The USD is ending the 2nd consecutive day as the strongest of the major currencies . The JPY is the weakest. The USDJPY was the biggest mover with a

The USD is ending the 2nd consecutive day as the strongest of the major currencies . The JPY is the weakest. The USDJPY was the biggest mover with a gain of 1.12%.

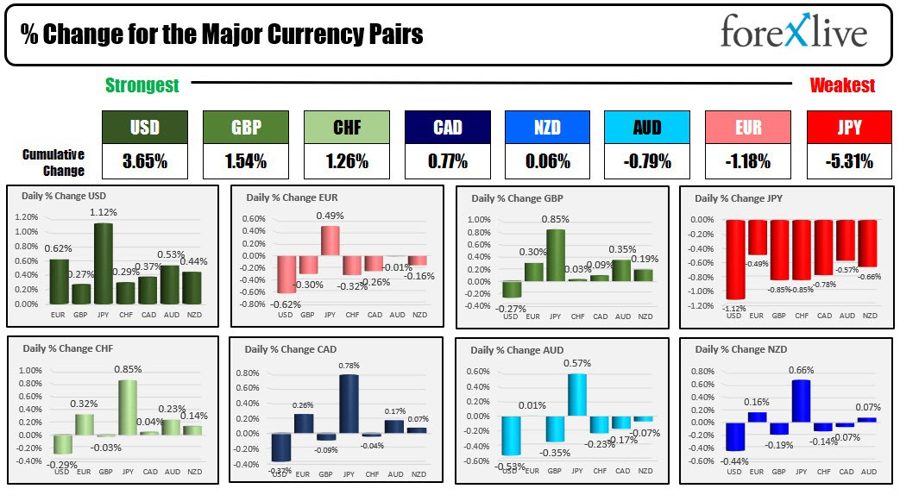

The strongest to the weakest of the major currencies

The catalyst for the US dollar was high rates on expectations for a more hawkish fed after the US jobs report shocked the market on Friday (gain of 517 K versus expectations 185K – see video here).

The US yields continued their surge higher today, by rising close to 18 basis points to 4.47% for the 2 year note. The benchmark 10 year yield moved up 11.2 basis points to 3.64%. European 10 year yields also moved higher led by the UK 10 year up 12 basis points.

The US stocks reacted negatively to the moves with the NASDAQ falling 1%, after dipping below that level intraday. The 4100 level was home to two separate highs in December. Last week, the S&P was able to move above that level, and despite the declines on Friday and today, remains above the level (keeping the buyers in play/control).

The biggest mover today, the USDJPY, was helped by a piece in the Nikkei saying that Deputy Gov. Massayoshi Amamiya was the likely successor to current Gov. Kuroda at the BOJ.

Amamaya is considered by markets is more dovish than other contenders Hiroshi Nakaso and Hirohide Yamaguchi.

Amamiya is called “Mr. BOJ” for playing a key role in drafting Kuroda’s asset-buying program in 2013. It is thought he would be inclined to continue the stimulative process if named Governor.

With US yields moving back higher, that is more bullish for the USDJPY.

In other markets today:

- Spot gold rose $2.46 or 0.15% at $1867.30

- Spot silver is down -$0.08 at $22.25

- Crude oil is at $74.29 after settling at $74.11

- Bitcoin is trading at $22921, a little higher than the level at the start of the NY trading session.

Tomorrow, the Fed Chair will be speaking. Traders will be waiting to hear his assessment of the strong US jobs report and whether it changes the Fed storyline of 5.0% to 5.25%.

Fed’s Williams is also scheduled to speak tomorrow.

www.forexlive.com