After year-long volatility, the forex market is getting stable with the exchange rates of the dollar settling between Tk123 and Tk124 for the la

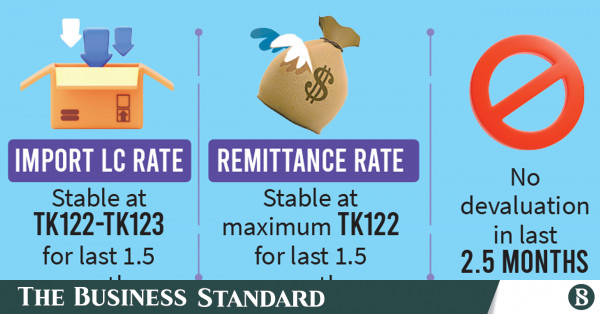

After year-long volatility, the forex market is getting stable with the exchange rates of the dollar settling between Tk123 and Tk124 for the last one and a half months, preventing a steep fall of the taka.

A reduction in repayment pressure on private sector short-term loans coupled with a conservative approach in opening letters of credit (LCs) against imports have helped ease exchange rate fluctuations, industry insiders say.

Political stability is another factor that has contributed to achieving macroeconomic stability, as the country has overcome election-centric uncertainties, according to industry experts.

The inflow of $2.10 billion in remittances in January, marking the highest monthly inflow in the past seven months, has also played a role in easing the situation.

Furthermore, the Bangladesh Bank kept selling dollars to banks from its foreign exchange reserves to maintain price stability.

The cash dollar price has also remained stable at Tk123 to Tk124 for the last one month amid the increasing supply after the national election held on 7 January.

BB has no plans for devaluation in near future

The Bangladesh Bank is expecting no further fluctuation in exchange rates and has no plans for additional devaluation in the near future, until the introduction of the newly announced crawling peg mechanism, said a senior executive of the central bank.

Although exchange rate fluctuations have eased, the gap between the official rate and the unofficial rate is still high at above Tk12, diverting remittances into informal channels.

The officially declared dollar rate is Tk110 to Tk110.5 for buying and selling, but most banks have been purchasing remittances at rates above Tk122 and selling to importers at rates exceeding Tk123, reports industry insiders.

Despite the significant gap between the official and unofficial exchange rates, the Bangladesh Bank did not go for devaluation after November of last year. Instead, the central bank reduced dollar prices twice during November and December of the same year.

The country witnessed a 26% devaluation of the taka in just one year in 2022, but this slowed down to 2.8% in 2023.

On the other hand, the Real Effective Exchange Rate (REER)-based exchange rate, which surged to above Tk119 in October last year, has settled down to Tk115 plus in January. This signals that devaluation pressure has eased.

The REER is an indicator of the competitiveness of a country’s currency with respect to a basket of currencies, adjusted for inflation effects.

The REER index indicates that the bilateral exchange rate of the dollar should be Tk115 instead of the current rate of Tk110.

However, remitters are already enjoying the dollar price at Tk115 if 2.5% of the government’s incentive and 2.5% banks’ own incentive are considered.

Though there is still dollar pressure in banks, exchange rate fluctuations have ceased, which is a great relief for the Bangladesh Bank, said a senior researcher of the Bangladesh Bank.

He said a surplus current account balance helped to settle down the price, and the current price range signals that it is unlikely to cross the range further.

He suggested that the dollar price may move slightly after the introduction of the crawling peg.

He also agreed with Moody’s forecast that the taka may decline by 4% by June after the introduction of the crawling peg.

Moody’s Investors Service recently forecasted a 4% decline in the Bangladesh taka by June, anticipating that limits on the currency may be eased. This move, it said, could bolster the nation’s dwindling foreign-exchange reserves.

The Bangladesh Bank announced this month that it is evaluating a plan to introduce a crawling peg system for the local currency to maintain stability, marking a step toward a flexible exchange-rate regime. Moody’s suggested that the taka could trade at around 115 per dollar by the end of June, compared to 110 on 28 January.

“The introduction of the crawling peg would allow greater stability and predictability of the exchange rate, while further reflecting prevailing market forces compared to the current rate-fixing mechanism,” said Marcus Yiu, analyst at Moody’s in Singapore, reports Bloomberg.

The Bangladesh Bank is working with the IMF (International Monetary Fund) to prepare the pegging mechanism. A team of the IMF will visit the country in March to finalise the new mechanism and then the central bank will go for implementation of it, according to Bangladesh Bank sources.

Another senior executive of the Bangladesh Bank on condition of anonymity said that controlling inflation is the main priority in line with the prime minister’s instruction. So the central bank has no intention to go for further devaluation. Rather, it will keep supporting dollar liquidity even at the cost of reserve erosion.

He said cash dollar supply increased in the kerb market as people who were holding dollars expecting a rise in prices are now selling after the election.

The Bangladesh Bank has sold nearly $8 billion dollars from reserve in the first seven months of current fiscal year till 22 January. As a result, gross foreign exchange reserves, which improved to $21.8 billion in December from $19.3 billion in November last year, fell further to $20 billion on 24 January, according to Bangladesh Bank data.

The dollar selling spree was higher than previous fiscal year as the central bank sold $13.57 billion in the entire FY23.

However, the central bank sees a ray of hope in increasing dollar inflow, as remittance earnings, which dipped to $1.3 billion in September last year, have improved to nearly $2 billion in the last three consecutive months since October as banks are offering higher rates to expatriates to encourage them to send money home.

On the other hand, banks continued their conservative approach in LC opening resulting in a 37-months low import in December last year.

As a result, gross foreign exchange held by commercial banks increased by 16% year-on-year to $5.5 billion in December last year, according to Bangladesh Bank data.

Current account balance turned to a surplus to $579 million in July-November of the current fiscal year from a $5.6 billion deficit in the same period of the last year.

In the new monetary policy announced for the second half of FY24, the Bangladesh Bank projected that the deficit in the current account balance will narrow to $332 million by June from $2 billion in FY23.

Md Mejbaul Haque, deputy executive director and spokesperson of the Bangladesh Bank, told TBS that the dollar market has stabilised due to a surplus in the current account balance. The amount of dollars required to pay off the country’s total debt is no longer the same, which has had a positive effect on the dollar price.

Additionally, the price announced by the ABB-Bafeda is closely aligned with the real effective exchange rate. As a result, the dollar has maintained a price within Tk110 for the past five months, he added.

Former Bangladesh Bank Governor Salehuddin Ahmed said the dollar problem has arisen due to the decline in export income and remittances. To address this issue, there is no alternative but to increase export and remittance earnings.

“Providing a 2% to 2.5% incentive on remittance alone will not improve the situation; other measures, such as export diversification, need to be introduced,” he said.

He further suggested that another way to address the dollar crisis is through foreign investment. According to him, the introduction of the crawling peg method may not be successful in stabilising the situation. Making the country more investment-friendly could lead to an increase in dollar inflow.

www.tbsnews.net

COMMENTS