The US CPI came in at 0.5% for the headline and 0.4% for the core. The shelter component apparently was responsible for 1/2 of the rise, but service C

The US CPI came in at 0.5% for the headline and 0.4% for the core. The shelter component apparently was responsible for 1/2 of the rise, but service CPI still remains a concern and not coming down. If that trend continues, it is hard to see the CPI coming down toward the 2% target soon. ON the other other side of the equation, is shelter is expected to come down in the 2H of the year which if goods and shelter remain low, the service is the last piece for success.

Meanwhile, the economy seems solid. We do get a key piece of data tomorrow with US retail sales being released at 8:30 AM ET. The expectations are for 1.9% which offsets the -1.1% decline last month. The Core retail sales are expected to come in at 0.9% (vs -1.1% last month).

There was a lot of Fed speak today. A headline summary shows

Fed’s Barkin:

- There is a very good case for leaving rates higher for longer for a period of time

Fed’s Logan:

- Fed must be prepared to keep raising rates longer than anticipated

- Tightening policy too little is the top risk.

- Little sign of improvement in core services ex housing inflation

Feds Harker:

- At some point this year, expect policy rate will be restrictive enough to hold rates in place

- Fed not done yet, but we are likely close

- I do think we need to continue above 5% in 25 basis point increments for a while

Fed’s Williams:

- Outlook for year-end Fed funds rate of 5% – 5.5% looks reasonable

- Big worries at high inflation gets embedded in public expectations

- Fed is not going rates to where they needs to be

Fed’s Williams did say that it is possible that the Fed cuts rates in 2024 and 2025 to reflect lower inflation.

Overall, it is hard for the Fed officials to say that they have inflation whipped.

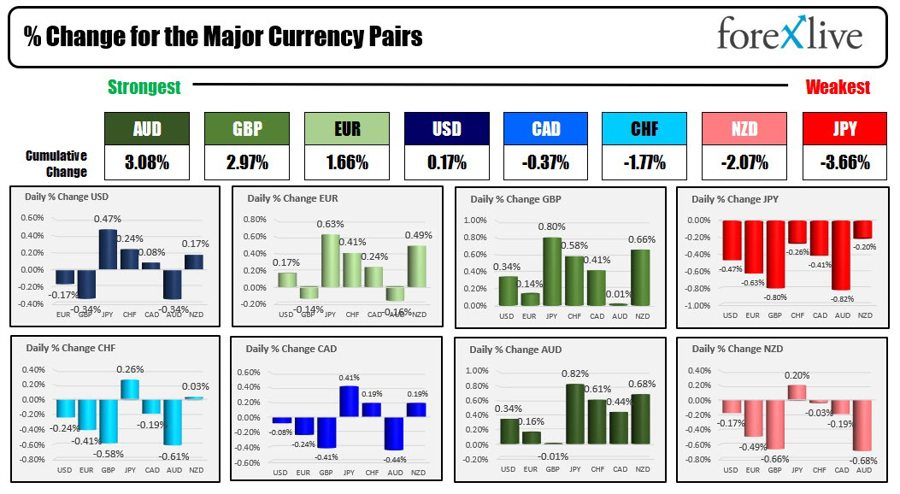

The strongest to the weakest of the major currencies shows the AUD overtook the GBP as the strongest (the GBP was the strongest at the start of the US session), while the JPY is the weakest. The USD dipped into the close and is closing the day mixed.

The strongest to the weakest of the major currencies

The mixed dollar comes despite higher rates:

- 2 year yield 4.615%, +9.3 basis points. The high yield reached 4.641%

- 5 year yield 3.999% +8.5 basis points. The high yield reached 4.037%

- 10 year yield 3.749% +4.4 basis points. The high yield reached 3.797%

- 30 year 3.78% +0.4 basis points. The high yield reached 3.843%

in the US stock market, the NASDAQ moved higher, but the S&P and Dow Industrial Average were lower on the day:

- Dow Industrial Average -156.66 points or -0.46% at 34089.28

- S&P index -1.16 points or -0.03% at 4136.14

- NASDAQ index up 68.37 points or 0.57% at 11960.18

Crude oil fell about one dollar of the day to $79.11. The US announced the release of 26 million barrels from the strategic petroleum reserve yesterday helping to weaken the price.

Bitcoin saw some risk on sentiment at the price moving back above the $22,000 level. The low for the day reached $21,569. The high reached $22,316. It is currently trading at $22,198.

www.forexlive.com