The US yields moved higher and it helped to bump up the US dollar in trading today. The market is preparing for the Jackson Hole Symposium that begins

The US yields moved higher and it helped to bump up the US dollar in trading today. The market is preparing for the Jackson Hole Symposium that begins tomorrow. Although the Fed Chair is scheduled to speak on Friday, the event attracts central bankers from around the world and the media to support it. I know CNBC has a number of officials set to speak. There will not be a shortage of opinions both from US officials, and from other central bankers from around the world.

Fed Powell is the highlight but he is not one for a shock and awe. The storyline is higher rates, fight until the death for inflation and data dependent. If he goes nuclear, I think it would be in the quantitative tightening side, but as mentioned, it is not in his DNA to cause a tsunami but small ripples.

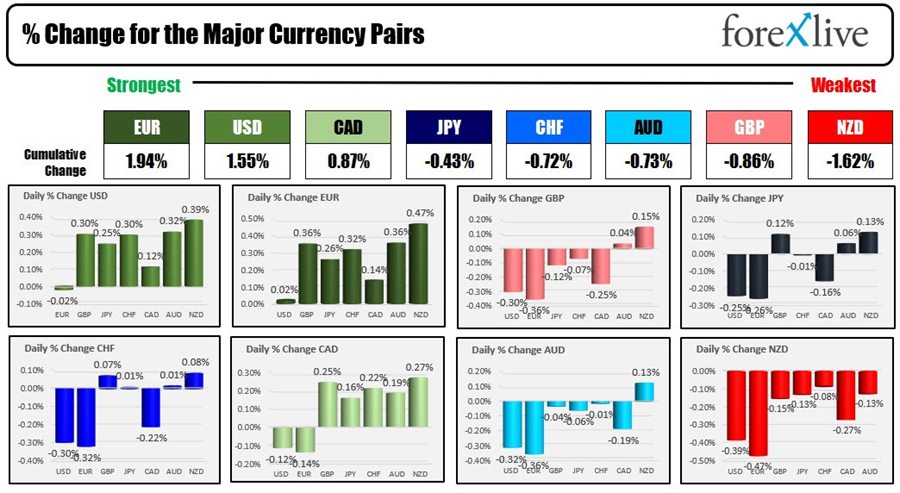

The USD saw up and down price action with an upward bias. The strongest of the majors was the EUR followed closely by the USD. The weakest was the NZD.

The strongest to the weakest of the major currencies

Technically, the day is ending with some key levels solidifying themselves from the trading action today:

- EURUSD. The EURUSD on the downside held the lows from yesterday between 0.9899 and 0,9912, The low for the day reached 0.9909. Move below that area would increase the bearish bias and have the pair trading at yet another new 2022 low. The correction higher today moved up to retest the parity level (at 1.0000) along with the falling 100 hour MA (currently at 0.99494 and moving lower). IN between sits the swing low from July 2022 (old low for the year) at 0.99515. The price trades at 0.9966 going into the close between 0.9951 and 1.0000

- GBPUSD: The GBPUSD – like the EURUSD traded up test its falling 100 hour MA and found sellers. As long as the price stays below that MA level in the new trading day, the sellers are more in control. A move above gives the dip buyers some hope. THe low this week moved to 1.1716 THe low today reached 1.1755.

- AUDUSD: The AUDUSD traded up and down today and above and below its 100 hour MA currently at 0.68979. The price in the NY session moved above that MA and stayed above into the cloe. The current price is at 0.6907. Move below is more bearish. Stay above and a run toward the 200 hour MA at 0.6951 (and moving lower) would be eyed.

- NZDUSD.The NZD was the weakest and although closing off the lows the highs today stalled near the falling 100 hour MA at 0.61959 currently. Stay below is more bearish. Move above is more bullish.

IN the US debt market, yields moved higher:

- 2 year 3.392, up 8.9 bps

- 5 year 3.235%, up 6.7 bps

- 10 year 3.109%, up 5. 9 bps

- 30 year 3.317%, up 5.9 bps

US stocks closed modestly higher today:

- Dow industrial average rose 59.64 points or 0.18% and 32969.24

- S&P index rose 12.04 points or 0.29% at 4140.76

- NASDAQ index rose 50.24 points or 0.41% at 12431.54

- Russell 2000 rose 16.14 points or 0.84% at 1935.28

The gains today snapped a three day losing streak for the major indices.

www.forexlive.com