US existing home sales came in weaker than expected at 3.79M annualized versus 3.90M . That was the lowest level going back to 2010 and is indicative

US existing home sales came in weaker than expected at 3.79M annualized versus 3.90M . That was the lowest level going back to 2010 and is indicative of a low supply (which remains half of what a normal market is) and higher prices and mortgage rate. Mortgage rates have come off from nearly 8% to 7.3% – 7.4% currently. That may kickstart some of the market but affordability is still difficult especially for young first-time buyers.

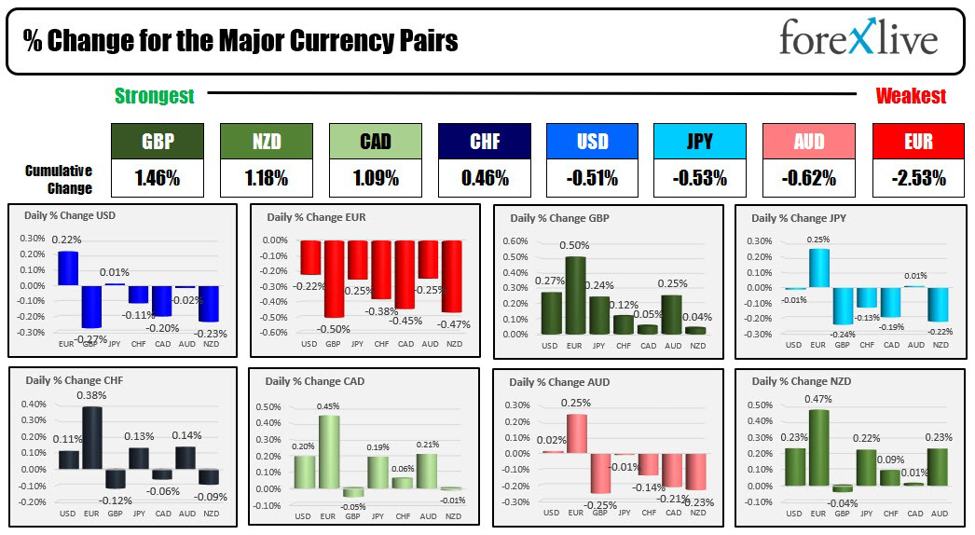

Looking at the Forex market, the GBP was the strongest of the major currencies today. The weakest was the EUR. THe US dollar is ending the day mixed with gains vs the EUR. The USD fell versus the GBP, CHF, CAD and NZD but the declines were modest. The USDJPY and the AUDUSD are near unchanged.

Looking at some of the individual pairs.

- EURUSD: The EURUSD started the trading day with only a 28 pips trading range. The average over the last month was 77 pips. That range was extended as the trading moved into the US afternoon session and is ending the day with a 65 PIP range. The low for the day took the price down to 1.0899. That is within 5 pips of the rising 100-hour moving average 1.0894. Going into the new trading day the 100 are moving average will be a barometer for buyers and sellers. Moving below will be more bearish. Staying above would be more bullish.

- USDJPY: The USDJPY moved lower in the Asian session and into the European session. The move took the low to 147.143 which was the lowest level going back to September 14. However, buyers came in as sellers took profits ahead of its rising 100-day moving average at 146.56. The price has not traded below its 100-day moving average since April 14. The price is currently trading at 148.38 which has taken it back above the swing low from yesterday and the swing low going back to October 17 at 148.15. The next upside target comes in at 148.68. The high price for the day reached 148.60

- AUDUSD: The AUDUSD continued its most recent run to the upside that was started on a Fridays trade. Yesterday the price moved above a ceiling area at 0.66229. Today the momentum continued with the price moving up to test its 200 day moving average of 0.65893. The high price for the day reached 0.6589 and stalled. The price has since moved down and currently trades at 0.6556 going into the close for the day. In the new trading day look for support at 0.6544. If that can hold, there could be another one toward the 200 day moving average.

In the US debt market, yields traded higher and lower. The longer end did see yields move higher (the 10 year TIPS auction was disappointing and that led to some selling in debt instruments). However, the Fed minutes from the November meeting were thought to be a bit less hawkish than expectations. That led to a rotation back to the downside in yields (and into negative territory). For a review of the Fed minutes click here)

A snapshot of the debt market currently shows:

- 2-year yield 4.83%, -2.8 basis points

- 5-year yield 4.410% -3.1 basis points

- 10-year yield 4.400%, -2.2 basis points. At highs, the yield was up 1.9 basis points.

- 30-year yield 4.553% -2.2 basis points. At highs, the yield is up 3.4 basis points.

Crude oil took a breather today and is currently trading near unchanged at $77.84. Session highs reached $77.88. The low was at $76.97. Technically, the prices remain below its 200 day moving average at $78.12. Yesterday the price extended briefly back above that moving average only to fail and rotate lower.

Gold prices moved sharply hard today with the price extending to an intraday high of $2007.54. That took the price within about $2 of the October 27 high of $2009.42 (the next target). The price has come off into the close, and in doing so has moved back below the natural support at the $2000 level. The $2000 level will be a barometer for buyers and sellers going into the new trading day.

In the US stock market, the major indices all fell. The declines in the S&P and NASDAQ snapped five-day win streaks:

- Dow industrial average fell -62.75 points or -0.18% at 35088.30

- S&P index fell -9.21 points or -0.20% at 4538.18

- NASDAQ index fell -84.56 points or -0.59% at 14199.97

After the close Nvidia announced its earnings for the current quarter:

- EPS came in at $4.02 per share which was higher than the $3.37 expected

- Revenues also beat expectations at $18.12 billion versus expected $16.18 billion

- Forward guidance showed Q4 revenues at $20 billion + or – 2% versus expected $17.9 billion

Nvidia is reporting that its competitive position has been harmed from US export controls, while competitive and future results may be further harmed over the long term if there are further changes to export controls.

In after-hours trading, Nvidia shares are trading down $4.83 or -0.97% at $494.61.

Tomorrow should be a quiet day as the US traders look toward the Thanksgiving day holiday.

www.forexlive.com

COMMENTS