The USD is ending the day as the strongest of the major currencies outpacing the JPY. The AUD is ending as the weakest ahead of the RBA rate decision

The USD is ending the day as the strongest of the major currencies outpacing the JPY. The AUD is ending as the weakest ahead of the RBA rate decision in the new trading day. The central bank is expected to keep rates unchanged at 4.10%. Focus will be on hints going forward.

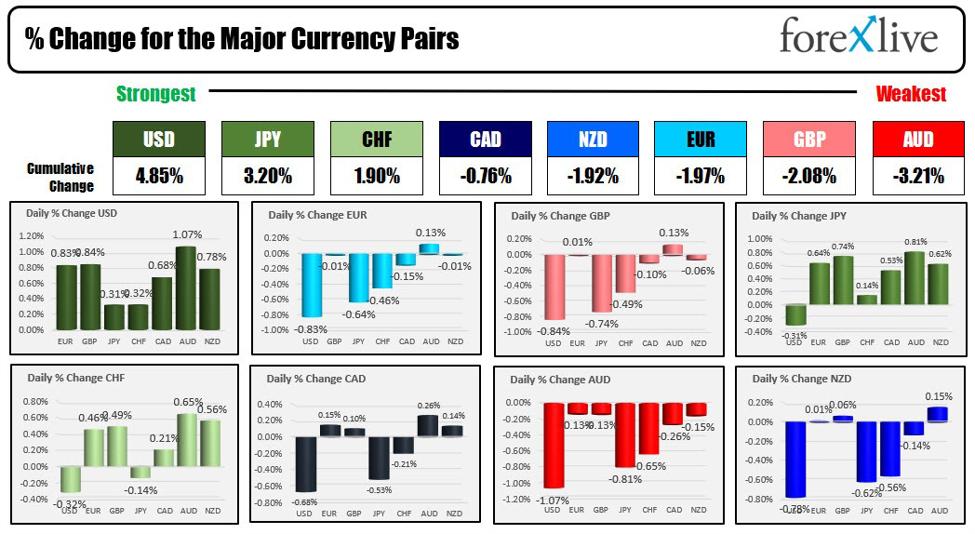

The strongest to weakest of the major currencies

The US dollars rise was helped by:

- Concerns about the US fiscal policy. Markets are getting concerned not only about the inability of Washington to cut spending – and the ever-increasing deficits – but also the increasing expectations at the rates will be higher for longer. That will raise interest costs for the U.S. Treasury at a time when the U.S. Treasury is issuing more debt. The three-month bill yield is 5.471%. In October 2022, the yield was at 3.24%. In October 2021, the yield was at 0.05%. That’s a big leap in rates and if the Fed were to keep rates higher for longer it again interest expense.

- Better ISM data. The ISM manufacturing index today increased to 49.0 versus 47.8 expected and 47.6 last month. Although negative, it still represents a significant push higher this month. The employment index moved back above the 50 level at 51.2 versus 48.5 last month. New orders were better as well at 49.2 versus 46.8 last month.

- Higher US yields.

Looking at the US debt market, yields were higher across the board with the yield curve steepening (even though it is still negative) a snapshot of the US debt market as we head toward the close it shows:

- 2-year yield 5.110%, +6.4 basis points

- 5-year yield 4.715%, 11.1 basis points

- 10-year yield 4.688%, +11.8 basis points

- 30-year yield 4.801%, +9.2 basis points

The 2 – 10 year spread continued its steepening (although it still remains negative). The yield spread is highest since May 4th when it closed at -41.4 basis points. The 2 – 30 year spread is at -31 basis points which is its highest level since May 17.

The rising dollar and rising yields sent gold to its lowest level since March. The price of gold is trading down -$20.43 or -1.10% at $1827.42.

Looking at some of the major currency pairs:

- EURUSD: The EURUSD is trading to a new low going back to December 7, 2022, after falling below the 1.0483 level. That level held support last week and traders tried to hold today until the final push toward the close today. It would now take a move above the swing area between 1.0483 and 1.0533 to disappoint the sellers. For a technical look at the EURUSD, CLICK HERE.

- GBPUSD: The GBPUSD is also trading to new session lows and to the lowest level since March 16, 2023. The pair is also approaching a key target at the 38.2% of the move up from the September 2022 low. That level comes in at 1.20763. Move below, and the sellers take more control technically. Stay above, and the selling may dry up. See the video on the GBPUSD by CLICK HERE.

- USDJPY: The USDJPY moved higher in the Asian session and in doing so extended to the highest level since October 2022. The price waffled up and down in the NY session but is looking to test the earlier high at 149.869. Get above that and the natural resistance at 150.00 is the next hurdle for buyers. On the downside watch 149.699. That level was the swing high from last Wednesday and is a close support level that if broken, could see buyers turn to sellers on upside disappointment.

- AUDUSD: The AUDUSD moved lower ahead of the RBA rate decision later today. The price moved into a swing area on the 4-hour chart between 0.6355 and 0.6340. Moving below that swing area in the new day and then the low extreme from last week at 0.63309, would open the door for more selling momentum. On the topside, a move above 0.6379 to 0.6387 would have traders looking more to the topside. For a video look at the AUDUSD CLICK HERE.

- NZDUSD. The NZDUSD is lower today, but remains above the 100/200 bar MA on the 4-hour chart near 0.5924. The price is approaching that level (currently at 0.5954). Move below, would open the downside technically. CLICK HERE for the technicals driving that pair.

In the US stock market, today, the major indices are closing mixed, with the Dow lower, but late-day buying ticking the S&P to just above unchanged, and sending the Nasdaq higher. The final numbers are showing:

- Dow industrial average fell -74.15 points or -0.22% at 33433.36

- S&P rose by a scant 0.36 points or 0.01% at 4288.40

- Nasdaq rose 88.44 points or 0.67% at 13307.76

Thank you for your support. Good fortune with your trading.

www.forexlive.com

COMMENTS