The USD is trading little changed vs the EURUSD, GBPUSD, USDJPY, USDCHF and USDCAD in what was up and down trading in each of those currency pairs. Th

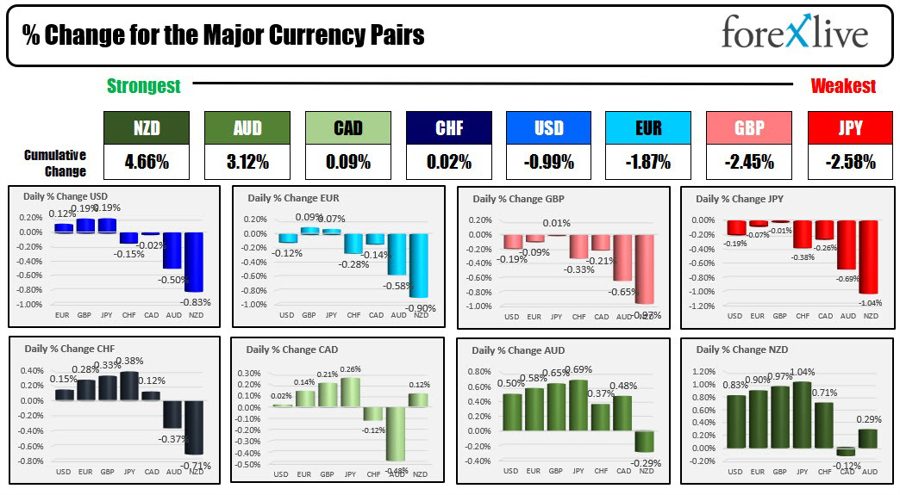

The USD is trading little changed vs the EURUSD, GBPUSD, USDJPY, USDCHF and USDCAD in what was up and down trading in each of those currency pairs. Those pairs move less than 0.19% with the USDCAD down -0.01%, and the USDCHF and EURUSD off by modest 0.12%. The dollar was lower vs the AUD and NZD (-0.50% and -0.86% respectively).

The strongest to the weakest of the major currencies

The EURUSD trading range was only 67% of the monthly average, the USDJPY was just 52% of the range and the USDCHF was only 62%. The NZDUSD and AUDUSD did trend more to the upside today as strong metals and Oil helped to support those pairs today.

Price action was influenced by a lack of key data, and the UK market holiday due to the coordination of King Charles. In other news today:

- Fed’s Goolsbee said he sees some signs of a credit crunch and supported the need for data dependency at this point of Fed policy

- The Q1 Fed Senior Loan Officers survey confirmed expectations of tighter credit conditions, lower customer demand and a further tightening of credit conditions likely throughout the year.

- US employment trends moved up to 116.18 from 115.51 last month after the better jobs report on Friday.

- US wholesale inventories were unchanged on the month but sales fell -2.1%. That spiked the inventory/sale ratio to 1.4 months from 1.25 months last month. That was the highest rate going back to the pandemic data

In other markets Crude oil futures extended gains from last Thursday’s low near $63.70, with WTI crude rising 2.6% to $73.16 per barrel. Brent crude increasing 2.3% to $77.01 per barrel. The gains were attributed to a technical recovery from oversold conditions, reduced recession debates, and fewer headlines about US banking troubles, all leading to increased risk-taking in oil markets. However, investors are likely to be cautious ahead of the release of key US inflation data, which will influence the Federal Reserve’s interest rate decision in June.

Gold prices are trading up around $5 or 0.25% in $2021. The high price reached $2029.36. The low price was at $2014.40. Once we on Thursday the price of gold reached an all-time record high near $2081. The Federal Reserve’s neutral stance on interest rates has been a catalyst for the support in gold prices. the day.

In the US interest rate market, yield moved higher today with the 2 year yield ticking back above the 4% level:

- 2 year yield 4.001% +7.9 basis points

- 5 year yield 3.487% +6.9 basis points

- 10 year yield 3.507% +6.1 basis points

- 30 year yield 3.824% +6.3 basis points

The US stock market was a little changed with the Dow industrial average modestly lower, the S&P index near unchanged, and the NASDAQ index rising marginally. The final numbers showing:

- Dow industrial average -55.69 points or -0.17% at 33618.70

- S&P index up 1.87 points or 0.05% at 4138.13

- NASDAQ index up 21.49 points or less 0.18% at 12256.91

www.forexlive.com