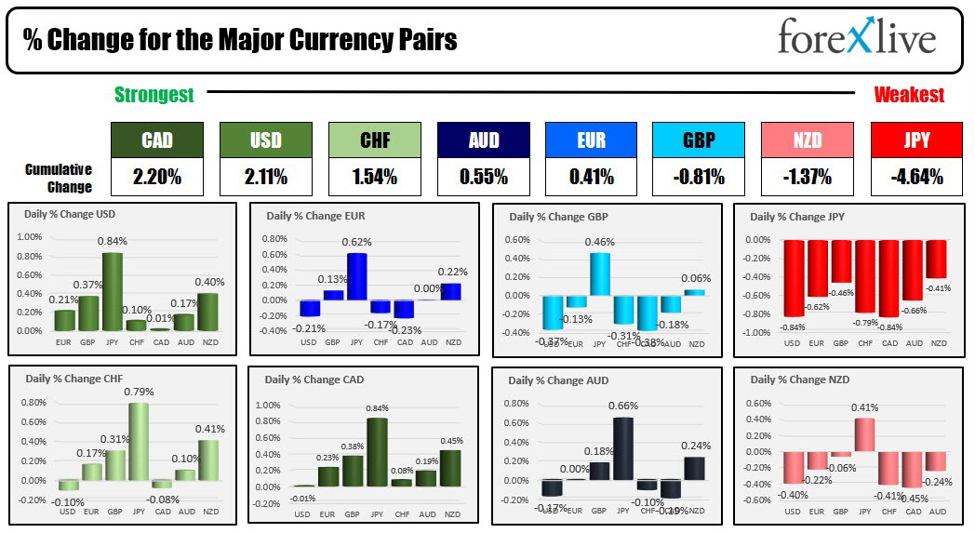

As traders look forward to the exits in the US session (with the Thanksgiving day looming tomorrow), the CAD is ending the day as the strongest of the

As traders look forward to the exits in the US session (with the Thanksgiving day looming tomorrow), the CAD is ending the day as the strongest of the major currencies. The JPY is the weakest.

The CAD is the strongest and the JPY is the weakest.

The USD has moved higher in the US session helped by a reversal of yields after earlier declines The Michigan Consumer sentiment was a catalyst in holiday trading as it continued to show stronger consumer expectations for inflation 1 and 5 years out (1 year at 4.5%. The 5 year at 3.2%). That spooked yields higher, before settling and moving marginally lower. The short end is higher. The longer end is now unchanged to lower.

A snapshot of the US yield curve is showing:

- 2 year yield 4.921%, up 3.8 bps

- 5 year yield 4.48%, +3.0 bps

- 10 year yield 4.4217%, up 0.4 bps

- 30 year yield 4.553%, -2.6 bps

The US stock market opening higher dipped a bit but stayed in positive territory. With a few hours left before the stocks shut down for the day, a snapshot shows:

- Dow Industrial Average up 174.5 points or 0.50 at 35263.79

- S&P index up 21.91 points or 0.48% at 4559.89

- Nasdaq up 97 points or 0.69% at 14297.57

Shares of Nvidia are not participating after earnings yesterday, but is trading back near the closing level from yesterday after trading down as much at -$22.54 at session lows (price is down -$5.17 or -1.03% at 494.19

Oil prices moved sharply lower after OPEC+ postponed their meeting for November 26 to November 30. There is some disagreement from members as to the proposed cuts from Saudi Arabia to keep prices higher. One problem is the US is now producing more oil than ever. Also, global growth is softer. Oil inventories today (from EIA) showed a build of 8.701M which comes on the back of a 3.59M gain last week. Crude oil moved as low as $73.85, but has since squeezed higher and trades near $77.00 currently.

Durable goods today showed that weakness with a greater than expected decline of -5.4% today. The weekly jobless claims strengthened after the sharp rise last week. This week, initial claims fell to 209K from 233K last week. The continuing claims dipped to 1.840M from 1.862M last week.

www.forexlive.com

COMMENTS