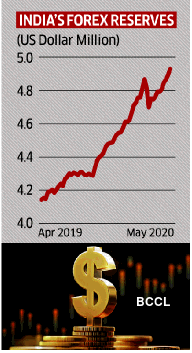

Mumbai: India’s international alternate reserves are prone to contact the magic half-a-trillion mark for the primary time within the subsequent few

India has already leapfrogged Russia and South Korea to change into the third-biggest holder of reserves after China and Japan, and can consolidate its place additional when it reaches the $500 billion mark. The rise caps a exceptional journey for a rustic which in 1991 got here near defaulting on international debt and was pressured to pledge gold reserves to boost cash. Extra lately, in 2012/13 with reserves at $259 billion, and sufficient to fund solely seven months of imports, India was battered by the worldwide monetary market turmoil and was a part of the group of ‘Fragile 5’ nations that suffered most from the panic. Present reserves at $493 billion is sufficient to fund 17 months of imports.

“Whereas increasing foreign exchange reserves will present safety to the rupee throughout wet days, swelling reserves additionally assist improve RBI’s revenues, benefitting the federal government by way of dividend payouts,” mentioned Madan Sabnavis, economist at CARE Rankings. “Attaining half a trillion foreign exchange reserves is a matter of time.”

The enlargement in reserves comes amid the worldwide pandemic that has triggered each monetary market and financial turmoil. India’s case has been helped by a pick-up in international fund flows after the sharp drop-off in March and international direct funding.

Share gross sales by Kotak Mahindra Financial institution and Bharti Airtel have additionally helped. Reliance Industries’ large rights problem and its sale of stake in Jio Platforms to a slew of international traders that raised almost 1 lakh crore is anticipated to additional enhance flows.

S&P’s determination on Wednesday to not change India’s ranking and outlook can be anticipated to enhance world fund flows into the nation.

“Greater foreign exchange reserves come at a price. However in addition they present a buffer amidst uncertainties,” mentioned Anubhuti Sahay, head of South Asia Financial Analysis at Customary Chartered Financial institution India. “Slender present account deficit amidst low commodity costs and fall in import demand together with sturdy FDI inflows have helped construct foreign exchange reserves.”

The reserve pile-up helped the rupee get well by round 2 per cent from a document low of 76.92 in April 2020. Since then, the forex has been fairly resilient, buying and selling within the vary of 75-76. However there are dangers of outflows too.

Throughout main monetary crises, such because the 1997 Asian disaster or the 2013 taper tantrum, India needed to give you particular deposit schemes to lure US {dollars}. This time spherical, greenback reserves are comfy sufficient for the central financial institution to behave by itself to defend the forex. India’s international alternate reserves touched $493 billion on Might 29, up $18 billion since March. With international traders pouring in 19,239 crore ($2.55 billion) thus far in June, it’s poised to the touch $500 billion quickly. India has come a good distance since its twin deficit disaster in 2013. Its present account deficit, the surplus of imports over exports, in April-December 2019 was 1 per cent of GDP. In the course of the worst interval of 2012/13, it was 4.82 per cent of the GDP.