The USD moved lower in trading today a day before the key US CPI report for June. That report will be released tomorrow at 8:30 AM with the expectatio

The USD moved lower in trading today a day before the key US CPI report for June. That report will be released tomorrow at 8:30 AM with the expectations for the headline YoY to fall to 3.1% from 4.0% last month. The core is a bit more sticky and expected to decline from 5.3% to 5.0% this month.

Shelter, which accounts for around 34% of CPI, rose 0.6% last month and is up 8.0% YoY, and is still a key component for the ex services/core component. Much was made this week about the decline in the Mannheim Used Car price data this week. Will those prices continue their move lower from the pandemic spike?

What we know, is the Fed is laser-focused on the CPI, and more specifically the core/services components which remain sticky to the upside. It is not good enough for energy inflation to come down. They need to see service prices moving lower.

For a preview of the CPI CLICK HERE.

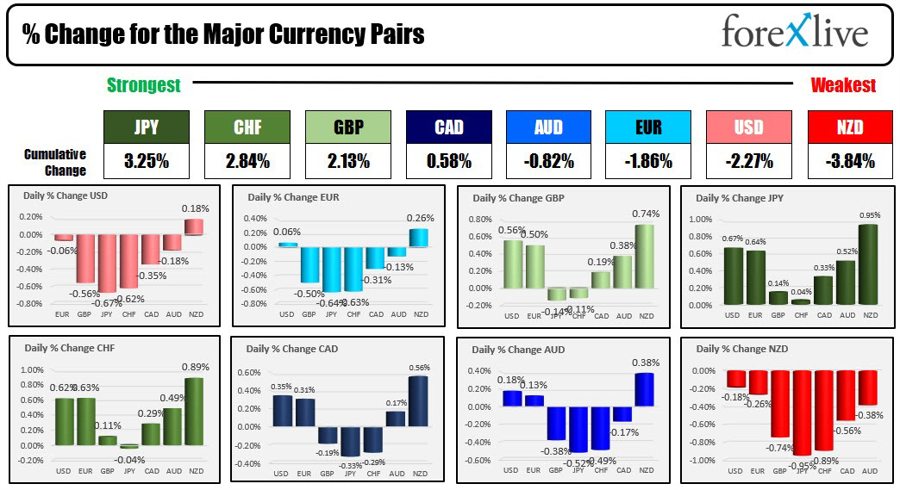

The strongest to weakest of the major currencies

Looking at the strongest to the weakest of the major currencies the JPY is the strongest of the major currencies, The NZD is the weakest followed by the USD. At the start of the US session, the USD was mixed/marginally lower. The greenback is trading near the lowest level for the day vs the GBP, JPY, CHF, and CAD and is certainly off the highs vs the EUR, AUD and NZD.

Technically speaking:

- EURUSD: The EURUSD moved above the June high at 1.1011 in the Asian Pacific session, moving to the highest level since early May. The February 2023 high reached 1.10317, and the price stalled at 1.1026 today. The move lower did find support buyers against a swing area between 1.09618 and 1.09759 (near the high of that swing area). In the new trading day getting above the June high at 1.1011 and 1.10317 are the next upside targets on a more bullish run in the new trading day. Conversely, a move back below 1.09759 and 1.09618 area would open the door for further downside probing.

- GBPUSD: The GBPUSD extended above a topside trendline on the hourly chart, but found resistance against a similar topside trendline on the daily chart at session highs in the early European session. The correction lower into the US session was modest and buyers returned in the US session helped by the overall dollar selling. In the new trading day, the daily topside trendline cuts across at 1.2950. The current price is trading at 1.29281. Getting above that level would open the door for further upside momentum with a swing area between 1.2971 and 1.29987. A correction is not out of the market against that target, but moving below 1.2900 would be close support, but it would take a move below 1.28349 – 1.2848 to hurt the bullish bias more seriously at least in the short term.

- USDJPY: The USDJPY continued its move down as JPY buying dominates on fears that the BOJ may be close to easing up on its yield curve controls (YCC). The price moved into a swing area between 140.22 and 140.45. The current price trades at 140.36. Move below it opens a door toward 139.84 and then down to 138.73 – 138.89.

In other markets today:

- Crude oil is up $1.79 or 2.46% at $74.78. The futures price settled at $74.83

- Gold is up $6.96 or 0.36%

- Silver is down two cents or -0.09% at $23.10

- Bitcoin is trading up about $400 from this time yesterday at $30,609

in the US stock market today, the major indices are up for the 2nd consecutive day. The gains were led by the Dow industrial average also for the 2nd consecutive day, and the NASDAQ index was the laggard…yes…. Also for the 2nd consecutive day.

- Dow industrial average rose 317.02 points or 0.93% at 34261.43

- S&P index rose 29.71 points or 0.67% at 4439.25

- NASDAQ index rose 75.21 points or 0.55% at 13760.69

- Russell 2000 increased by 18.10 points or 0.96% at 1913.36

European indices were also higher with Frances CAC leading the way with a gain of 1.07%. The German DAx rose 0.75%, Spain’s Ibex increase 0.85%, and Italy’s FTSE MIB rose 0.68%. The UK FTSE 100 lagged with a gain of 0.12%

In the US debt market, yields were mixed with the shorter and higher and the longer and lower. The U.S. Treasury successfully auctioned off three-year notes with components all better showing solid demand from both domestic and international players.

- 2-year yield 4.81%, +1.9 basis points

- 5-year yield 4.233%, -1.2 basis points

- 10-year yield 3.976% -3.0 basis points

- 30 year 4.011%, -3.1 basis points

IN late NY session news, the private API data showed:

- Crude showing a build of 3.026 million

- Gasoline showing a build of 1.004 million

- Distillates showing a build of 2.908 million

- Cushing had a drawdown of -2.15M

www.forexlive.com