Financial institution of Japan to show sights on restoration progress as Suga takes over as PM – Foreign exchange Information

Financial institution of Japan to show sights on restoration progress as Suga takes over as PM – Foreign exchange Information Preview

Posted on September 15, 2020 at 2:45 pm GMTRaffi Boyadjian, XM Funding Analysis Desk

The Financial institution of Japan is predicted to carry its hearth when it concludes its two-day financial coverage assembly on Thursday, maintaining its emergency stimulus measures intact. Nevertheless, with rising proof that the worldwide financial restoration from the pandemic stays on a strong footing regardless of the sharp resurgence of the virus in lots of nations, together with Japan, the BoJ is predicted so as to add its personal upbeat tackle the financial system. However, so far as the yen is worried, it’s politics that buyers might be maintaining a more in-depth watch on as long-time Abe ally Yoshihide Suga is confirmed as Japan’s subsequent prime minister.

Virus’ financial ache is easing

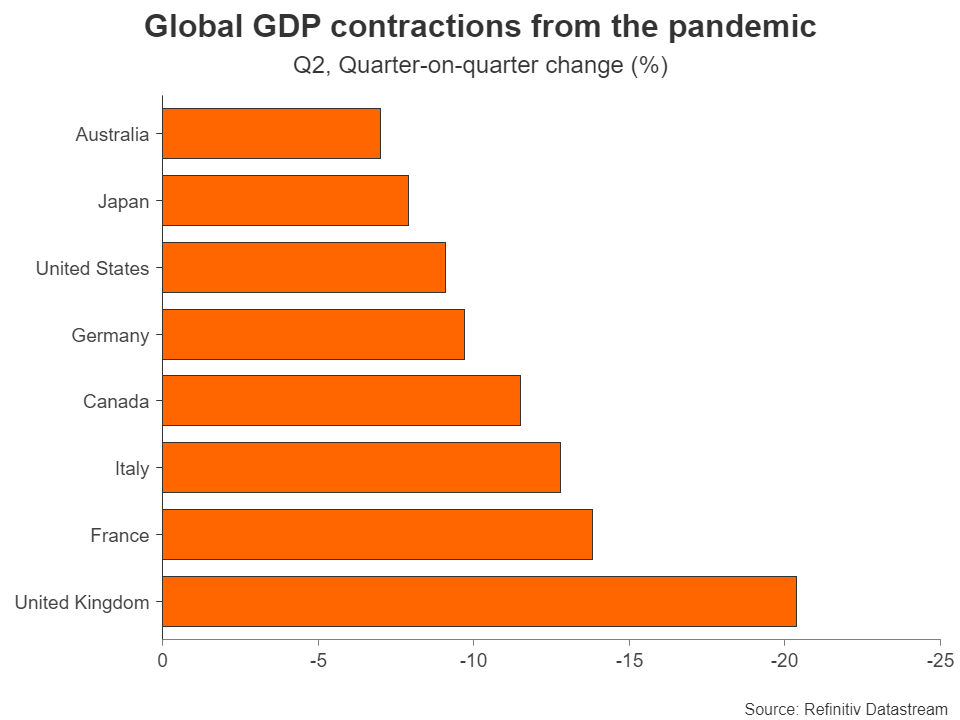

Japan’s GDP contracted by 7.9% within the second quarter, performing considerably higher than different superior economies however nonetheless happening in historical past as one of many greatest slumps on document. The comparatively smaller contraction can also be nothing to shout about when contemplating that development was sluggish going into the pandemic and the restoration has been considerably slower.

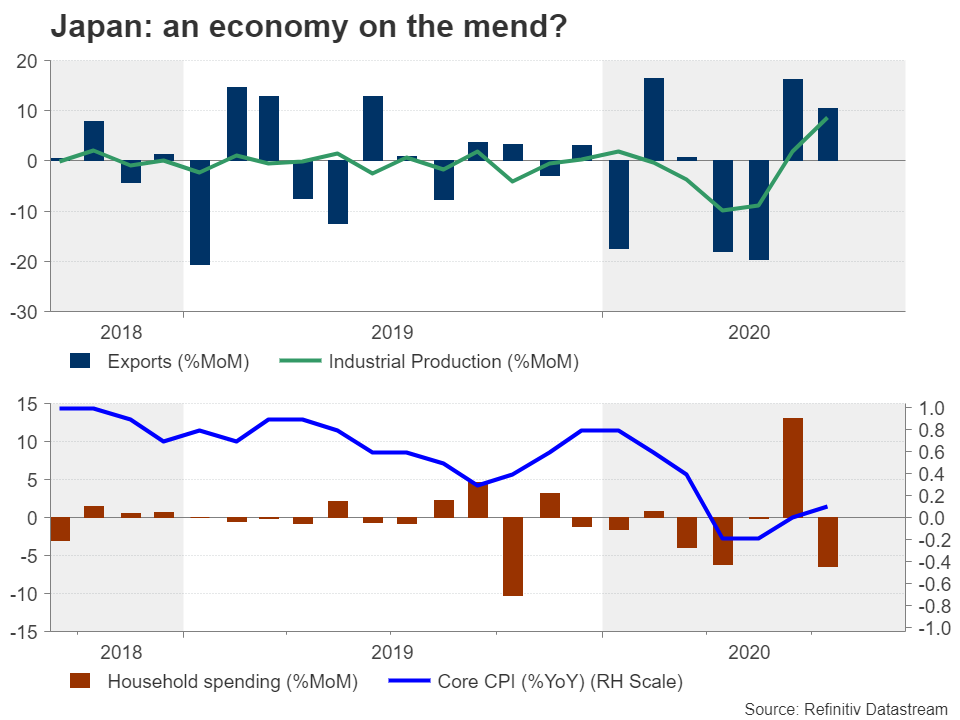

Nonetheless, a restoration is underway, taking the stress off the Financial institution of Japan to ramp up stimulus within the close to time period. Exports, whereas down on a yearly foundation, have been up month-on-month in June and July. Industrial output additionally turned optimistic throughout the identical interval. However the rebound in consumption seems to have stalled, indicating there’s an extended option to go earlier than Japanese households are feeling assured sufficient to half with their money extra sparingly. Moreover, inflation is hovering round zero once more, undoing the current progress to carry costs.

BoJ to strike extra optimistic tone

The bumpy restoration is prone to hold the BoJ on an ultra-dovish path for at the very least the foreseeable future, however policymakers will most likely acknowledge the bettering image by sounding extra optimistic. A extra upbeat assertion would sign the Financial institution is much less anxious concerning the financial system and that it may sit on the sidelines for some time. Nevertheless, altering its language and tweaking the emergency lending services are all that the BoJ can do provided that it’s virtually out of ammunition.

That reality alone is why adjustments to policymakers’ outlook aren’t about to spark a lot response within the yen and haven’t for a while. If a brighter or bleaker evaluation can’t be adopted up with a substantive coverage response, the market response might be equally muted. Therefore, this is the reason the yen stays primarily pushed by safe-haven flows and has been declining towards most of its main friends over the summer time because the virus-induced panic subsides.

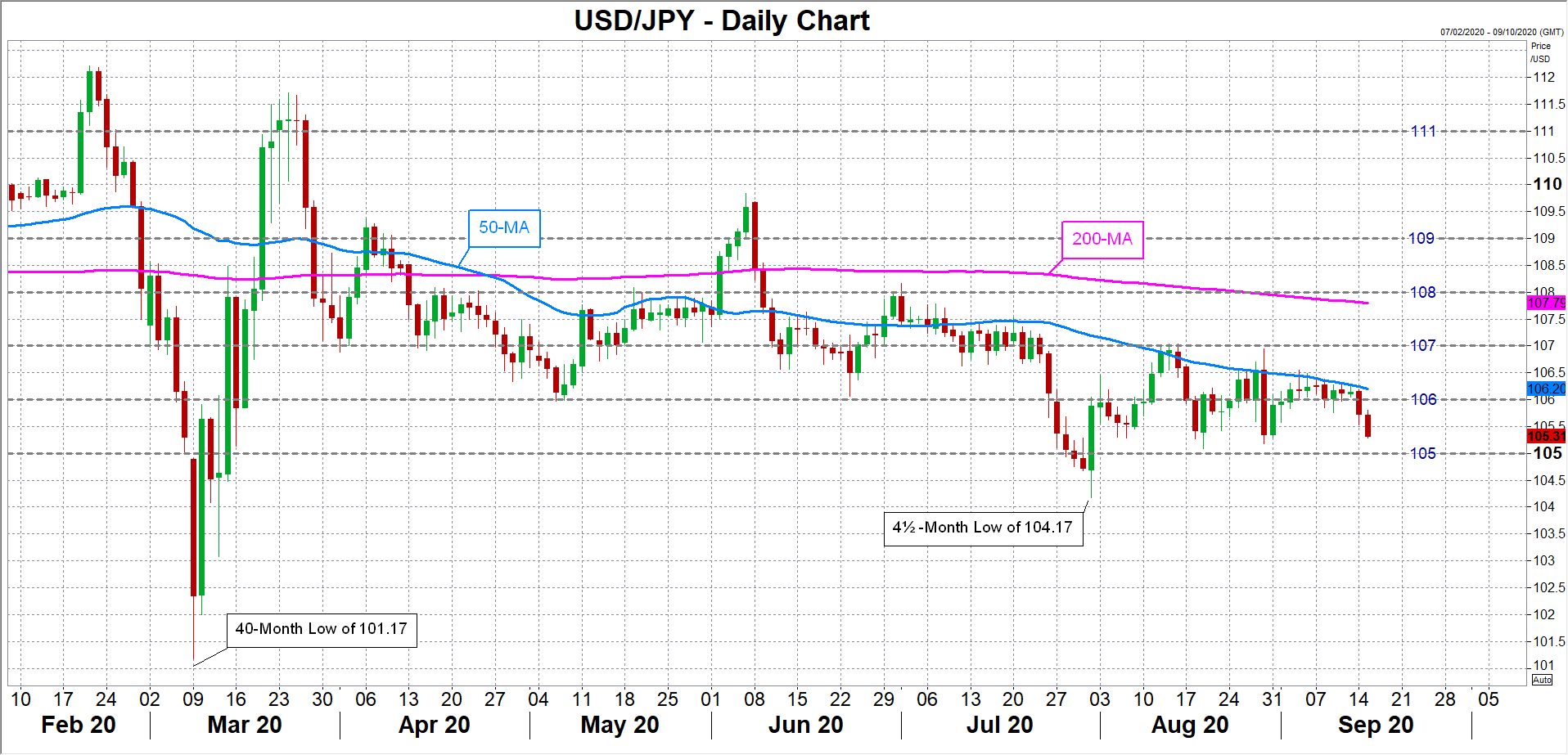

Yen confined to tight vary versus greenback

Towards the US greenback, nevertheless, which is one other safe-haven forex, the yen is confined to a slim vary, with its broader pattern tilted barely to the upside. This pattern is one thing that each the BoJ and the federal government are most likely maintaining an in depth eye on as a robust forex would weigh on Japan’s export-dependent producers. After the virus disaster pressured the Federal Reserve to slash charges to close zero, the buck misplaced all its yield benefit over the yen, opening the door to draw back dangers for the greenback/yen pair.

Will new PM accommodate a stronger yen?

This then raises the query of how the BoJ and the federal government led by incoming prime minister, Yoshihide Suga, might engineer to maintain the yen down. Suga is a robust advocate of Abenomics and most count on him to keep up the federal government’s shut working relationship with the Financial institution of Japan to maintain the financial and financial stimulus faucets large open.

Suga has already signalled his help for extra reduction for struggling households and companies. Nevertheless, he has previously displayed some resistance to elevated public spending so future fiscal packages might not be as beneficiant because the earlier ones have been below Shinzo Abe. Having stated that, Suga was a key participant in weakening the yen throughout Abe’s tenure and will take a extra interventionist method in stopping the appreciation of the trade fee.

Jobs might develop into new focus Japan

However maybe essentially the most vital change markets may see from Suga is the prioritization of jobs. The brand new prime minister reportedly needs to focus extra on defending jobs and will even give the BoJ a task in reaching that. Such a transfer can be detrimental for the yen because the BoJ may doubtlessly have to search out new methods to maintain the financial system stimulated in an try to advertise a wholesome labour market on high of its inflation objective.

Within the quick time period, nevertheless, there’s nowhere a lot for greenback/yen to run, with the 105 stage being the important thing barrier to look at on the draw back for a bearish break, and the 50-day transferring common being the speedy resistance space round 106.20 that would set a extra bullish tone if overcome.

USDJPY