Headlines from the Fed chair:Other news:Markets:NZD leads, JPY lagsGold down $3 to $1932WTI crude oil up $1.45 to $72.64S&P 500 down 23 points to

Headlines from the Fed chair:

Other news:

Markets:

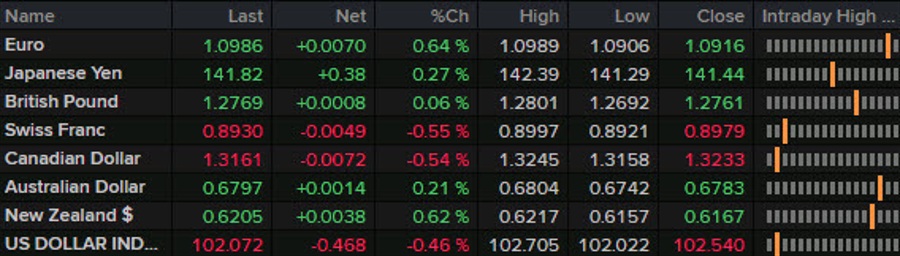

- NZD leads, JPY lags

- Gold down $3 to $1932

- WTI crude oil up $1.45 to $72.64

- S&P 500 down 23 points to 4365

- US 10-year yields flat at 3.72%

The US dollar was steadily sold off in North American trading.

Powell didn’t offer much that we hadn’t heard in the post-FOMC press conference but he continues to crack open the door to holding rates in July by saying decisions will be meeting-by-meeting. Goolsbee and Bostic both opened the door further with their comments, which highlight a preference to watch and wait due to the lags of monetary policy.

Cable was in focus due to the hot CPI report and while the initial market reaction was to sell the pound on over-tightening risk, it recovered in New York trade to finish just into positive territory on the day. The Bank of England decision is tomorrow.

The euro was a larger beneficiary of flows as it rose 70 pips to 1.0984. The big figure looms but EUR/JPY is also a focus as that pair rose to a fresh 15-year high.

USD/CAD fell to a 9-month low at 1.3158 and closed near the lows. That was helped by a two-week high in oil and some fresh bids in natural gas. Eyes are on tomorrow’s inventory reports and speculation is high that draws are coming.

AUD wasn’t quite as enthusiastic as CAD and NZD but still made gains in North American trading. There is worry about China as stocks there fell again today as the fiscal side fails to yet materialize. The market could also be coming around to the idea that we’ll see a few fiscal bullets rather than a fiscal bazooka from Beijing.

Still, the yen was broadly softer in a sign that market feels ok about global growth. Canadian retail sales certainly underscored the theme of a resilient consumer.

www.forexlive.com