The US Consumer Price Index (CPI) data for June 2023 came out slightly lower than expected, reflecting a slower inflation rate. The overall CPI increa

The US Consumer Price Index (CPI) data for June 2023 came out slightly lower than expected, reflecting a slower inflation rate. The overall CPI increased by 3.0% year-on-year, matching the expected figure but lower than the previous 4.0%. On a month-on-month basis, the CPI grew by 0.2%, slightly less than the expected 0.3% and up from last month’s 0.1% growth.

Meanwhile, the core CPI, which excludes volatile items like food and energy, increased by 0.2% month-on-month, lower than the anticipated 0.3% and down from last month’s 0.4%. The year-on-year core CPI was 4.8%, under the expected 5.0% and down from last month’s 5.3%.

Shelter prices increased by 0.4% month-on-month, lower than last month’s 0.6%. On a year-on-year basis, shelter prices went up by 7.8%, a slight decrease from the previous 8.0%. Shelter accounts for over 34% of the CPI calculation. This month’s increase contributed 70% of the gain. If only shelter would start to show lower gains?

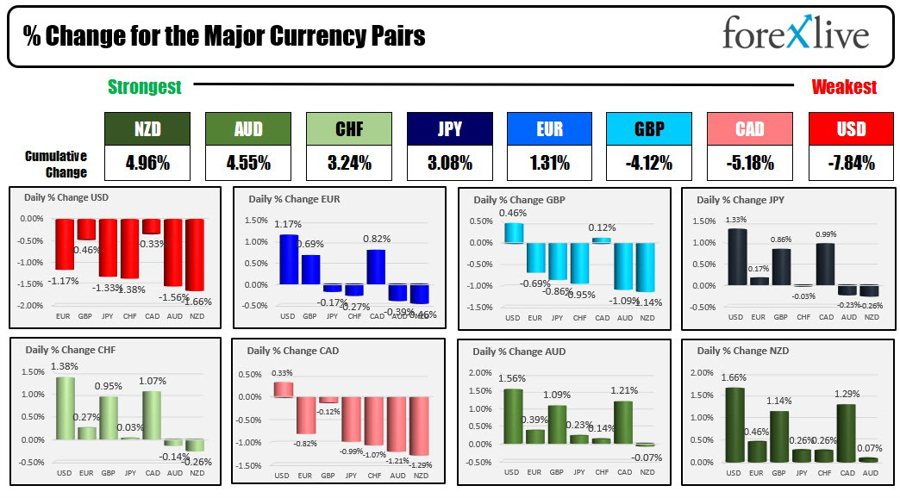

Nevertheless, the better data sent the US dollar tumbling with large risk-on flows. The NZD and the AUD were the biggest gainers.

The US dollar fell 1.66% versus the New Zealand dollar and -1.56% versus the Australian dollar.

The strongest weakest to the major currencies

The US dollar fared the best versus the Canadian dollar. In Canada they raise rates by 25 basis points to 5.5%. Although the statement (I thought) was a touch more hawkish, the USDCAD cannot extend below the for the year at 1.31157. The low price today reached 1.31428 and is currently trading up at 1.3185. Go figure.

Bank of Canada’s Governor, Tiff Macklem, at his press conference after the rate rise, said that while monetary policy is working, inflationary pressures remain stubborn. Consequently, higher interest rates are required to slow the economy’s demand growth and alleviate price pressures. Macklem acknowledged the labor market’s tightness and the BOC’s preparedness to further raise rates. Striving for balance, the BOC aims to mitigate risks of under and over tightening of monetary policy. If current measures are deemed insufficient, Macklem forewarns a potential necessity for future augmentations. Macklem also revealed the Governing council’s consensus to employ more restrictive monetary policy to steer inflation back to a 2% target, despite discussions about maintaining unchanged rates. He concluded that the cost of inaction outweighs the benefit of waiting, and with the rate increases in June and July, the BOC anticipates a gradual return to the 2% inflation target.

Richmond Fed President Barkin commented on the state of inflation (after the announcement), still emphasized that inflation remains too high. He pointed out that while demand continues to be elevated, supply constraints are slowing down the process of achieving a balance. Barkin observed a settling down of demand but expressed uncertainty about its impact on inflation rates. He posed a question on whether inflation could stabilize amidst a strong labor market. If incoming data does not affirm a return of inflation to the target, Barkin asserted his comfortability with the idea of implementing more proactive policy measures.

Looking at other markets, interest rate traders spent the day buying notes and bonds (sending yields lower). As the market moves toward the end of the day:

- 2-year yield is trading at 4.748%, down -14.8 basis points

- 5-year yield is trading at 4.076% down -16.2 basis points

- 10-year yield is trading at 3.865%, down -11.7 basis points

- 30 year yield is trading at 3.954%, down -6.6 basis points

With the yield sharply lower, and risk-on flows elevated, US stocks rallied for the 3rd consecutive day. European stocks even fared better:

- Dow industrial average which outperformed on Monday and Tuesday, was the weaker of the 3 major indices today. The index rose 86.01 points or 0.25% at 34347.44

- S&P index rose 32.90 points or 0.74% at 4472.15

- NASDAQ index rose 158.27 points or 1.15% at 13918.97

In Europe:

- German DAX rose 1.47%

- Frances CAC rose 1.57%

- UK’s FTSE 100 rose 1.83%

- Spain’s Ibex rose 1.31%

- Italy’s FTSE MIB rose 1.75%

In other markets:

- Crude oil is trading at $1.06 or 1.42% at $75.89

- Gold surged $25.69 or 1.33% at $1957.88. That was the largest one-day percentage gain since May 2

- Silver rose $1 or 4.36% at $24.12. The game today was the largest since March 13

- Bitcoin is trading at $30,330. At the start of the $30,759

www.forexlive.com