Markets: Gold down $32 to $1897 WTI crude oil down $2.99 to $99.08 US 10-year yields down 8 bps to 2.82% S&P 500 up 24 points to 4

Markets:

- Gold down $32 to $1897

- WTI crude oil down $2.99 to $99.08

- US 10-year yields down 8 bps to 2.82%

- S&P 500 up 24 points to 4296

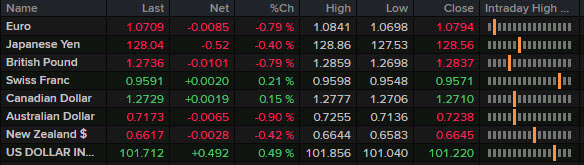

- JPY leads, AUD lags

It looked like it would be an ugly day across the board but the falling yields enticed tech bulls to try to catch the falling knife once again. The Twitter bid was perhaps a signal that buyers are out there, although there’s only one ‘world’s richest man’ so we will have to see if that sentiment holds up.

The issue is that yields and stocks are growing more reflexive. Today’s rebound in stocks could push bond yields back up. We saw some of that late in the day as 10s climbed to 2.82% from 2.75% at lunchtime in New York.

That same turn helped to lift USD/JPY from the low of 127.53 back to 128.04.

The turn in sentiment did nearly nothing for GBP and EUR, which remain under heavy pressure. Both fell nearly 100 pips as the ugly breakdown in cable continues. The euro has now fallen to the lowest since March 2020 and has less than 80 pips of breathing room before breaking the pandemic low.

But it’s the CNY where there’s the most focus. The PBOC took a step to curb the yuan’s fall and it’s worked so far. US ETFs point to a corresponding rebound in Chinese stocks after a bruising day. Ultimately, though, we will go where the virus takes us and the mass testing in Beijing along with continued elevated cases in Shanghai are incredibly worrisome.

AUD and CAD made new lows in North American trading while NZD didn’t. Later, all three turned around with the Canadian dollar eventually getting back to nearly flat on the day.

Overall, it was an impressive turn in markets, but what is there to sustain it?

www.forexlive.com