FOMC INTEREST RATE DECISION KEY POINTSThe Fed hit the pause button at its September meeting, holding interest rates at a 22-year high of 5.25% to 5.50

FOMC INTEREST RATE DECISION KEY POINTS

- The Fed hit the pause button at its September meeting, holding interest rates at a 22-year high of 5.25% to 5.50%.

- Policymakers upgraded their GDP outlook and reduced the core PCE projection for the year. Meanwhile, the dot-plot continued to signal another hike in 2023.

- Gold and the U.S. dollar headed in different directions after the FOMC statement was released.

Most Read: EUR/USD Forecast – How Will Fed’s Decision Impact Euro’s Outlook?

The Federal Reverse today concluded its highly anticipated September meeting, unanimously voting to keep its benchmark interest rate at a 22-year high within the range of 5.25% to 5.50%, in line with Wall Street expectations and market prices.

The move to uphold the present position reflects a commitment to a data-driven approach, with a focus on assessing the impact of past actions on the broader economy. In alignment with this perspective, Chair Powell has unequivocally stated recently that the central bank’s policy stance “will depend on the economic outlook as informed by the totality of the incoming data”.

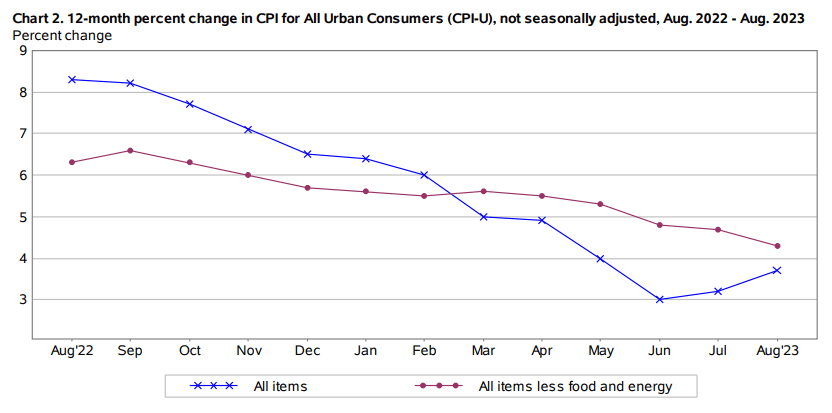

To provide some context, the Fed has raised borrowing costs 11 times since 2022, delivering 525 basis points of cumulative tightening to contain elevated price pressures. This strategy seems to be yielding results, albeit at a gradual pace. At its peak last year, annual inflation exceeded 9.0%, but has since slowed 3.7%, a welcome improvement, but still too high relative to the 2.0% target to declare victory.

Discover what sets the best apart: download our comprehensive guide on the traits of successful traders and transform your trading game!

Recommended by Diego Colman

Traits of Successful Traders

AUGUST HEADLINE AND CORE US INFLATION CHART

Source: BLS

FOMC POLICY STATEMENT

In its communiqué, the Fed struck a positive tone on growth, noting that economic activity has been expanding at a solid pace, a subtle upgrade from the previous “moderate” characterization. The optimism was bolstered by comments on the labor market, which underscored that job gains have slowed but remained strong.

Regarding consumer prices, the statement noted that inflation remains elevated and that policymakers will be “highly attentive” towards the associated risks, mirroring comments from two months ago.

Shifting the spotlight to forward guidance, the language remained the same, with the Fed noting that it would consider various factors “in determining the extent of additional policy firming that may be appropriate to return inflation to 2 percent over time”. Keeping this guidance unchanged might be a strategic move to preserve maximum flexibility should additional actions become necessary in the future.

Take your trading proficiency to the next level: Explore the gold’s prospects through a holistic approach, combining fundamental and technical analysis insights. Grab your free quarterly guide today!

Recommended by Diego Colman

Get Your Free Gold Forecast

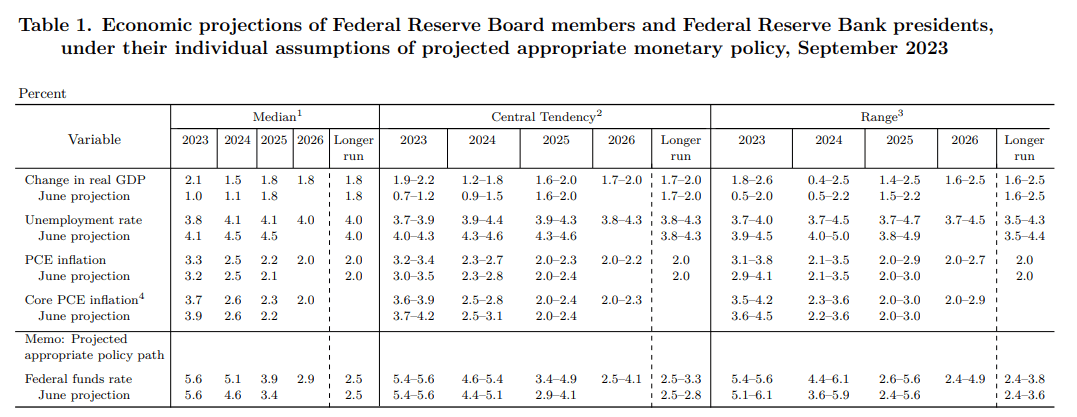

SUMMARY OF ECONOMIC PROJECTIONS

GDP, UNEMPLOYMENT RATE AND CORE PCE

The September Summary of Economic Projections revealed significant revisions compared to the estimates provided in the previous quarter.

First off, gross domestic product for 2023 was upgraded to 2.1% from 1.0% previously to reflect the economy’s enduring resilience and continued robustness. Looking ahead to 2024, the GDP outlook revised upwards, from 1.5% to 1.1%, thereby alleviating any concerns about an imminent recession.

Directing our focus to the labor market, policymakers foresee an unemployment rate of 3.8% in 2023, down from 4.1% in June. With regard to inflation, the core PCE forecast for 2023 was marked down modestly, dropping to 3.7% from the previous 3.9%. Meanwhile, the projection for 2024 held steady at 2.6%

FED DOT PLOT

The dot plot, which illustrates the anticipated trajectory of borrowing costs across multiple years as envisioned by Fed officials, remained somewhat consistent with the version presented in June. That said, the median interest rate projection for 2023 stayed unchanged at 5.6%, implying 25 basis points of additional tightening this year.

For 2024, the U.S. central bank sees interest rates inching down to 5.1%, marking a shift from the 4.6% projection in the previous dot plot. This signals a reduced level of easing in the forecast, suggesting that interest rates are expected to persist at elevated levels for a longer period.

The following table provides a summary of the Federal Reserve’s updated macroeconomic projections.

Source: Federal Reserve

Enhance your trading prowess and seize a competitive advantage. Secure your copy of the U.S. dollar’s outlook today for exclusive insights into the key risk factors influencing the American currency!

Recommended by Diego Colman

Get Your Free USD Forecast

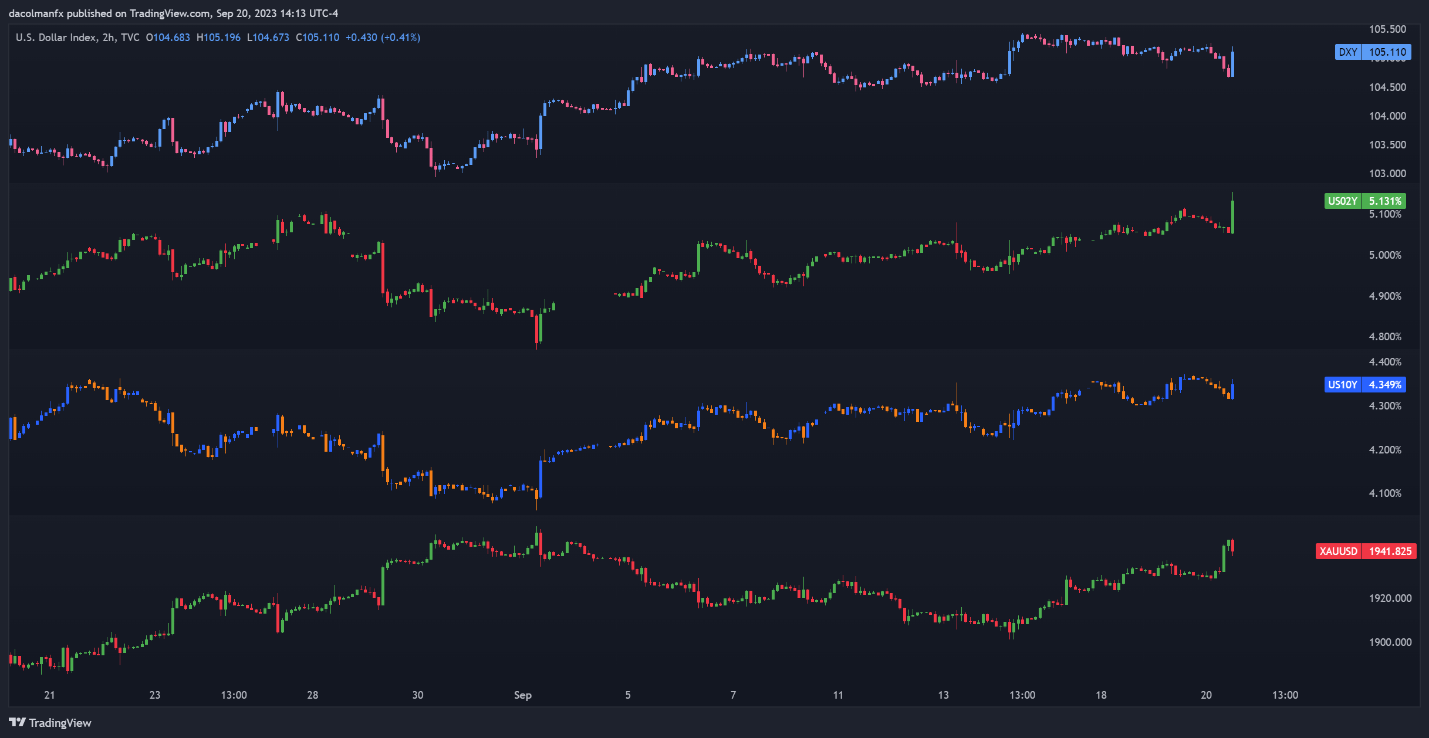

In the immediate kneejerk reaction, gold prices erased some of its session gains, as U.S. Treasury yields and the U.S. dollar drifted upwards. Overall, the Fed’s hawkish monetary policy outlook should be positive for the greenback and rates in the near term, creating a challenging backdrop for precious metals. In any case, Powell’s press conference may offer more insight into the central bank’s future steps.

US DOLLAR, YIELDS AND GOLD PRICES CHART

Source: TradingView

element inside the

element. This is probably not what you meant to do!Load your application’s JavaScript bundle inside the element instead.

www.dailyfx.com

COMMENTS