The US dollar surged on safety flows today. The greenback is the strongest of the major currencies. The AUD and NZD are ending as the weakest. Below

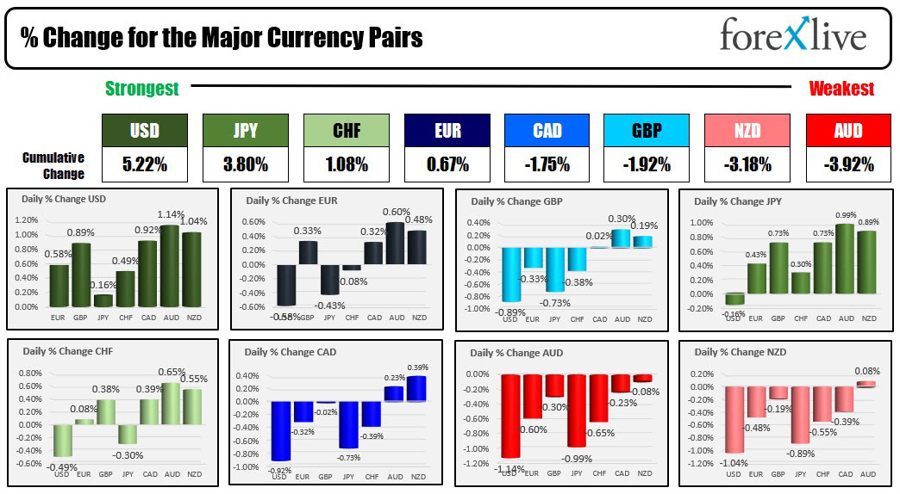

The US dollar surged on safety flows today. The greenback is the strongest of the major currencies. The AUD and NZD are ending as the weakest. Below is the ranking from the % changes of the major currencies vs each other.

The USD is the strongest of the major currencies today

The greenbacks move higher was not on stronger economic data. The weekly initial jobless claims rose to 19 month highs (more claims is weaker employment) and PPI was also lower than expectations. Although weaker jobs is good news for inflation , traders worry that if layoffs beget more layoffs, a hard landing will be more of a problem. Having said that, the tight labor market could use a little correction. Today, the Atlanta Fed wage tracker was down from 6.4% to 6.1% this month, but remained above the 3.5% to 4% levels seen pre-Covid. There is room to continue the easing of wages.

Other support for safety flows comes from regional banking fears once again. During the week ended May 5, PacWest said deposits declined about 9.5%, with the majority of those outflows happening on May 4 and May 5 after news reports said PacWest was exploring options. The bank says it has $15 billion in liquidity and that is more than enough to cover its $5.2 billion in uninsured deposits. However, the bank is still exploring strategic asset sales to be completed in Q2 2023 to ease the pain.

Shares of PacWest fell -22.70% to $4.70, but it could have been worse. The stock low reached $4.00 near the open before bouncing. Nevertheless, risk remains high as it is hard to dissuade depositor who fear their money’s safety in a bank. The KRE ETF of regional banks fell -$0.90 or -2.43%.

Meanwhile, the circular problem for even healthy banks was felt after the FDIC said they would assess banks 12.5 basis points on deposits over the FDIC threshold going back to 2022. The assessment would replenish/pay for the recent bank failures.

What the insurers don’t want to see is rolling bankruptcies (i.e. if PacWest goes, will Western Alliance Bancorp be the next to see deposit withdrawals?

The regionals were not the only losers in the banks today. PNC shares fell -1.11%, CIti fell -0.75%, JPMorgan fell -0.31%.

Looking at some of the major currency pairs:

- GBPUSD fell -0.89% today (snapshot change) despite a 25 basis point hike by the BOE. Bank of England (BOE) Governor Andrew Bailey commented on the impact of past rate hikes on the economy, stating that they will weigh more on the economy in the coming quarters. He mentioned that the Monetary Policy Committee (MPC) factors this into its decisions and will adjust the bank rate as necessary to return inflation to target sustainably. Despite weak GDP growth, Bailey noted that there is no bias in rate-setting going forward. He also discussed the resilience of the economy and the expected decline in inflation from April. However, Bailey emphasized that the BOE has not seen evidence that allows it to be sure that rates can stay on hold, and that the outlook for food price inflation remains uncertain. Technically, the GBPUSD reached a swing area support target between 1.2495 and 1.2500 and bounced (see earlier post outlining the support target). The price is trading back near the 50% of the move up from the April 17 low at 1.25158. Getting above the 50% is needed to give the buyers more hope.

- The EURUSD saw the pair testing 1.0900 at its lowest point. The move to the low may have been influenced by significant option expirations at a strike near 1.0900. The price waffled up and down with a corrective high near 1.0929. The pair remains below a swing area at 1.0933-42. That will be close resistance in the new trading day (see video outlining the area here).

- The JPY was also strong today (it was the 2nd strongest currency today). The JPY can also be bucketed in the “relative safety of the JPY” argument. Meanwhile the AUD (down -1.14% vs the USD), and the NZD (-1.04%) suffered from the “risk off” flows. Those currencies were also impacted by softer China CPI and PPI data, and the decline in commodity prices. The CAD also fell by 0.92% vs the USD as it was weighed down.

See technical videos for:

IN other markets:

- Gold fell $14.10 or -0.69% to 2015.30

- Silver tumbled $1.22 or -4.81% to $24.16

- Crude oil fell $-1.12 or -1.54% to $71.44

- Bitcoin which was trading at $27,889 at this time yesterday, is trading down at $27,017 currently

US yields move lower in trading today, but moved higher into the close especially in the shorter end:

- 2 year 3.899%, -0.2 basis points

- 5 year yield 3.355% -1.8 basis points

- 10 year yield 3.386% -5.0 basis points

- 30 year yield 3.740% -5.9 basis points

The 30 year bond auction was met with strong demand from overseas investors.

www.forexlive.com