Table of Content Introduction The forex market, also known as the foreign exchange market, is the largest and most liquid financial

Table of Content

Introduction

The forex market, also known as the foreign exchange market, is the largest and most liquid financial market in the world. It involves the buying and selling of currencies from different countries. Traders engage in forex trading for various reasons, including speculation, hedging, and international trade.

What is Forex Market?

The forex market is a decentralized market where participants trade one currency for another. It operates 24 hours a day, five days a week, across different time zones. The market is made up of various financial institutions, such as banks, central banks, hedge funds, corporations, and individual traders. Unlike stock markets, forex trading does not have a centralized exchange. Instead, transactions take place over-the-counter (OTC) electronically.

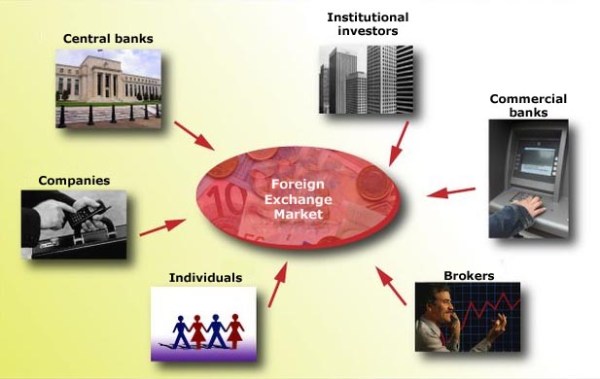

Major Participants in Forex Market

The major participants in the forex market include:

- Banks: Commercial and investment banks play a significant role in forex trading. They facilitate transactions for their clients and engage in proprietary trading.

- Hedge Funds: Hedge funds participate in forex trading to generate profits for their investors. They often take more significant risks for higher potential returns.

- Central Banks: Central banks, such as the Federal Reserve, European Central Bank, and Bank of Japan, influence currency values through monetary policies and interventions.

- Corporations: International businesses engage in forex trading to manage their exposure to currency fluctuations resulting from global operations.

- Retail Traders: Individual traders, including retail investors and speculators, access the forex market through brokerage firms or online platforms.

Significance of Forex Market News

Forex market news plays a crucial role in shaping currency movements and overall market sentiment. Traders rely on news releases, economic indicators, and geopolitical events to assess market conditions and make informed trading decisions. Here are some key factors monitored in forex market news:

- Macroeconomic Data: Economic indicators like GDP growth, inflation, unemployment rates, and central bank decisions impact currency values.

- Interest Rates: Central banks’ monetary policies and changes in interest rates affect currency exchange rates.

- Geopolitical Events: Political instability, trade disputes, and international conflicts can cause volatility in currency markets.

- Market Sentiment: News about market trends, investor sentiment, and risk appetite can influence currency movements.

Factors Affecting Currency Movements

Currency movements in the forex market are determined by a variety of factors:

- Supply and Demand: The exchange rate of a currency is influenced by the demand and supply dynamics in the forex market.

- Interest Rate Differentials: Higher interest rates attract investors, leading to an increase in demand for a currency.

- Political Stability: Stable political environments often attract foreign investors, positively impacting a currency’s value.

- Inflation Rates: Currencies from countries with low inflation rates tend to appreciate against those with higher inflation rates.

- Trade Balance: A nation’s trade balance influences its currency value. A trade surplus may strengthen a currency, while a deficit can weaken it.

How to Stay Updated with Forex Market News

To stay informed about forex market news, follow these strategies:

- News Websites and Platforms: Regularly visit reputable financial news websites and utilize news platforms that provide real-time updates.

- Economic Calendars: Consult economic calendars that highlight upcoming releases of economic data and events.

- Central Bank Announcements: Monitor central bank statements, interest rate decisions, and policy changes.

- Social Media: Follow finance experts, market commentators, and news organizations on social media for quick updates.

Key Takeaways

In summary, the forex market is a decentralized market where participants trade currencies. Major participants include banks, hedge funds, central banks, corporations, and retail traders. Forex market news plays a vital role in shaping currency movements, driven by factors such as economic data, interest rates, geopolitical events, and market sentiment. Staying updated with forex market news is crucial for informed trading decisions.

Frequently Asked Questions

Q: Can individuals trade forex market news?

A: Yes, individuals can access the forex market through brokerage firms or online trading platforms and participate in trading based on forex market news.

Q: How often does forex market news get released?

A: Forex market news is released regularly throughout the trading week, including economic indicators, central bank statements, and geopolitical developments.

Q: Can forex market news guarantee profitable trades?

A: While forex market news provides essential information, profitability in trading depends on various factors, including knowledge, experience, and risk management strategies.

Q: Is forex trading suitable for beginners?

A: Forex trading can be complex, and beginners should acquire sufficient knowledge and practice on demo accounts before engaging in live trading.

Q: Are there risks involved in forex trading?

A: Yes, forex trading involves risks, such as market volatility, leverage, and potential losses. Traders should carefully assess their risk tolerance and use risk management strategies.

Q: Can automated systems trade based on forex market news?

A: Yes, automated trading systems, also known as forex robots, can be programmed to execute trades based on predefined criteria that include forex market news and indicators.

nnn.ng