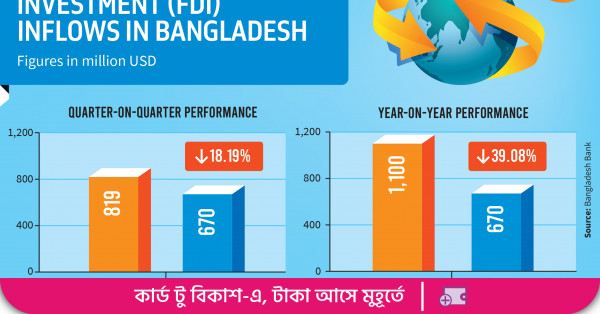

The net FDI during the July-September quarter was $670 million, down from $1.1 billion in the same period last year Net foreign direct

The net FDI during the July-September quarter was $670 million, down from $1.1 billion in the same period last year

Net foreign direct investment (FDI) in Bangladesh fell by nearly 40% in the three months to September 2023, putting stress on the country’s shrinking forex reserves.

Bangladesh Bank data shows that the net FDI in Bangladesh during the July-September quarter was $670 million, down from $1.1 billion in the same period last year.

The net FDI in the country during the first nine months of 2023 was $2.115 billion, down by nearly 23.78% from the same period in 2022.

Foreign direct net investment refers to the overall flow of investment across international borders, specifically when an investor from one country establishes a long-term, significant interest in an enterprise in another country. But net investment refers to the difference between investment inflows and outflows.

Bankers say that foreign investment is likely to remain low in Bangladesh as long as the country’s economy continues to be plagued by corruption, poor governance, low labour productivity, and underdeveloped money and capital markets.

They also say that the decline in net foreign investment in Bangladesh is a sign of declining gross money inflow. That means that foreigners are getting a higher return on investment elsewhere than in Bangladesh, the bankers say.

Syed Abu Naser Bukhtear Ahmed, former managing director of Agrani Bank, told The Business Standard that foreign investors consider many factors before investing in a country. “In particular, the country’s credit rating has been downgraded by several international rating agencies. In addition, there is a significant lack of good governance, especially in the financial sector. This is why foreign investment is declining in Bangladesh.”

He also said that when foreign investors want to invest, they pay special attention to corporate taxes. “In Bangladesh, land and labour can be found at low prices, but there is a fuel crisis and the process of obtaining approvals from various government agencies is complex. This is why foreign investors may not be interested in investing in the country right now.”

To attract foreign investment again, the government must build an investment-friendly country, the banker said.

Intra-company loans plunge 162%

Intra-company loans, one of the components of foreign direct investment, fell by 162% in the September quarter of 2023. At the time, the net debt of the component was negative $59 million. That was in contrast to the same time of the previous year, when it was positive 95%.

Intra-company loans means a parent company may use loans to provide subsidiary companies with needed capital for operations, investments, or managing cash flow fluctuations.

Shawkat Jahan Khan, CFO of Rupali Bank, told TBS that the dollar crisis in Bangladesh has prevented local companies from borrowing from their parent companies for the past two years. However, they have paid off more of the loans they took earlier, resulting in more outflow than inflow, he said.

The rising value of the dollar in Bangladesh over the past year has caused companies that borrowed money at Tk85 per dollar earlier to face significant financial difficulties. They now have to repay their loans at Tk110, which has resulted in widespread business losses. As a result, Intra-company loans have decreased.

Total FDI stands at $20 billion as of September 2023

Bangladesh’s total FDI amount reached $20 billion as of September 2023. The largest investments were in the textile and apparel, gas and petroleum, power, banking, and telecommunications sectors. The top investing countries were the United States of America (USA), United Kingdom (UK), Singapore, Korea, Hong Kong, and China.

In Bangladesh, the dollar crisis has not been resolved due to the relatively slow growth of remittances and export earnings, which are two of the country’s main sources of foreign exchange. In the meantime, the financial account deficit, a key indicator of the country, is increasing due to a significant decline in short-term foreign loans and foreign investment.

The forex reserves of the country are declining continuously to meet the financial account deficit.

As of 17 January 2024, the forex reserves stood at $20.03 billion. This is a decrease from the reserves of $32.49 billion a year ago.

According to central bank data, the financial account deficit in the July-November period of current fiscal 2023-24 was negative $5.4 billion, which was positive $1.26 billion at the same time last fiscal year.

During the period, gross FDI has decreased by 14.50%, medium and long-term loans have decreased by 20.70%, and foreign trade credit deficit has increased to $5.37 billion.

www.tbsnews.net

COMMENTS