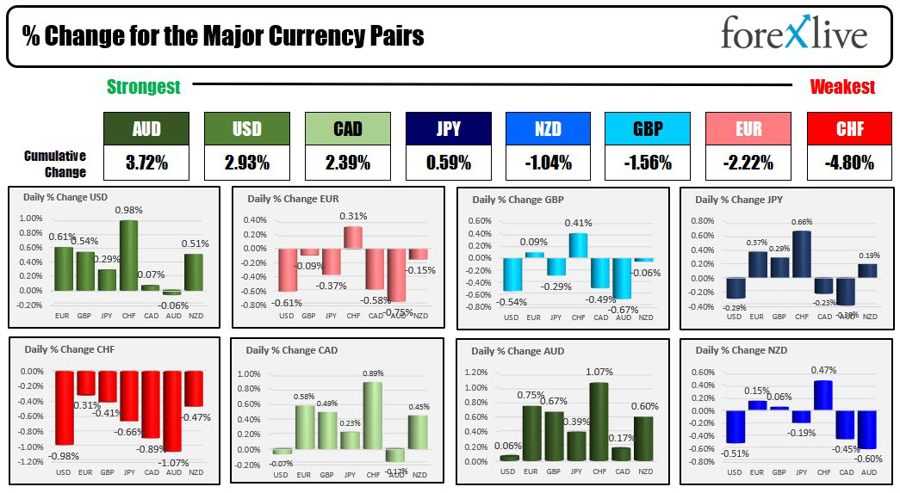

The AUD is ending the day as the strongest of the majors. The CHF is the weakest. The USD is just behind the AUD as the strongest today. USD is mostl

The AUD is ending the day as the strongest of the majors. The CHF is the weakest. The USD is just behind the AUD as the strongest today.

USD is mostly stronger today

The USDs move higher was driven by lower initial jobless claims and a sharp rise in US yields. Initial claims were at 228k, their lowest since early May.

In the US debt market, yields rose across the yield curve. A snapshot of the yield curve shows the:

- 2-year yield 4.843%, +8.8 basis points

- 5-year yield 4.103%, +13.2 basis points

- 10-year yield 3.856%, +11.4 basis points

- 30-year yield 3.913%, +7.4 basis points

The USDCHF was the biggest mover vs the greenback with a gain of 0.98%. Higher yields in the US, and corrective action off the lowest levels since January 2015, helped to push the pair to the upside. Technically, the price of the USDCHF moved above its 100-hour MA – with plenty of momentum – at 0.8595. Later, the price also moved above its 200-hour MA for the first time since July 6 at 0.8655. The price is trading at 0.8666 at the end of day. The close risk would be the 200-hour moving average. Stay above is more bullish in the new trading day

The AUDUSD is trading near unchanged on the day, but performed the best among the major currencies. That performance was not without up and down volatility for the pair. In the Asian/Pacific session a stronger-than-expected, sent the pair sharply to the upside. After the better US jobs data was released, buyers turned to sellers and push the price all the way down to the closing level from yesterday at 0.6770. The price bounced modestly and currently trades at 0.6780. The price is also below its 200 hour moving average of 0.6787.

The NZDUSDr was lower due to general risk aversion helped by sharp selling in the NASDAQ index., with NZD/USD trading between 0.6214 and 0.6308. The move to the downside took the price below its 50% midpoint of the range since the June 29 low. That level comes in at 0.6230. The current price is trading at 0.6232 going into the end of day. The point will be the barometer for buyers and sellers in the new trading day

The USDJPY extended back above the 140.00 level reaching a high of 140.49. That took the price briefly above a swing area that topped out at 1.4045. The price of the USDJPY rotated lower over the last few hours of trading and is trading at 140.06 near the end of day. CPI data Japan will be released on Friday.

The EURUSD fell below its 200-hour moving average currently at 1.11594. That level will be risk for sellers going into the new trading day. The current price is trading at 1.1130. On the downside, the 38.2% retracement of the move up from the July low comes in at 1.1106. That is the next target for the pair.

The GBPUSD fell below its 50% midpoint at 1.28658 and stalled the fall within a swing area between 1.28349 and 1.28486. The price is just above the 50% midpoint at 1.2867 going into the close. That midpoint level will be the barometer for more bullish/more bearish in the new trading day.

The USD has been moving lower with the dollar index down -3.86% since July 6. The move back to the upside the head of the key FOMC meeting next week is not a surprise. The Fed is expected to raise rates by 25 basis points. The US calendar for Friday is quiet, with only a few earnings reports scheduled in the US. Retail sales will be released in Canada.

A snapshot of other markets as the day comes to an end shows:

- Crude oil is trading up $0.46 or 0.61% at $75.75. The price remains between its 100-day moving average below at $73.67 and its 200-day moving average above at $77.22.

- Gold is trading down $-6.90 or -0.35% at $1969.27

- Silver is trading down $0.36 or -1.42% at $24.75

- Bitcoin is trading at $29,734. The high price reached $30,414. The low price extended to $29,567.

In the US stock market today, the Dow Industrial Average closed higher for the 9th consecutive day. The broader S&P and NASDAQ index fell with the NASDAQ index tumbling over 2% on the day.

- Dow industrial average rose 0.47%

- S&P index fell -0.68%

- NASDAQ index fell -2.05%

In the European equity markets, the major indices closed higher:

- German DAX +0.59%

- Frances CAC +0.79%

- UK’s FTSE 100 +0.76%

- Spain’s Ibex +0.72%

- Italy’s FTSE MIB +0.36%

www.forexlive.com