The Bangladesh Bank has overstated its foreign exchange reserves by $7.2 billion through inclusion of non-reserve assets underestimating rela

The Bangladesh Bank has overstated its foreign exchange reserves by $7.2 billion through inclusion of non-reserve assets underestimating related risks, the International Monetary Fund says.

In a draft report on safeguards assessment of the Bangladesh Bank for 2021, the IMF has identified the misclassification of foreign assets leading to an inflated foreign reserve held by the central bank.

The foreign exchange reserve of $46 billion as reported at the end of June this year was overstated by 15%. Originally, the forex reserve would be $39 billion, according to IMF calculation.

Explaining this finding, the global lender has said a portion of the reserve has been used to finance, deposit with resident banks, invest in non-investment grade bonds and lend to Sri Lanka following the decisions of the central bank board and its investment committee.

Yet the central bank continues to include these non-reserve assets in the performance and risk analysis for foreign reserves

“Such exaggeration of foreign reserves leads to a wrong judgement about their redundancy,” said the IMF report, which also mentioned that the Bangladesh Bank has limited expertise and constrained IT capacity.

The IMF recommended that the Bangladesh Bank should manage foreign reserves separately from non-reserve assets to avoid overstatement of foreign currency liquidity and underestimation of related risks, and report transparently.

When contacted about the issue, Kazi Sayedur Rahman, deputy governor of the Bangladesh Bank who is responsible for the Forex Reserve and Treasury Management Department, refused to explain the IMF’s claim of overstating foreign exchange reserves.

Another senior official of the Bangladesh Bank on condition of anonymity told The Business Standard that the respective department was preparing a written answer for the IMF over the issue.

Referring to the Bangladesh Bank’s disbursement of $250 million to the central bank of Sri Lanka as foreign currency support, the IMF report said the short-term financing was guaranteed by a deposit in Sri Lanka rupees of equivalent amount at the Bangladesh Bank. The lending in foreign currency should be ideally collateralised in the same currency of the loan, the report pointed out.

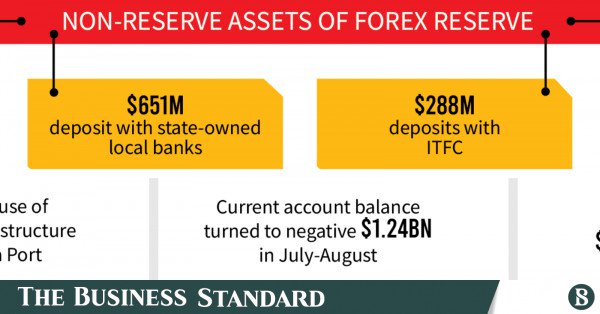

The non-reserve assets that IMF identified are- foreign currency loans to local banks– $6198 million, deposit with state-owed local banks–$651 million, deposits with ITFC (IDB Group)– $288 million and fixed income securities below investment grade– $60 million.

The IMF also raised an objection to the utilisation of $2 billion from foreign exchange reserves for the government’s priority infrastructure projects including the Payra Port.

In the report, the IMF said that large infrastructure projects often suffer from significant under-management of risks and providers of finance typically bear the immediate losses. Consequently, there is a risk of foreign reserves depletion, as well as financial loss for the Bangladesh Bank.

The report recommended that before making any commitments to finance infrastructure projects, the central bank should diligently monitor the level of its foreign reserves, considering balance of payment pressures as well as volatility in remittances and trade.

The government created the Bangladesh Infrastructure Development Fund (BIDF) where the central bank committed to provide $2 billion from its foreign exchange reserve to finance port and power sector infrastructure projects.

The foreign exchange market came under pressure amid rising import expenditure and slow remittance inflow in the subsequent period.

The current account balance turned to negative $1.24 billion in July-August period of the current fiscal year which was a surplus of $3.22 billion in the same period of last year, according to Bangladesh Bank data.

Dollar price remained upward since last month amid rising demand.

The inter-bank exchange rate increased to Tk 85.65 per dollar in October which was Tk 85.20 in the previous month, central bank data shows.

The dollar crisis has prompted the Bangladesh Bank to backtrack on its dollar buying spree and start selling dollars to banks in order to keep the market stable.

The Bangladesh Bank bought a record $8 billion US dollars in the fiscal 2020-21 amid low imports and high inflow of remittance.

However, since August this year, the Bangladesh Bank has sold $305 million dollars to banks, according to the central bank’s data.

www.tbsnews.net