Markets:GBP leads, USD lagsWTI crude oil down $2.20 to $85.88US 10-year yields down 6.7 bps to 4.85%S&P 500 down 0.1% to 4219Gold down $8 to $1972

Markets:

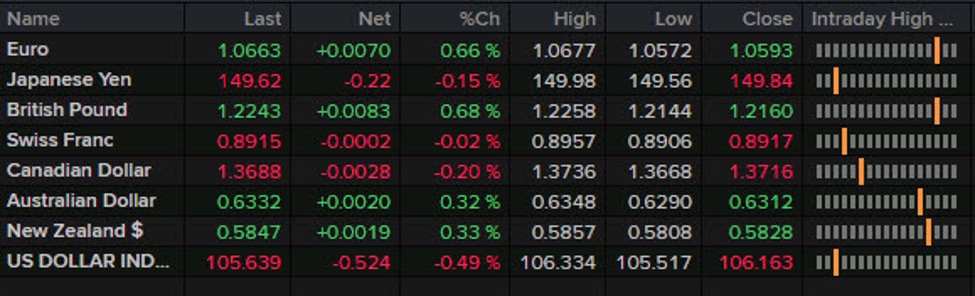

- GBP leads, USD lags

- WTI crude oil down $2.20 to $85.88

- US 10-year yields down 6.7 bps to 4.85%

- S&P 500 down 0.1% to 4219

- Gold down $8 to $1972

A turnaround was the story of the day in North American trade. New York woke up to 5% ten-year Treasury yields on a broad selloff in early European trade and that spilled over into a slump in equities. The dollar was curiously indifferent and that could have been a tell or reflected a wall of selling in USD/JPY at 150.00.

In any case, some bids for bonds appeared early in New York and that was followed by a flood of buying after Bill Ackman said he’s covered his well-timed bond short. With that yields fell from 5.02% all the way down to 4.84% with similar price action along the curve.

Unlike in the bond slide, FX reacted to the rebound as the dollar slumped across the board and particularly against the European currencies. On Friday, the market priced in more Fed easing late next year and the sentiment that economic pain is coming was magnified after economic worries from Ackman and Bill Gross.

Economic news was light and the Fed is in the blackout period. In the Middle East, reports of a large hostage release appear to be false but a dip in oil prices highlights some optimism that a broader war doesn’t take place.

Commodity currencies were less enthusiastic about the risk rebound in light of oil and metals lagging.

USD/JPY touched a five-day low at 149.56 but that still doesn’t leave the Japanese ministry of finance with much breathing room.

www.forexlive.com

COMMENTS