The US jobs report came in close enough to expectations inclusive of the revisions. The NFP came in at 431K vs 490K estimate but the prior month was r

The US jobs report came in close enough to expectations inclusive of the revisions. The NFP came in at 431K vs 490K estimate but the prior month was revised up 72K to 750K from 678K. The January revision added another +23K. The Unemployment rate was lower at 3.6% (vs 3.7%). Goods producing jobs have added 200K over the last 3 months. Service jobs have added 1463K over that time. Leisure and Hospitality added 112k, while higher paying Professional and business services added 100K for the 2nd consecutive month.

The report keeps the Fed on target for a 50 BP hike/hikes at the May and most likely June meeting as well. That would take the target rate to 1.25% to 1.50%. That leave 4 meetings to the end of the year. Rises of 25 basis points at each takes the target rate to 2.25% to 2.5%, which is the so called neutral rate that Fed officials speak to.

Current rates 2 years and out are currently near those level, doing the Fed’s job for them:

- 2 year, 2.462%

- 5 year, 2.56%

- 10 year, 2.386%

- 30 year, 2.436%

The yield curve from 2-10 years inverted today to -7.6 basis points which tends to foreshadow a recession afterwards. When that happens can be delayed, but the bond market is hoping inflation – which is north of 7% now – starts to come back down. Otherwise, there certainly is room to roam yet in yields.

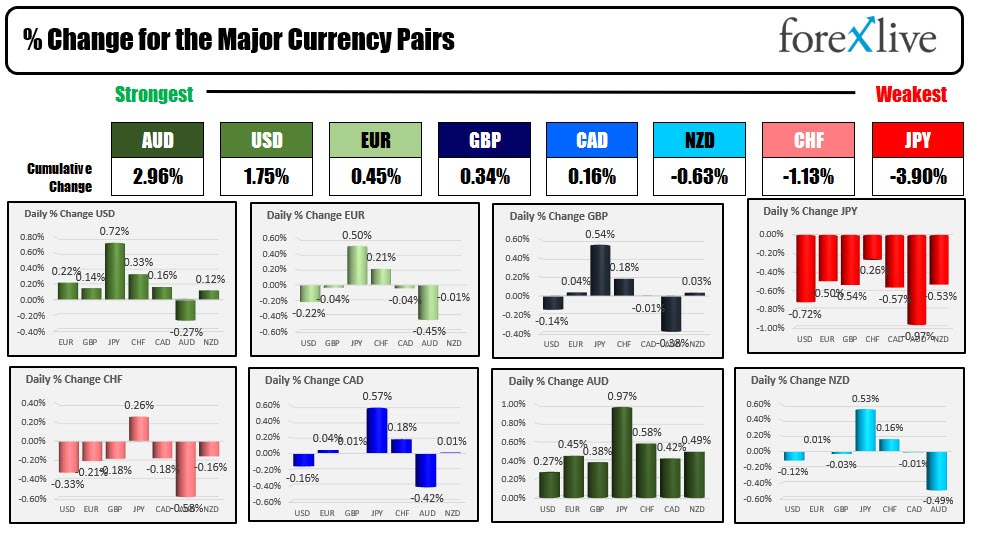

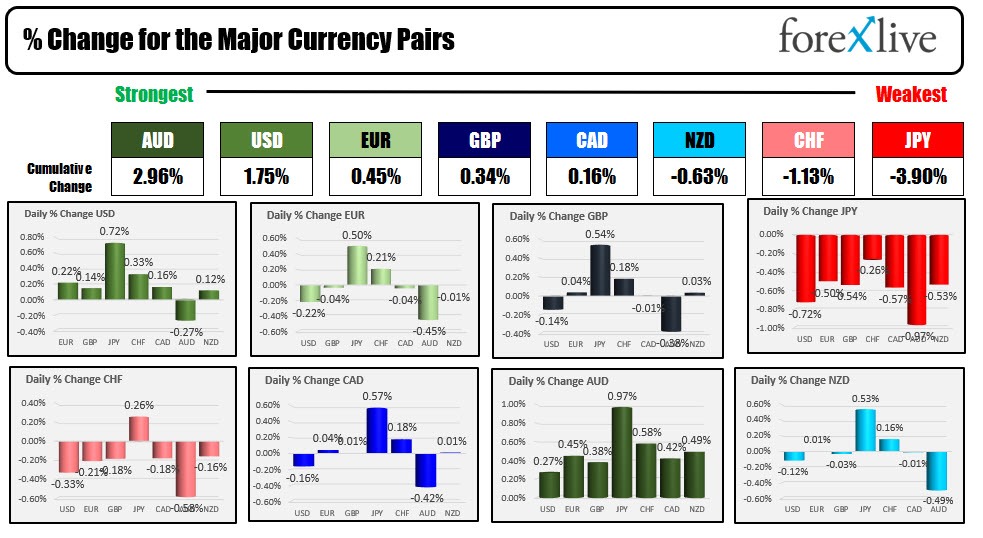

In the forex the , the AUD and the USD are ending the day as the strongest of the majors, while the JPY is the weakest.

The USDJPY snapped it’s 3 day decline after running higher for most of March. The correction for the pair off the high, stalled the fall this week near the 38.2% at 121.12 (the low reached 121.29 this week before moving back to the upside today).

The EURUSD tried to extend back below the ubiquitous 200 hour moving average once again today after breaking above it on Tuesday’s surge the upside. The 200 hour moving average comes in at1.10405. The low price reached 1.10272 before rebounding back to the upside and closing near 1.1049. The 200 hour MA will be a key barometer in early trading next week.

The GBPUSD moved back below its 100 hour MA at 1.31196 but found willing buyers near a support swing area between 1.30783 and 1.30878 (the low reached 1.30855. The price did rebound into the close to 1.3115 – just below the 100 hour MA. Next week the pair will use that 100 hour MA as IT’S early barometer. Move above is more bullish. Stay below keeps the sellers in control.

www.forexlive.com