The US headline CPI fell to 5% from 6% last month but the core inflation moved higher to 5.6% from 5.5% last. The shelter component declined from last

The US headline CPI fell to 5% from 6% last month but the core inflation moved higher to 5.6% from 5.5% last. The shelter component declined from last month, but still came in at 0.6% (vs 0.8% last month). Shelter accounts for 34.7% of CPI inflation. Many economist/analysts have been calling for it’s decline, but so far 0.6% MoM may be lower than 0.8% last month, but it is still a high number and at nearly 35% of the CPI, still a major contributor to the rate being well above the 2% target level.

The Fed’s Barkin commented that he is still waiting for inflation to come down despite the sharp fall…which is true. The headline and core inflation is STILLL at 5% and 5.6% respectively. Barkin said that inflation would need to reach 2% target for a few months to make sure inflation is killed. Fed’s Daly was also unimpressed by the higher inflation saying the Fed has more work to do on rate hikes.

Meanwhile the Fed minutes showed that Fed staff forecast a mild recession by the end of the year. They also said that inflation will “step down markedly” this year, and slow “sharply” next year. At the same time they commented that economic risks are to the downside but inflation risks are still to the upside.

The room is spinning from all the projections and comments, but the Fed officials seem to indicate that they are sticking to their guns on rates (with rates staying high into 2024). They will continue to fight inflation – or say they will fight the fight – even with some indications that it is moving lower despite the higher shelter costs.

The market is taking a different track as rates moved lower today with:

- 2 year at 3.968%, -9.0 basis points

- 5 year yield 3.467, -8.2 basis points.

- 10 year yield 3.401%, -3.2 basis points (this despite an unimpressive 10 year note auction with a 2.0 basis point tail)

The longer 30 year yield did move marginally higher.

- 30 year yield 3.633% +1.2 basis points

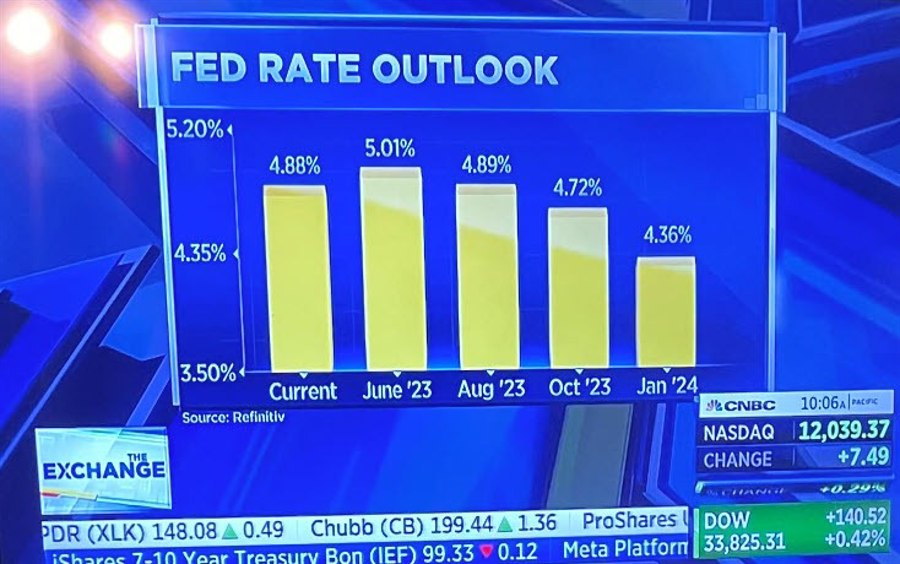

The market sees the terminal rate at 5.01% in June with the Fed target rate falling to 4.36% by January 2024

Fed Funds Target

In other markets.

- Spot gold is trading up $11.06 or 0.59% at $2014.68.

- Spot silver is up $0.42 or 1.71% at $25.49

- WTI crude oil is trading at the highest levels this year at $83.27

- Bitcoin is dipping back below the 30,000 level as we head toward the end of the day at $29,914

US stocks with the NASDAQ index doing the worst:

- Dow industrial average fell -38.29 points are -0.11% at 33646.51

- S&P index fell -16.99 points or -0.41% at 4091.96

- NASDAQ index fell minus 102.55.2 -0.85% at 11929.33

- Russell 2000 fell -12.89 points or -0.72% at 1773.69

In the forex market, the CHF is the strongest of the majors while the USD is the weakest. The CAD was also weaker today after the Bank of Canada kept rates unchanged for the 2nd consecutive day.

www.forexlive.com