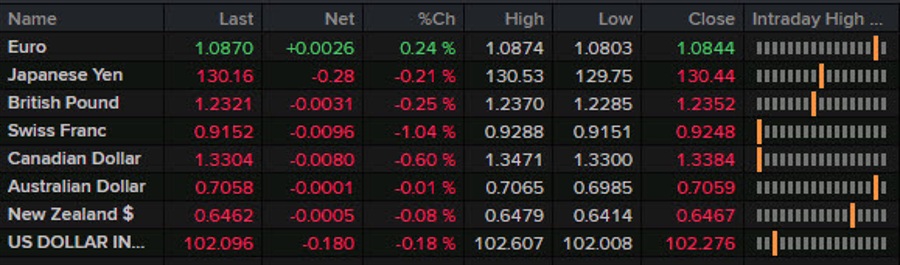

Markets:Gold up $5 to $1927US 10-year yields down 3 bps to 3.52%S&P 500 up 44 points to 4062WTI crude oil up $1.19 to $79.37CHF leads, GBP lagsCau

Markets:

- Gold up $5 to $1927

- US 10-year yields down 3 bps to 3.52%

- S&P 500 up 44 points to 4062

- WTI crude oil up $1.19 to $79.37

- CHF leads, GBP lags

Caution was the story of the day following a weak German retail sales report and angst ahead of the FOMC but the mood shifted after US wage data indicated a dwindling chance of a wage-price spiral. Soft ‘expectations’ numbers in the Conference Board data also strengthened the case for a top in rates.

In turn, the US dollar sagged and risk trades rebounded. At first the move was tentative but stocks soared late in the day and oil turned losses into a decent gain. The Canadian dollar and Swiss franc were the main beneficiaries and that’s a weird couple but could speak to month end dynamics.

USD/CAD erased all of yesterday’s gains in an 80 pip decline while AUD and NZD simply traded flat on the day and remain well-off yesterday’s levels. Some of that could speak to a bit of caution creeping in on China but it’s a stark divergence.

Cable struggled badly on worries about the Europe consumer. The euro initially fell to 1.0803 but bids at 1.0800 held and it tracked back to 1.0870 on the soft dollar. The pound was less able to take advantage of the weak dollar and only bounced about 25 pips.

USD/JPY fell as low as 129.75 from 130.37 before the wage data but bounced back to 130.18.

The day ahead is going to feature some big moves with much of the talk now centering on the Fed indicating more of a wait-and-see or meeting-by-meeting approach. It’s tough to say how much of that is priced into the broader market but it’s certainly headed in that direction.

Tune in tomorrow for all the fun.

news.google.com