Banks are holding an increased amount of foreign exchange, bolstered by falling imports and higher export proceeds, said bankers. At the end of Novemb

Banks are holding an increased amount of foreign exchange, bolstered by falling imports and higher export proceeds, said bankers.

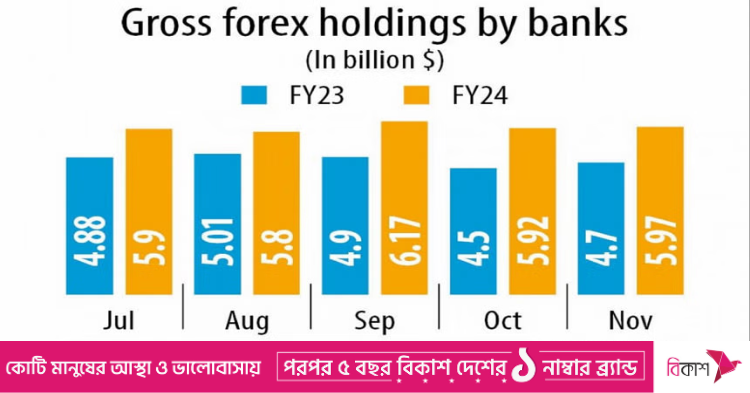

At the end of November, gross foreign exchange held by commercial banks stood at $5.97 billion, up 27 percent from $4.7 billion a year ago. The amount of outstanding foreign exchange holdings was also marginally higher compared to October this year, according to data from Bangladesh Bank (BB).

As a result, there is an increased availability of the greenback, which has been getting dearer for nearly two years, causing significant devaluation of taka and depletion of the country’s forex reserves.

“Now, there is no severe shortage of dollar in the market. One can get dollars if required. But the cost of the greenback still remains high,” the chief of a treasury division of a private bank said, seeking anonymity.

The official attributed the rise to higher inflows of export proceeds.

“We have recorded increased export proceeds this month while the trend of opening of Letters of Credit (LCs) has remained the same as in previous months,” he said.

Besides, when the interest rate rises in the local market, the inflow of dollars usually rises, he said.

Bangladesh’s exports grew 1.3 percent year-on-year to $22.32 billion in four months to the end of November in the fiscal year 2023-24. Remittance inflows were also marginally higher during the period, according to the central bank’s data.

On the other hand, year-on-year imports dropped 20.5 percent to $20.26 billion in the July-October period, leading to a fall in the requirement for payments.

As such, holdings of foreign exchange by banks has been on an upward trajectory.

A senior official of another private bank said not all the banks had seen increased foreign exchange holdings.

“Some banks are holding an increased amount of foreign exchange, supported by lower import payment obligations, an upward trend in inward remittances, and steady growth in export earnings,” he added.

Syed Mahbubur Rahman, managing director and CEO of Mutual Trust Bank, said higher foreign exchange holdings in banks was a good trend. “But we need to see if we can retain this,” he added.

Md Habibur Rahman, chief economist at the BB, said the taka appreciated in recent weeks because of increased inflows of foreign currency.

If holdings of foreign exchange reserves rise persistently, it is a good sign for the economy. The central bank will not be required to intervene in the market and depreciation pressure on foreign exchange will ease, he said.

www.thedailystar.net

COMMENTS