The USD surged at the start of the US session, as bond yields spiked to their highest levels since March 20th after a strong ISM manufacturing repor

The USD surged at the start of the US session, as bond yields spiked to their highest levels since March 20th after a strong ISM manufacturing report. The 10-year Treasury yields saw a notable increase of 12 basis points, the largest jump in two weeks, while the 2-year yields rose by 9 basis points, marking its biggest one-day gain since February in two weeks. This surge in yields led to a revision in FED rate reduction expectations for this year, with the estimate now at 65 basis points, down from 80 basis points last week.

The positive momentum in bond yields was fueled by stronger-than-expected ISM manufacturing data, which showed a return to expansion at 50.3 points, after being in recession for 18 months. Expectations were surpassed, as analysts had anticipated a reading of 48.4 points.

Additionally, the prices paid component of the ISM report also increased to 55.8 points from 52.5 points last month, reaching its highest level since July 2022. Amidst these developments, crude Oil prices rose by almost $1 to reach $84, following Israel’s attack on Iran’s consulate in Damascus. However, US equities closed mixed, with the Dow Jones and S&P 500 experiencing losses while the NASDAQ index saw marginal gains.

Today’s Market Expectations

Today started with the Reserve Bank of Australia (RBA) recently released the minutes of its March 18th-19th meeting, during which the central bank opted to maintain the Cash Rate Target at 4.35%, in line with unanimous expectations. The minutes highlighted the Board’s unwavering commitment to restoring inflation to its target range, emphasizing that while inflation is moderating, it remains elevated. Notably, the RBA underscored that the Board is neither ruling anything in nor out regarding interest rates. This stance represents a subtle shift from previous statements, which had indicated that further interest rate increases could not be discounted. Governor Bullock echoed a similar sentiment during last month’s news conference, suggesting continuity in the central bank’s approach to monetary policy.

The upcoming JOLTS job openings report in the United States is anticipated to show a slight decrease, with predictions indicating a decline to 8.790 million from the previous figure of 8.863 million. While this data is from February and considered somewhat dated, it remains a significant market-moving announcement, typically capturing market attention and might offer an indication for Friday’s Non-Farm Payrolls. The previous report was a miss, with negative adjustments to prior readings and this month is expected to be lower as well, suggesting a stable but declining employment market. Additionally, market observers will closely monitor hiring and quitting rates, both of which have fallen below pre-pandemic levels.

Yesterday the price action was very slow during the Asian and European sessions with Europe and the Americas off for the Catholic Easter holiday, apart from Gold which made another record high at $2,360 before pulling back lower. However, things got exciting right after the US ISm report which sent the USD 50-70 pips higher across the board and triggered the take profit targets on four of our forex signals, since we were long on the USD.

You Can’t Keep Gold Down

gold experienced a significant rally, reaching a high of $2,265 with a target price of $2,500 due to strong buying momentum. However, there was a retreat to $2,228 before the price reversed back above $2,050, indicating that buyers are ready to jump in after every small dip.

XAU/USD – 60 minute chart

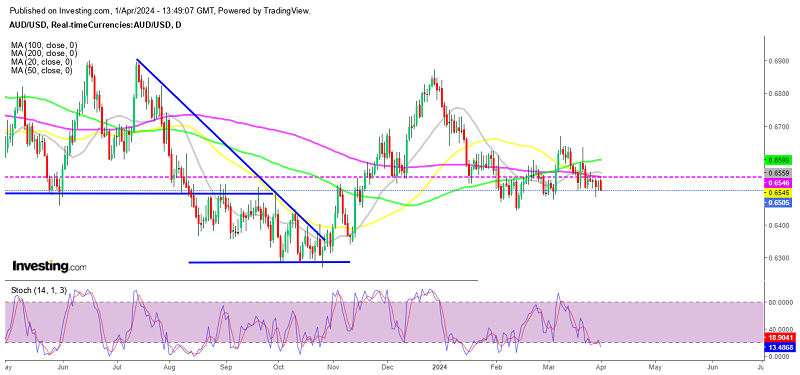

AUD/USD Closes the Week Below 0.60

Sellers have gained control in AUD/USD, leading to a break of the 0.6500 level. The AUD/USD pair closed the week above that level but seems to be under pressure again. Currently, the 200-day moving average at 0.6545 is acting as significant resistance. If the pair maintains below this level, it could prompt sellers to retest the 0.6500 level. Additional support is present around 0.648-0.6485, which was the low last week, preventing a deeper decline in AUD/USD. However, a break below this support level could lead to a retest of the February low at 0.6450 and potentially even lower levels.

Cryptocurrency Update

The 20 Daily SMA Continues to Hold as Support for Bitcoin

Despite the remarkable rally in previous months, sustaining the price above $70,000 is proving to be difficult, suggesting the emergence of a near-term peak. This could indicate that bullish momentum might be slowing down, potentially leading to a short-term reversal in the price of Bitcoin. Analysis of the daily chart suggests the formation of a bearish reversal pattern, further indicating the possibility of an impending decline. Bearish reversal patterns often signify a shift in market sentiment from bullish to bearish, which could lead to downward price movements.

The 50 SMA Continues to Hold for Ethereum

Despite experiencing a bearish reversal after surpassing $4,000, ETHEREUM found strong support at the 50-period SMA, indicating the significance of this technical level in influencing price movements. The bounce from the 50-period SMA attracted buyers, resulting in a subsequent price increase. However, Ethereum has encountered resistance around the 20-period SMA (grey), which has hindered further upward progress. The 20-period SMA acting as resistance suggests that there might be selling pressure or lack of bullish momentum at this level, preventing Ethereum from moving higher.

www.fxleaders.com

COMMENTS