Today, Fed Chair Powell testified again on Capitol Hill and with oil prices racing to $116+ before coming back off, the comments, seemed a felt a bit

Today, Fed Chair Powell testified again on Capitol Hill and with oil prices racing to $116+ before coming back off, the comments, seemed a felt a bit more concerning about inflation. Once again the Fed Chair expressed the likely 25 basis point rise but reiterated once again that if inflation remains elevated, he would be prepared to raise by more than that in meeting – or meetings – if inflation doesn’t come down. The plural of “meetings” carried a lot more weight, especially since it seems that the Russians are not in any hurry to back down, despite the economic pounding imposed by sanctions, a weakened RUB and a stock market that is afraid to open. PS the VanEck Russia ETFis down about 65% from February 25th closing level which was the last time the MOEX index traded. Since February 16, that ETF is down close to 80%. Ouch.

Powell also scared the stock market when asked if he would be Volkeresque and do all he could to stop inflation, and replied “Yes”. All of the sudden, Powell lost some of his dovish looks.

Meanwhile, Putin looked to shift the propaganda toward the heroism of the soldiers who have died for the unity of Ukraine and Russian (hmmm are Ukrainian’s united under Putin), and how they are all fighting against the threats from the west, including nuclear threats. HMMMM. The last I remember, Putin was the only one to bring up the word “nuclear” (and did it more than once).

The US imposed more economic sanctions against the oligarchy today in an attempt to weaken Putin from within. The situation is still very volatile.

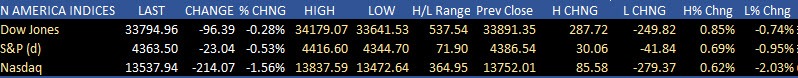

US stocks did not like the optics and the Nasdaq gave up all the gains from yesterday. The Dow and S&P fared better but were still lower on the day.

In the European session, all the majors indices knocked prices down by -1.8% to -3.72%. PPI data out of Europe did not help as it rose above 30% for the year (beating expectations of 27%).

In the US debt market, the US yields are mixed/ little changed on the day. That comes after tumbling lower on Tuesday, and rallying back higher by close to 20 basis points yesterday. Having a day where the yields are little changed today makes sense (although the 2 year did trade in a 10 basis point range).

In the forex market, the AUD was the strongest and the EUR is the weakest. The USD is ending the day mixed with gains vs the EUR, GBP, CHD and declines vs the CHF, AUD an NZD. The USD is near unchanged vs the JPY.

A technical look at some of the major currencies going into the new trading day shows:

EURUSD: The EURUSD moved to another new cycle low and the lowest level since end of May 2020. The low price reached 1.10326. That saw the price move below a downward sloping trend line on the hourly chart but momentum could not be sustained (line cuts across at 1.1039 currently). The pair is trading near the lows from yesterday at 1.1057. On more upside, the January and February 2021 lows at 1.1106 and 1.11207 will be eyed as resistance. A failure to extend back above those levels would keep the sellers in control with more downside probing the increases on a break of the aforementioned trend line at 1.1039.

USDJPY: The USDJPY moved higher in the Asian and early European session but stalled near a swing high level near 115.786. The high price reach 115 point at zero before rotating back to the downside. The pair is closing near the low levels for the day and also near the 50% midpoint of the move down from the February 10 high and also the 100 hour moving average. The 50% level comes in at 115.369. The 100 hour moving average comes in at 115.309. In the new trading day breaking below each of those levels would have traders next targeting the 200 hour moving average of 115.17. Break below that level in the buys switches back into full control of the sellers/bears. Recall from yesterday, the price moved back above those moving averages and that gave the go-ahead to push higher.

GBPUSD. The GBPUSD was trading above and below its 100 hour moving average around the 1.33708 at the start of the North American session. The price was also staying above the swing lows going back to January 27 and January 28 between 1.3357 and 1.3374. However, after sellers took the price below the 1.3357 level, buyers turned to sellers and pushed down to the next target near the swing low from Monday’s trading at 1.33157. This time, buyers leaned against that low level and pushed the price back up toward the low of the January 27/28 at 1.3357. Sellers leaned again. Holding the 1.3357 level The sellers more in control. In the new day it would take a move back above that level, and the 100 hour moving average of 1.33708 to tilt the bias back more in the favor of the buyers/bulls (at least in the short term). Absent that, and traders will likely start to look again toward the swing low from last week, and swing low from this week at 1.32704.

USDCAD: The USDCAD closed yesterday near its 100 day MA near 1.2640. The price moved lower in the Asian session and away from that moving average, bottoming at 1.26584 before rotating back to the upside. After moving back above the 100 day MA, the momentum tilted more in the favor of the buyers who pushed the price toward the falling 100 hour MA (currently at 1.2693). The MA has given traders some cause for pause and the price has since then traded between support near 1.26496 and the 100 hour MA at 1.2693. In the new day, it will take a move above that MA to increase the bullish bias Conversely, if the MA stalls the rise and the price can get back below 1.26496 and the 100 day MA at 1.26406, the sellers would likely push lower.

Tomorrow the US jobs report will be released with expectations of NFP rising 400K. The unemployment rate is expected to fall to 3.9%.Average hourly earnings are expected to rise 0.5%.

www.forexlive.com