The forex markets were choppy in US trading today. The USD saw a fairly large move of 0.92% vs the NZD and a 0.32% vs the AUD but the other currencies

The forex markets were choppy in US trading today. The USD saw a fairly large move of 0.92% vs the NZD and a 0.32% vs the AUD but the other currencies saw up and down price moves of 0.12% to 0.21% suggesting uncertainty. The markets may be struggling with “what’s next” as central bank tightenings may be coming to a close, war tensions escalate, and fears of oil shortages may not come to fruition as inventory builds are near 90-95% levels in Europe and milder weather and less travel is also helping supply concerns.

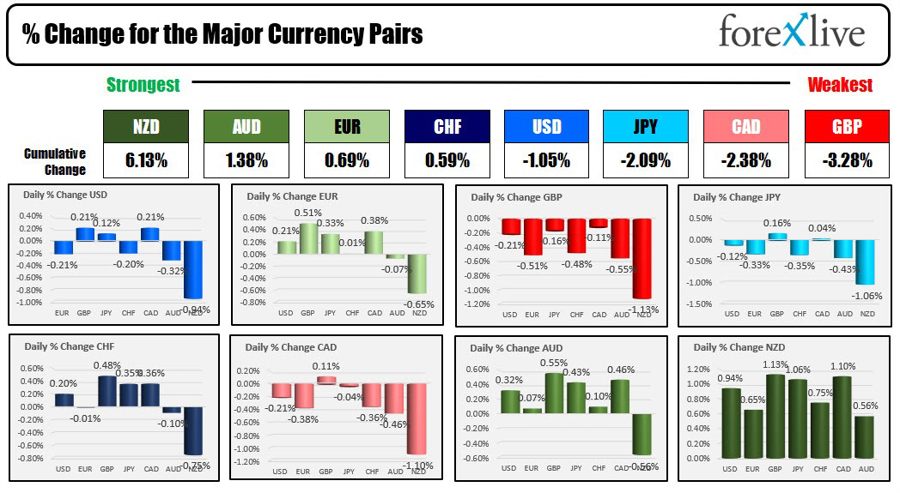

The strongest to the weakest of the major currencies

Looking at the strongest to the weakest the NZD is the strongest while the GBP and CAD were the weakest. The UK continues to deal with uncertainly. Newly appointed PM Truss may already be at the end her rise to the top journey with vote of confidence lurking around the corner. The CAD is weaker as oil prices moved lower in trading today with the price down -2.32% (it is off the lows at least).

The EURUSD in the NY session only had a 55 pip trading range in the NY session characterized by non trending up and down price action. the total price range for the day was 63 pips, about half of the normal 126 pips that has characterized the pair over the last monthe of trading.

The USDJPY did continue to move higher as traders still nudge the BOJ. The price is up for the 10th day in a row. The pair bottomed at 143.47 on October 5, and moved to a high today of 149.212. Admittedly, there was one plunge that saw the pair move from 149.28 to 148.10 (in 2 minutes), but the price shot back higher to 148.88 2 minutes later and eventually took out the high for the day in the NY session.

IN other markets:

- Spot gold is up $2.50 or 0.15% at $1651.97

- Silver is up $0.10 or 0.55% at $18.73

- Wti crude oil is trading at $83.57

- Bitcoin is at $19381 near the end of day

In the US debt market:

- 2 year 4.43%, -2.1 bps

- 5 year 4.227%, -1.1 bps

- 10 year 4.012%, -0.2 bps

- 30 year 4.032%, +1.8 bps

The US stock market closed higher for the 2nd consecutive day. After the close Netflix reported higher than expected earnings. Overall, the financial earnings were better and now Netflix too. Are corporations crying higher inflation and using it to fleece the consumer with even higher prices (and perpetuate the inflation in the process?). :

- Dow rose 337.98 points or 1.12% at 30523.81

- S&P rose 42.03 points or 1.14% at 3719.97

- Nasdaq rose 96.61 points or 0.90% at 10772.41

- Russell 2000 rose 20.20 points or 1.16% at 1755.95

www.forexlive.com