The Bank of England raised rates for the 3rd time in last 3 meetings. The central bank raised rates by 25 basis points to 0.75%. The move comes after

The Bank of England raised rates for the 3rd time in last 3 meetings. The central bank raised rates by 25 basis points to 0.75%. The move comes after a 15 basis point rise that kicked off the tightening cycle and a 25 basis point rise at their last meeting in January.

The statement was less demonstrative about policy going forward. For one, there was a dissenter who did not want to hike (Cunliffe). Morever, the statement tweaked the forward guidance, saying “some further modest tightening is likely to be appropriate” whereas now they are saying that “some further modest tightening may be appropriate”. “Likely” vs “may” gave hawks some pause for cause and that led to a sharp fall in the at the start of the North American session. For the full report, CLICK HERE.

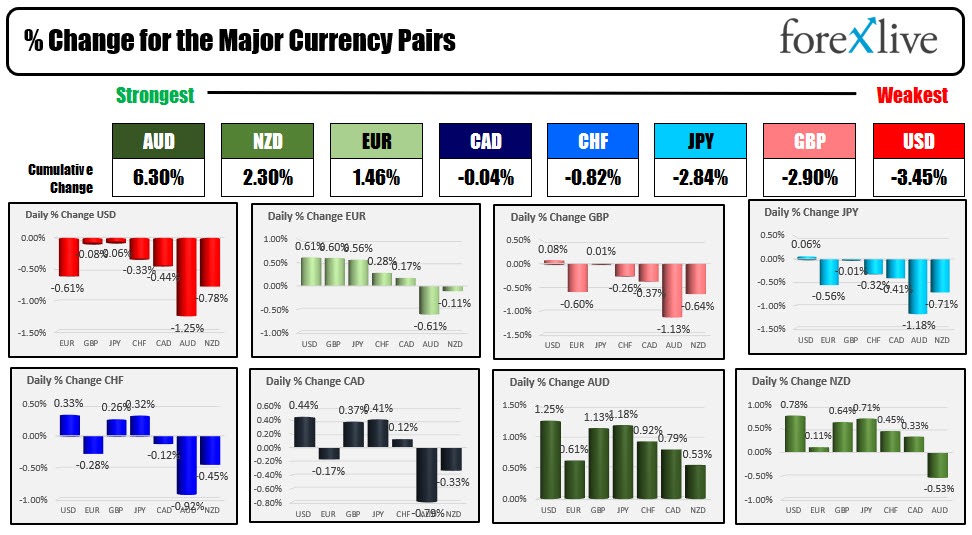

As a result, the GBP was the weakest of the majors to start the trading day, but as London/European traders were looking to exit for the day, there was a run out of the US dollar across all the major currencies. That led to the USD overtaking the GBP as the weakest of the majors for the day.

The AUD was the strongest all day, helped by China recovery and a stronger than expected jobs report overnight in Australia.

Below is a look at the strongest to weakest of the major currencies along with the changes of the major currencies vs each other.

Fundamentally in the US today, the initial jobs claims not showing any signs of anxiety were economic tension from the Russian/Ukraine war. The jobs claims fell to 214K while continuing claims continue to move to the lowest level since 1970.

The Philly Fed manufacturing index for February was stronger than expected. The Empire State manufacturing index released a couple days ago was weaker than expected and moved into negative territory but was for the month of March. Not sure if the Philly Fed index is reflective of most of the Russian Ukraine war, but nevertheless it was up filled with positive growth prospects.

Housing starts were also stronger than expectations as higher prices and higher rates have not yet weakened the supply/demand imbalances that have been driving the market. Low supply and high demand keep the market on solid footing and builders are still confident.

In other markets:

- Spot gold is trading up around $10 at $1937.30. The price traded above and below its 100 hour moving average at $1940.31 currently. Getting and staying above that moving average is required to push the price back to the upside after the sharp tumble from the March 8 high of $2070 down to $1894.70 during yesterday’s trade

- WTI crude oil futures moved back above the $100 level and is trading currently at $103.28. That’s up $8.28 on the day or 8.71%. Concerns about Russia supplying exiting the market (up to 3 million barrels by April) along with hopes for a quick reopening in China helped to spur the price higher

- Bitcoin remains above the $40,000 level at $40,702.49

In the US stock market, the major broader indices closed higher for the third consecutive day. The Dow industrial average of 30 stocks rose for the fourth consecutive day.

- Dow industrial average up 417.66 points or 1.23% to 34880.77

- S&P index of 53.81 points or 1.23% at 4411.66

- NASDAQ index up 178.24 points or 1.33% at 13614.79

- Russell 2000 rose 34.29 points or 1.69% at 2065.01

All four major indices were able to extend and close above their 200 hour moving averages in trading today. For the NASDAQ index it was the first close above its 200 hour moving average since January 4. For the S&P index index closed above its 200 hour moving average on February 9 for a single day before moving back below the key bias barometer. The breaks are positive is also price can remain above.

In the US debt market, the yields in the short end were lower while the yields further out the curve were near unchanged to higher. The two – 10 year spread reaches low 21.7 basis points but is trading at 25.6 basis points near the end of the day.

Some technical levels for the major currencies going into the new trading day shows:

- EURUSD: The EURUSD moved up to test the March high price at 1.11414, but came up just short of that level at 1.11369. The price backed off into the close and trades at 1.10910. The broken 38.2% retracement of the move down from the February 10 high cuts across at 1.10684. Stay above that level and the buyers are still in the game. Will below and all bets are off.

- USDJPY: The USDJPY snapped its string of higher highs at seven days, and is closing a little bit lower from yesterday’s close. Although the low price today fell below the Monday and early Tuesday swing highs near 118.40 – 118.44, the price decline could not extend down toward its rising 100 hour moving average at 118.225. The low price reached 118.36. The pair is closing near 118.59.

- GBPUSD: The GBPUSD fell sharply lower after the Bank of England rate decision but found support buyers near a swing area between 1.3080 and 1.30878. The low price reached 1.3087. Also near that level was the 200 hour moving average at 1.3097. The move up back above the 200 hour moving average turned sellers in the buyers and the price extended back above a swing area between 1.3138 and 1.31438.

- USDCHF: The USDCHF cracked below its 100 hour moving average currently at 0.9383 and fell toward its rising 200 hour moving average at 0.93339. The low price reached 0.9334 and rotated back higher. The current price is trading at 0.9370 between the 100 hour moving average above and the 200 hour moving average below. In the new trading day traders will look for a break outside of the moving average levels.

- USDCAD: The USDCAD traded above and below its 100 day moving average in the Asian session, but rotated more to the downside in the London session and stay below that key moving average at 1.2680. In the New York afternoon session, the price continued its fall and looked toward the 200 day moving average at 1.26015 into the new trading day. The current price is trading just above that level I.26125. Move below the 200 day moving average would increase the bearish bias

- AUDUSD: The AUDUSD was the strongest of the major currencies and traded to the highest level since March 7. In the process, the price moved briefly above a swing area between 0.7367 and 0.7379. The current price is trading at 0.7378 within that area. If the price can hold the 0.7367 level, the buyers would remain in control with the March 7 high at 0.74405 as a potential target into the new trading day. Move below the level and a rotation back up toward 0.7335 would be eyed as the first stop.

www.forexlive.com