepared by Richard Snow

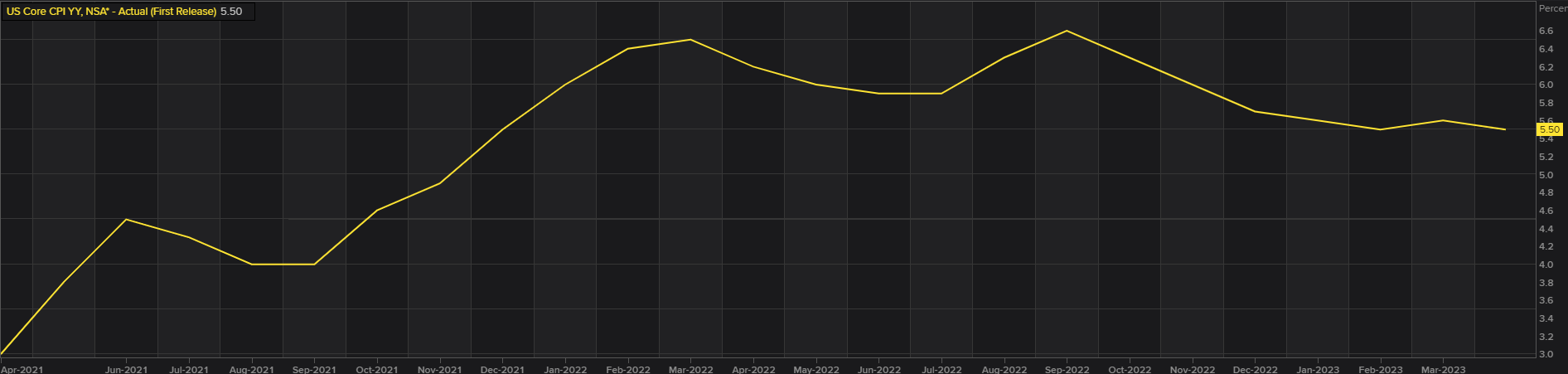

Core Inflation Remains a Concern Despite Progress in the Headline Measure

PPI serves to complement the market’s main inflation gauge – the consumer price index (CPI) which typically evokes a greater market response. Headline inflation added to last month’s massive drop of 1%, coming in at 4.9%. This is in stark contrast to the headline figure displayed below – showing a reluctance to head lower.

The longer price pressures persist, the longer the Fed expects to keep interest rates elevated – weighing on the economic outlook in the wake of the unresolved regional bank turmoil and impasse over the US debt ceiling.

US Core CPI Fails to Drop Considerably

Source: Refinitiv, prepared by Richard Snow

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com