Last Week’s Market WrapLast week we saw a continuation of the sentiment from the previous two weeks, which kept risk assets on the defense while the U

Last Week’s Market Wrap

Last week we saw a continuation of the sentiment from the previous two weeks, which kept risk assets on the defense while the USD continued to advance higher. It started with a round of negative data on Tuesday, as the Australian employment report came softer than expected, followed by some softer readings from China, which kept risk sentiment negative.

As a result, most major currencies resumed the decline while US Treasury yields continued to increase, keeping the USD bullish. Only the GBP ended the week in gains against the Buck, despite a softer employment report, although markets are still pricing in at least one more rate hike by the Bank of England.

The CPI (consumer price index) report showed that inflation increased in July, although the CAD remained bearish throughout the week, pulled down by the decline in crude Oil, which made a reversal in the last two days. But the CAD kept falling nonetheless, as China vowes kept the sentient down. The decent reading from the July retail sales gave the USD another boost, as did the FOMC minutes from the last FED meeting, which showed that members are undecided and likely to keep rates elevated until April next month.

This Week’s Market Expectations

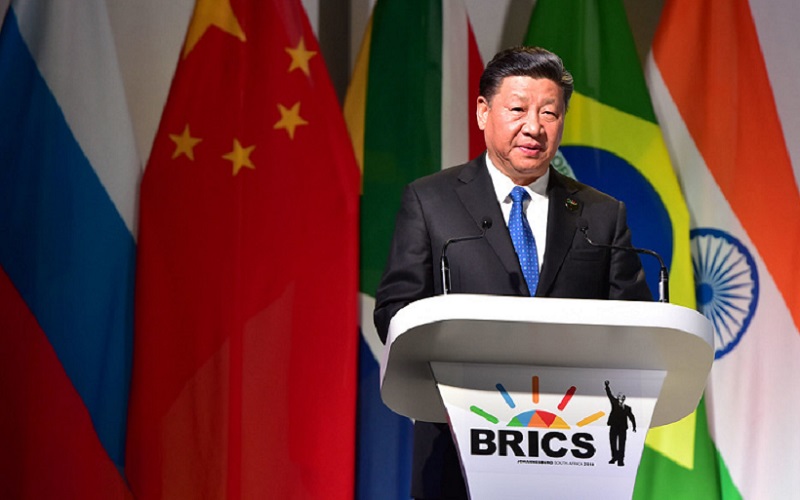

This week the economic calendar is lighter than in previous weeks. Today is almost empty, apart from the Chinese 1-year and 5-year Loan Prime Rates which are expected to go down by 15 points. This doesn’t usually get the market’s attention, but with the current situation in China, the loan rates are more important now for commodity dollars. Tomorrow we have the BRICS Summit and the Existing Home Sales from the US.

Wednesday is a manufacturing and services day, with reports scheduled for release from the Eurozone, UK and the US. Both sectors are expected to show further weakness, with manufacturing being in recession while services are heading there too. On Wednesday the headline US Durable Goods Orders are expected to show a big decline, which comes after a major increase, but core orders are expected to show an increase again. On Wednesday and Thursday, we have the BRICS summit which will be held in Johannesburg while the Jackson Hols Summit will be held at the end of the week.

Last week we kept the same trading strategy, remaining long on the USD and selling retraces higher in risk assets and Gold. That proved to be a successful strategy once again, as the situation in China kept risk assets down and we ended the week with 18 winning trading signals and 7 losing ones, giving us a 70%30% win/loss ratio.

For more detailed updates, please refer to the section below.

GOLD Buyers Can’t Overtake the 20 SMA

The downtrend in the price of Gold remains strong, as shown by the H4 chart below, with the smallest moving average acting as resistance. This trend has become very straightforward since buyers keep jumping at moving averages every time. We have seen many attempts to push the price higher, but they have been weak and have ended at the 20 SMA (gray) in the last two weeks, which looks like a great place to short Gold.

XAU/USD – 240 minute chart

- XAU/USD Sell Signal

- Entry Price: $1,894.5

- Stop Loss: $1,908.5

- Take Profit: $1,886.5

USD/JPY Heading for Last Year’s Highs

GBP/UD has been under pressure since it reversed at around 1.3150 by the middle of July, falling to 1.26 lows, which means losing more than 500 pips. Although sellers found solid support at the 100 SMA on the daily chart and the price formed a doji candlestick above it, which is a bearish reversing signal. The price showed some bullish signs yesterday and today looks like it will close bullish, with the price trading t 1.2750. Yesterday this pair was up by around helped by the UK consumer inflation numbers which were released in the morning. We decided to open a buy GBP/USD signal against the 200 SMA which turned into support on the H1 chart.

Cryptocurrency Update

BITCOIN Stops at $25,000, Trades at $26,000

BTC/USD – Daily chart

We’re looking to open another buy Bitcoin signal on Monday, playing the range again, buying BTC/USD around $26,000

ETHEREUM Breaks the 200 Daily SMA

Ethereum also crashed lower last week, following the SpaceX rumours and the Evergrande bankruptcy. It failed to hold the gains after climbing above $2,000. Despite the prevailing bearish trend that has persisted since the beginning of 2023, characterized by a series of progressively lower lows, Ethereum has exhibited a greater degree of resilience compared to Bitcoin. Although ETH wasn’t spared during this crypto crash and ETH/USD fell below $1,600, but the 200 SMA (purple) held as support on the weekly chart. So, we are thinking about going long on Ethereum again.

ETH/USD – Daily chart

- ETH Buy Signal

- Entry Price: $1,671.79

- Stop Loss: $1,371

- Take Profit: $1,971

www.fxleaders.com

COMMENTS