The price of Bitcoin moved up to test the $60,000 level into the US session and found initial sellers against the level. However, after breaking above

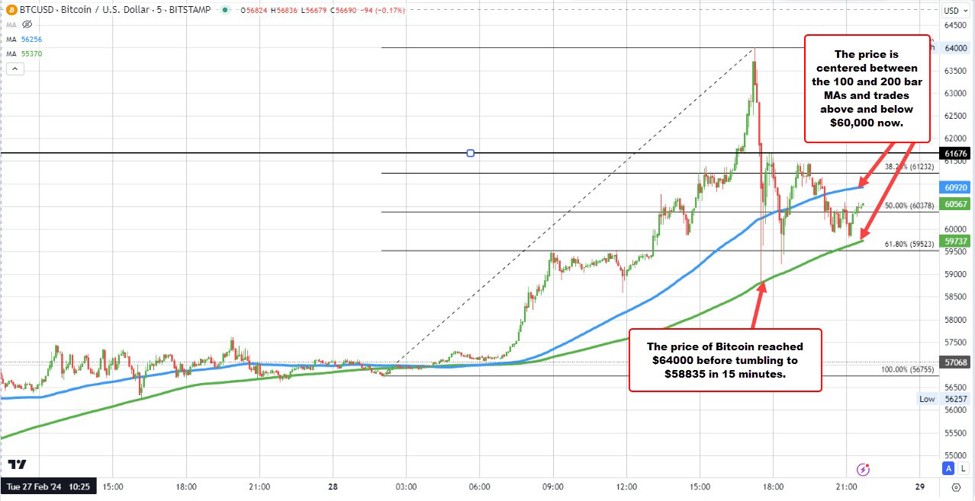

The price of Bitcoin moved up to test the $60,000 level into the US session and found initial sellers against the level. However, after breaking above, a bid pushed the digital currency to a high of $64,000. The sellers quickly entered and the price spent the next 15 minutes retracing down to a low of $58.835 before bouncing violently to $61,676.

Looking at the 5-minute chart, the tumble lower took the price right to the rising 200 bar MA (green line on the chart below), where buyers stalled the fall.

Currently, the price on the short-term chart trades between the 100 and 200 bar MA ($60918 above and $59721 below). Those level will be the new barometers in the short term for the digital currency as the squeeze higher, met it’s match with the sellers pushing lower.

Was it capitulation after rising from a low of $50,090 on February 26 to a high of $64,000 today? The sellers will have to get below the 200 bar MA on the chart above to show some added bearish strength (and stay below).

In the currency markets today, the NZD was the biggest mover after the Reserve Bank of New Zealand kept rates unchanged, but had a dovish bias. Some analysts thought the central bank would raise rates at the meeting. Most thought they would keep a hawkish bias. Instead the central bank called policy restrictive, lowered projections modestly for rates in 2024 and 2025 and said they expect growth/inflation to slow.

The NZDUSD fell -1.17% vs the USD and was down over 1% vs all the major currencies with the exception of the CAD (fell -0.83%) and the AUD (fell -0.44%).

The USD, CHF and EUR were the strongest of the major currencies although most of the gains were versus the CAD, AUD and NZD. Versus the rest of the currencies, the changes are relatively small – although intraday price action was up and down (with the price returning to near end-of-day levels from yesterday by the close. ).

The strongest to the weakest.

In the European stock market, the major indices were mixed. In the US, the major indices all fell and are on track for declines in the week.

- Dow industrial average fell -0.06% and is down -0.47% for the week

- S&P index fell -0.17% and is down -0.37% for the week

- Nasdaq index fell -0.55% and is down -0.31% for the week.

The small cap Russell 2000 fell -15.80 points or -0.77%. For the week, its shares are still up 1.17%

In the US debt market, yields are ending the day lower:

- 2- year yield 4.643%, -6.8 basis points

- 5-year yield 4.264%, -5.8 basis points

- 10 year yield 4.265%, -4.9 basis points

- 30-year yield 4.405%, -3.4 basis points.

There was a number of Fed speakers including Fed’s Williams and Collins:

- Fed’s Williams emphasized a cautious yet optimistic outlook regarding the Federal Reserve’s approach to inflation and monetary policy. He acknowledged that there’s still a distance to go before reaching the Fed’s 2% inflation target, and remains fully committed to this goal. The path back to 2% inflation is expected to be uneven, despite significant drops in inflation pressures and improvements across the board. Williams highlighted the existence of risks on both the upside and downside to the economic outlook, and projected inflation to reach between 2% and 2.25% this year and stabilize at 2% by 2025. He forecasts economic growth at 1.5% for the year, with unemployment rates slightly increasing to around 4%, but notes the economy and job market remain strong with diminishing imbalances. He asserted that the risks to the Fed’s job and inflation mandates are moving into better balance. With the Fed likely to cut rates later this year, Williams stressed the importance of data-driven decisions regarding rate cuts and suggested that discussing three interest-rate cuts in 2024 is reasonable.

- Fed’s Collins outlines a cautious yet forward-looking stance on monetary policy amidst evolving economic indicators. Collins indicates a potential shift towards easing policy later this year, tempered by the acknowledgment that progress toward the Federal Reserve’s goals might encounter fluctuations. She underscores the necessity for more concrete signs of a disinflationary trend before making significant adjustments to policy, advocating for a balanced approach to data interpretation without overemphasizing individual reports. Collins emphasizes the importance of moderate demand growth, stable wage growth, and declines in specific inflation sectors like housing and non-shelter services to achieve the 2% inflation target. She also acknowledges the balance of risks between acting too early or too late on policy adjustments, suggesting a deliberate pace in policy decisions. Collins points to the expected decline in reserves and the importance of monitoring such changes to determine the appropriateness of revisiting quantitative tightening (QT). Additionally, she expresses caution in interpreting housing inflation data, indicating it’s too early for definitive conclusions. This approach reflects a nuanced understanding of the current economic landscape, emphasizing data-driven policy making while considering the complexities of inflationary pressures and labor market dynamics.

Thank you for your support and good fortune with your trading.

www.forexlive.com

COMMENTS