Markets:Gold up $37 to $2021WTI crude oil up 2-cents to $80.45US 10-yaer yields down 8.4 bps to 3.35%S&P 500 down 24 points to 4100GBP leads, AUD

Markets:

- Gold up $37 to $2021

- WTI crude oil up 2-cents to $80.45

- US 10-yaer yields down 8.4 bps to 3.35%

- S&P 500 down 24 points to 4100

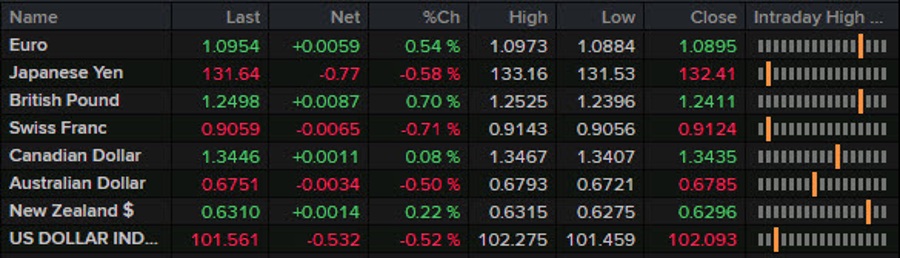

- GBP leads, AUD lags

The US dollar was soft in Asia and Europe but was staging something of a recovery in early North American trade until a soft JOLTS job opening report landed. That triggered an outsized move to the lows of the day for USD along with a corresponding jump in gold above $2000 and crypto.

USD/JPY fell to 131.66 from 132.60 in a full-cent drop. It continued to slide for an hour after the release but then tracked straight sideways as the day wound down.

EUR/USD rose to 1.0968 from 1.0900 on the data then gave a bit back before recouping it again late.

Cable was particularly strong all day but didn’t get a particularly large bump from the JOLTS number. It finishes very close to 1.2500 in a nearly 100-pip rally that broke the recent range top to the best levels since June 2022.

USD/CAD was more of a spike lower then reversal as it dropped to 1.3405 from 1.3430 then quickly rebounded. Oil fell on the JOLTS data and stocks stumbled on fears of a slowing economy and that hurt all commodity currencies. The worry around JOLTS may not be just the decline but the speed of the decline pointing, potentially, to a rapid slowdown.

AUD/USD was soft after the RBA move to the sidelines but finished North American trading flat.

www.forexlive.com