Financial institution of Canada to face pat, hold one eye on the loonie as restoration gathers steam – Foreign exchange Inform

Financial institution of Canada to face pat, hold one eye on the loonie as restoration gathers steam – Foreign exchange Information Preview

Posted on March 8, 2021 at 3:59 pm GMTRaffi Boyadjian, XM Funding Analysis Desk

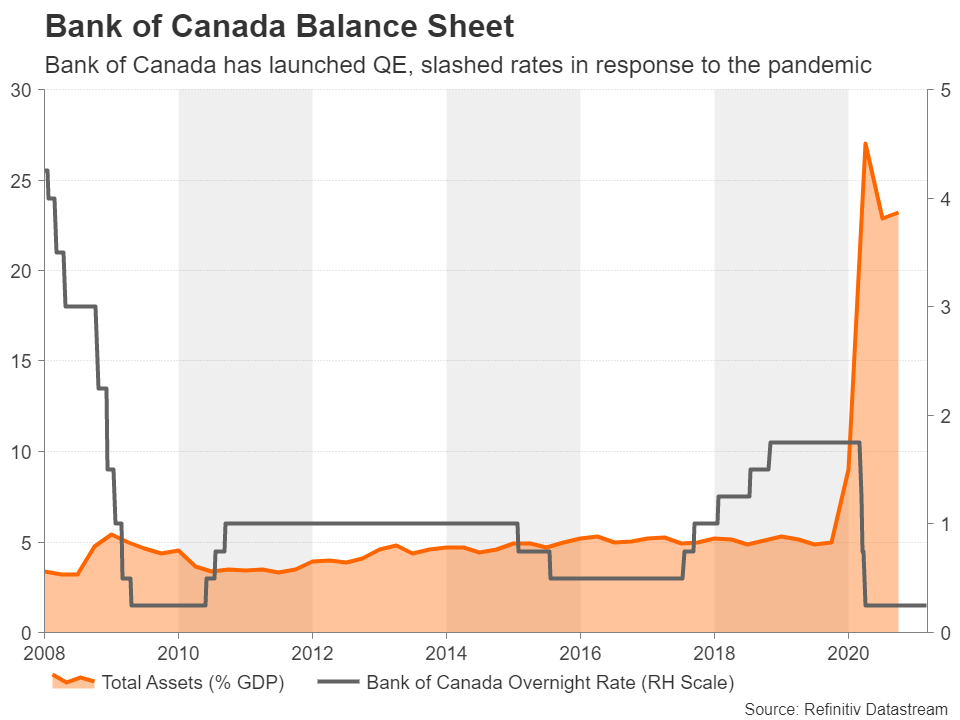

The Financial institution of Canada meets this week to set coverage and can announce its determination on Wednesday at 15:00 GMT. No change is anticipated in both rates of interest or the tempo of asset purchases. However following the better-than-anticipated GDP efficiency within the fourth quarter, a booming housing market, hovering oil costs and renewed efforts to speed up Canada’s vaccine rollout, hypothesis is rising about how quickly policymakers will sign a tapering of their quantitative easing (QE) programme. Within the meantime, the native greenback is basking close to three-year highs towards its US counterpart, amid a surge in Canadian authorities bond yields.

Some mild amid the lockdown darkness

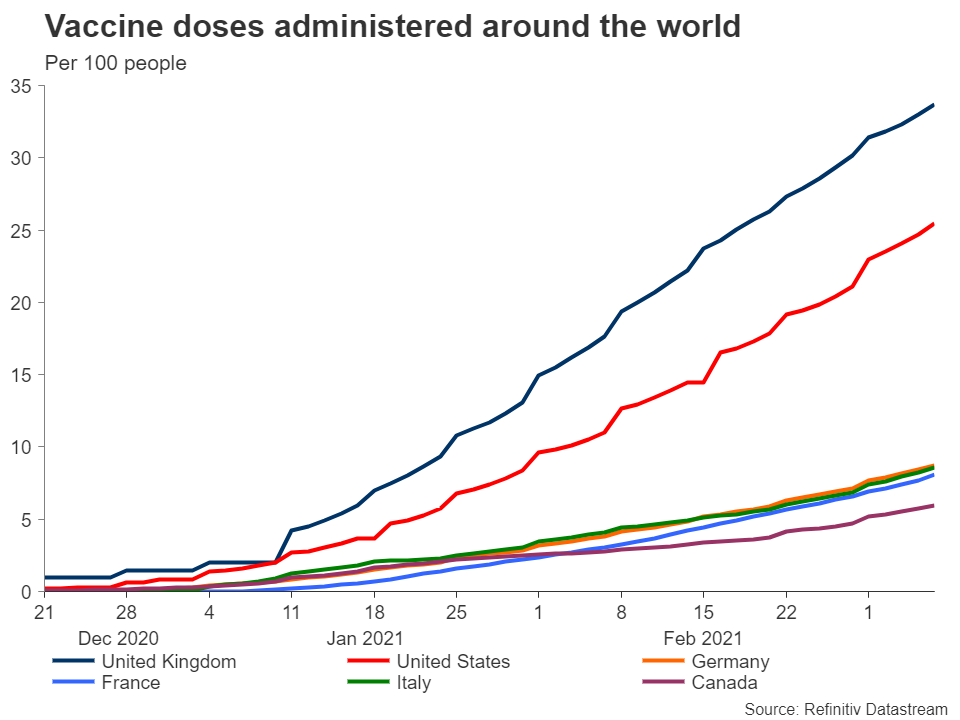

The Canadian economic system has had its fair proportion of setbacks in the previous couple of months. A number of provinces have been pressured to reintroduce lockdown guidelines because the nation was swept by a second wave of the coronavirus and vaccinations received off to a sluggish begin, elevating fears that Canada would get left behind within the world race to immunize. Nevertheless, even towards the backdrop of tight restrictions and shuttered companies, the economic system has been capable of spawn engines of development.

The housing market is reaping the advantages of low-cost borrowing and a deluge of liquidity within the monetary system. Housing begins jumped by 23% in January as house gross sales reached document ranges. Governor Tiff Macklem has described the newest patterns as “indicators of extra exuberance”. However whereas each the central financial institution and the federal government have the instruments to chill down the red-hot property market, the restoration may very well be at stake ought to they attempt to. The housing and development sectors are large employers so any try to curb exercise when a lot of the remainder of the economic system is in dire straits may show too controversial.

The power sector is one other shiny spot. Though the brand new US administration’s harder local weather coverage poses challenges for the way forward for large tasks such because the Keystone XL pipeline, and within the quick time period, oil manufacturing is anticipated to take a success from a month-long upkeep in Alberta’s oilsands, rising oil costs ought to however present a major enhance to the trade. WTI futures are flirting with $68 a barrel and Brent crude has simply cracked above $70 following the choice by the OPEC+ alliance to stay to present output caps moderately than increase them. The shortage of readiness by main producers to hurry forward with manufacturing hikes will possible hold costs elevated for the remainder of the yr.

A broadening restoration?

However the restoration may quickly be broadening as exports to the US – Canada’s largest buying and selling companion by far – elevated sharply in January as consumption south of the border was lifted by December’s stimulus bundle. With one other and even larger spherical of stimulus because of be signed off in Washington quickly, Canada’s producers look set for a bumper few months forward.

Add to the combo the truth that Canada is lastly managing to get a grip on its vaccination programme, with inoculations choosing up tempo prior to now couple of weeks, all of the components are there for a full financial rebound by the yr finish (assuming after all nothing jeopardizes the worldwide vaccine rollout similar to a brand new resistant pressure of the virus).

Is the Financial institution of Canada tapering?

So all this factors to the Financial institution of Canada being performed with easing throughout this cycle, however extra importantly, it suggests tapering will possible be the central financial institution’s subsequent transfer. In truth, the BoC has already begun scaling again its QE programme, decreasing its weekly purchases from C$5 billion to C$four billion in October. On the time, the Financial institution referred to as this ‘recalibration’, however it is likely to be more durable to promote future reductions beneath this label when the necessity for extraordinary doses of financial stimulus is diminishing quick.

Not solely that, however buyers have already began to cost in fee will increase, with the chances of a hike by October 2021 at present operating near 25%. Because the Financial institution expectedly retains coverage unchanged on the March assembly, the main focus will very a lot be on what clues policymakers lay of their assertion in regards to the future path of coverage. Like its Australian and New Zealand counterparts, that are in an analogous predicament, the BoC will in all probability need to preserve a dovish tone in order to not push bond yields and the change fee even increased.

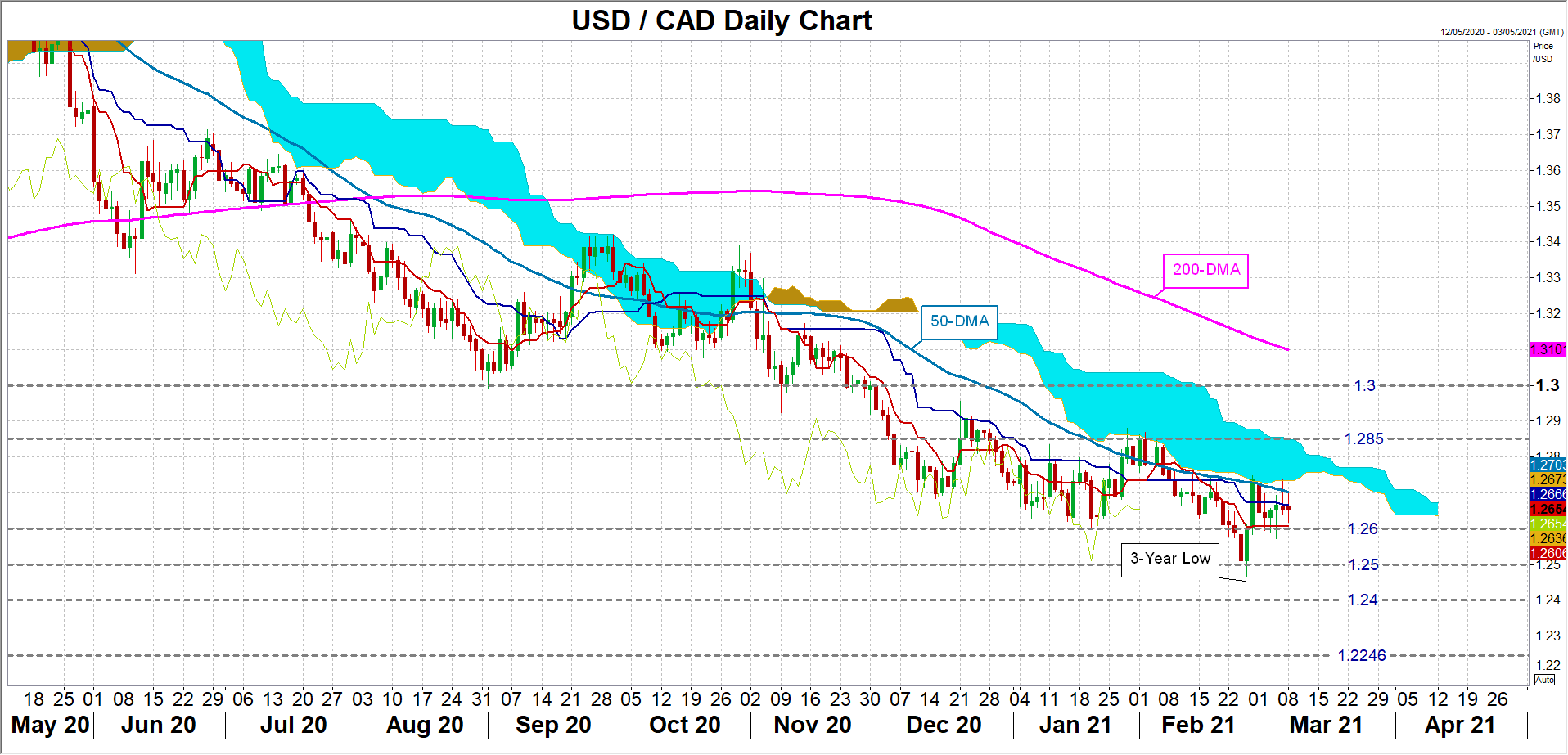

The yield on 10-year Canadian authorities bonds has surged to the very best since January 2020, climbing above 1.50% and narrowing the yield unfold with US Treasuries. Along with the rally in oil costs, the loonie has exploded increased, just lately hitting a three-year peak of 1.2464 towards the US greenback.

Taking part in it cautiously, for the loonie’s stake

Ought to the BoC flag a withdrawal of QE within the near-term horizon (some analysts suppose this might come as early because the April assembly), the loonie may resume its uptrend versus the buck. The greenback/loonie pair is at present hovering round 1.2650. A much less dovish assembly end result may pull the pair again in the direction of the February trough of 1.2464, bringing the 1.24 stage into vary. A fair steeper fall would more and more flip consideration to the January 2018 low of 1.2246.

Nevertheless, ought to policymakers take a harder stance towards market expectations of an early tapering, greenback/loonie may break above speedy resistance at its 50-day transferring common (MA) within the 1.27 area. Efficiently overcoming the 50-day MA would assist the pair climb again contained in the Ichimoku cloud and head in the direction of the 1.2850 resistance space.

A extra dovish-than-expected assertion might be the most important threat for the loonie proper now as buyers is likely to be getting forward of themselves in predicting a smoother and quicker restoration within the months forward. However apart from wanting to keep up some warning, the BoC is not going to need the loonie to understand so shortly. Macklem warned final month that the forex’s energy may turn into a “headwind” to the outlook, so buyers needs to be braced for even stronger language if the loonie retains on rising.

USDCAD