Flurry of UK information eyed, can the pound hold going? – Foreign exchange Information Preview Posted on

Flurry of UK information eyed, can the pound hold going? – Foreign exchange Information Preview

Posted on June 11, 2020 at 10:21 am GMTMarios Hadjikyriacos, XM Funding Analysis Desk

A flurry of UK information together with GDP numbers for April will hit the markets at 06:00 GMT on Friday, and forecasts level to abysmal readings. But, financial information hardly transfer the markets anymore, so the pound’s efficiency will possible be formed by a mixture of Brexit information and international danger sentiment. The dangers surrounding the forex appear tilted to the draw back, although any potential losses could also be extra seen towards the resurgent euro, not a lot towards the greenback that’s underneath strain itself.

Dismal information, however does it matter?

British GDP is forecast to have contracted by a scary 18.4% from the earlier month in April, because the pandemic-fighting lockdown measures are more likely to have introduced financial exercise to a halt.

In regular occasions, one would have anticipated this to be horrible information for the British pound, however these aren’t regular occasions. The FX market barely reacts to financial information anymore, with the considering being that that is ‘previous information’. Everybody is aware of this recession will likely be deep; what actually issues is how shortly every economic system bounces again.

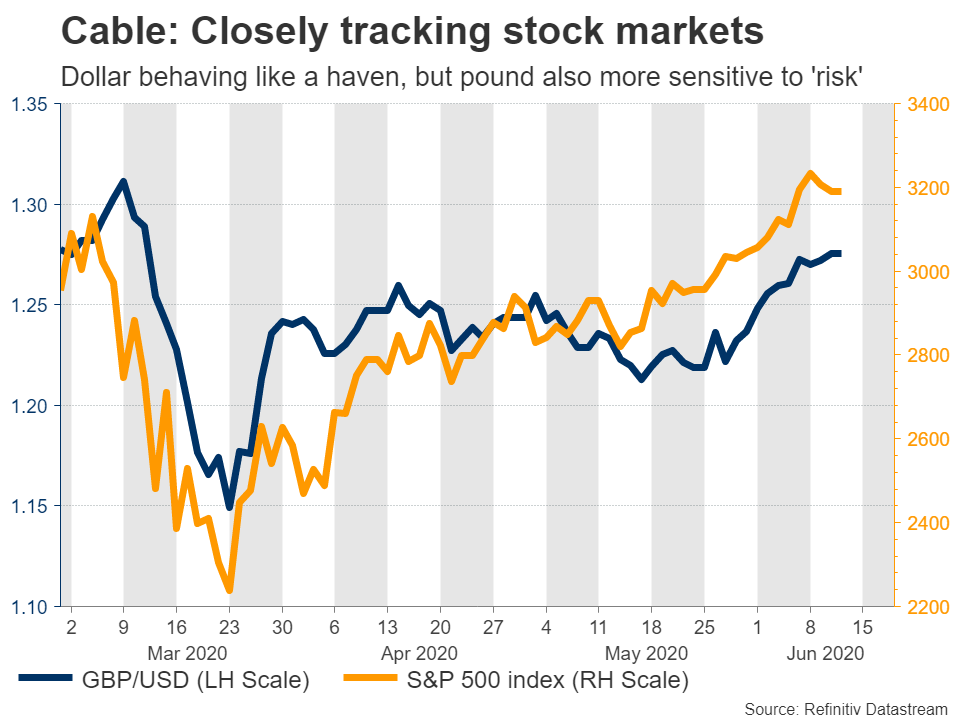

Certainly, since this disaster hit, Cable has been buying and selling principally as a perform of danger urge for food. That has so much to do with the greenback, which has been performing like a defensive asset for essentially the most half. However it’s not simply the greenback – the pound itself has grow to be extra delicate to ‘danger’. That’s most likely owed to the UK’s giant present account deficit, which wants financing from overseas and subsequently turns into a ache when the world is in recession and cross-border capital flows dry up.

So, can shares hold going?

Since Cable appears so correlated to inventory market efficiency and danger sentiment these days, the actual query could also be whether or not the celebration in shares can hold going. Admittedly, there are robust arguments each methods.

Arguing for extra upside is the truth that many institutional buyers had been sitting on the sidelines throughout this rally, so with mounting indicators that the worst is now behind us they may deploy some money again into shares. Any optimistic information on a virus vaccine may assist too. There’s additionally the long-term view that rates of interest will stay low ‘ceaselessly’ and that fiscal self-discipline is now useless globally, so authorities deficits will possible stay large lengthy after this disaster ends.

Arguing for a pullback are the boiling US-China tensions which can be changing into worse by the day, the danger of a second wave of infections within the US following the current nationwide protests, and the looming US presidential election the place the Democrats have been gaining within the polls. Moreover, whereas the unemployment charge appears to be shifting again down, it would take years earlier than we attain pre-covid ranges, which means a softer outlook for consumption. The wealthy valuations of US shares proper now are one other danger.

Euro/pound upside dangers as Brexit battle heats up?

Past danger sentiment, the opposite deciding issue for sterling will most likely be the Brexit saga. The most recent spherical of talks concluded but once more with little or no progress, and a June-end deadline to increase the transition interval past December is approaching quick. Nonetheless, the UK authorities has repeatedly dominated out such an extension. That might robotically make a no-deal exit on the finish of the yr the default choice.

In the end, some extension may be agreed even after June, even when that may contain an advanced authorized course of. Within the meantime although, markets would possible reprice a Brexit danger premium on the forex.

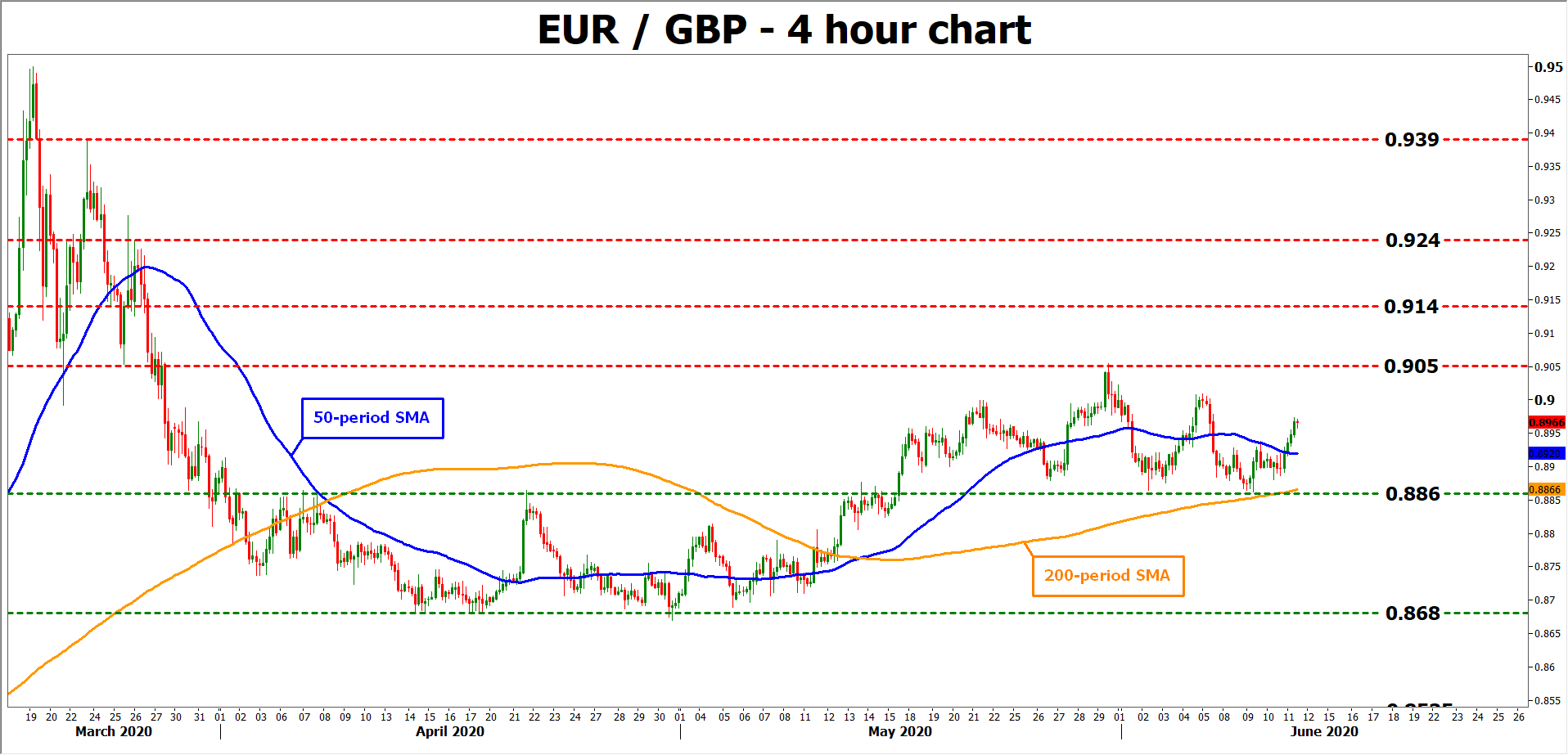

Does that imply Cable is heading decrease? Possibly not, since so much will depend on the greenback facet of the equation and shares. As an alternative, any sterling losses arising from Brexit worries could also be extra seen in euro/sterling, particularly now that the euro has gotten its ft underneath it amid alerts for an EU restoration fund.

Taking a technical take a look at euro/sterling, if Brexit uncertainty intensifies, the pair may problem the 0.9050 zone once more, the place an upside break would flip the main target to 0.9140.

On the draw back, if the pair breaches the 0.8860 space, the bears might goal the 0.8680 assist subsequent, which halted the drop a number of occasions lately.

EURGBPGBPUSD