The Bank of Canada raised rates by 25 basis points to 4.50% from 4.25%. They also signaled the intention to hold rates steady in what they called a "c

The Bank of Canada raised rates by 25 basis points to 4.50% from 4.25%. They also signaled the intention to hold rates steady in what they called a “conditional pause”. No promise were made. If inflation does not come back down toward 2%, they would have to tighten more. There are no expectations to cut rates. In fact, they said that they are not even thinking about cutting rates, but Macklem did say that the economy is “not going to feel good” over the next few months as the economy rebalances.

The USDCAD moved higher on the signal to pause tightening, and the price move above the 200/100 hour MAs, but by the end of the day, the price had rotated back below those MAs at 1.3404 and 1.33913 respectively. The price is trading just below those levels at 1.3387 into the close.

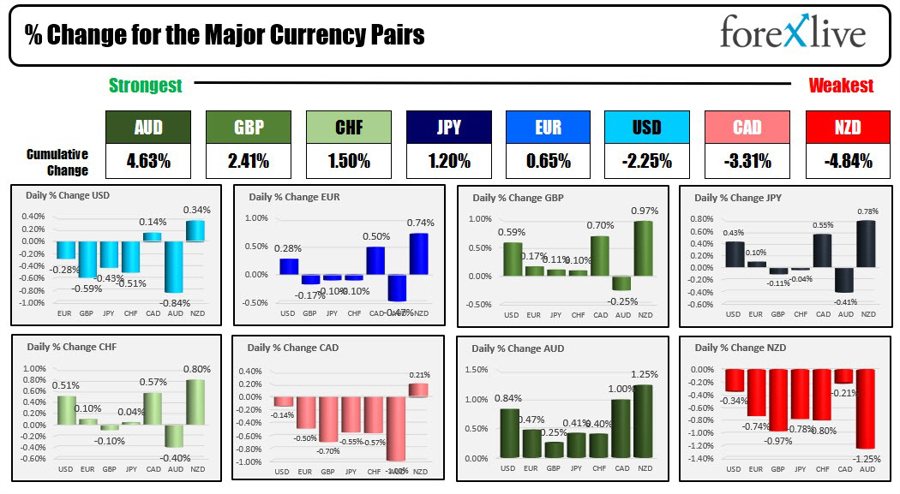

The CAD was the 2nd weakest of the major currencies, only outpaced by the NZD (vs the major currencies)

In the Forex market, the AUD was the strongest of the major currencies, while the NZD was the weakest. The Australian CPI data came in much stronger than expected at 1.9% for the fourth quarter. The New Zealand CPI was tamer 1.4% for the fourth quarter, but still marginally higher than expectations of 1.3%. Nevertheless the AUD was the big gainer today and the NZD was the big decliner.

The USD was mostly lower with declines vs all the major currencies with the exception of the CAD and NZD.

The strongest to the weakest of the major currencies

In other markets:

- Spot gold is trading up $9.25 or 0.48% at $1946.10

- Spot silver is trading up by five cents or 1.01% at $23.89

- WTI crude oil is trading up $0.31 at $80.44

- Bitcoin reversed higher as stocks recovered and is trading at $23,661. That’s the highest level since August 17, 2022.

The US stock market closed mixed for the second day in a row. The NASDAQ and S&P are now down for two consecutive days although declines have been minimal. The Dow Industrial Average rose for the fourth consecutive day albeit with a very modest rise today. The indices erased much lower intraday declines by the close:

- Dow rose 9.88 points or 0.03% at 33743.85. The Dow is down -460.76 points at its session lows

- S&P fell -0.73 points or -0.02% at 4016.21. The S&P index was down -67.80 points at its session lows

- Nasdaq fell -20.90 points or -0.18% at 11313.37. The NASDAQ index was down -265.10 points at its session lows

- Russell 2000 rose 4.708 points or 0.25% at 1890.31. The index fell -26.61 points at its session lows

The earlier declines were led by Microsoft whose stock fell over $11 on the back of lower forward guidance. However, the stock recovered most of its declines closing down only $-1.43 or -0.59%. Admittedly however, the price was up over $10 in after-hours trading yesterday before they announced lower forward guidance. So overall the stock was down around $11/$12 from its post-market levels yesterday at this time

European indices close modestly lower and also erased earlier declines

In the US debt market today, the U.S. Treasury was once again successful in auctioning off $42 billion of five year notes. Strong international demand once again was a catalyst for the successful auction. Investors overseas must be confident that the dollar might move higher and/or interest rates continue to move to the downside. A yield premium in the US may also be driving demand

- 2 year yield 4.131%, -2.0 basis points

- 5 year yield 3555%, -2.6 basis points

- 10 year 3.450% -1.6 basis points

- 30 year 3.602% -1.8 basis points

Happy Australia Day and continued Lunar New Year celebration.

news.google.com